With unemployment at a 50-year low, solid economic growth and a strong Wall Street, the U.S. economy appears to be in good health.

But there is one conundrum that divides U.S. policymakers – why is inflation still so low?

On one side, low inflation is "a pressing problem."

On the other, low inflation is "a beautiful thing!"

These two contrasting views were voiced in the past week by men representing two institutions that should work together to guide the U.S. economy – the Federal Reserve, and the Oval Office.

John Williams, president of the New York Fed, said on June 7 "while I will always be vigilant about inflation that's too high, inflation that's too low is now a more pressing problem."

That follows Fed Chair Jerome Powell's comments earlier this year, that low inflation is "one of the major challenges our time."

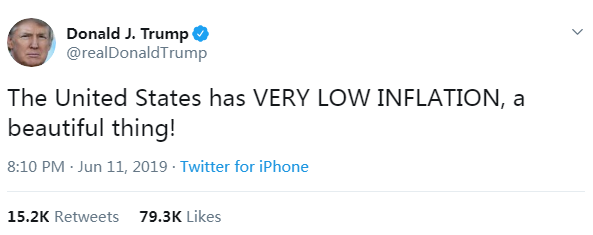

But on Tuesday, U.S. President Donald Trump made his views very clear, via Twitter, saying "The United States has VERY LOW INFLATION, a beautiful thing!"

How low is U.S. inflation and why does it matter?

Since 2012, inflation has struggled to reach the Fed's target of 2.0 percent.

While the consumer price index hit 2.0 percent in April, that was the highest it had been in five months. In the year ending March, inflation was just 1.6 percent.

2016 and 2017 saw inflation of 2.1 percent, but it started to drop again in 2018, coming in at 1.9 percent. In 2015, inflation was just 0.7 percent.

On the surface, low inflation sounds great for consumers – prices remain stable and affordable, the dollars you earn and spend today will pretty much be worth the same next month too.

But for the Federal Reserve, low inflation is an alarm bell, and leaves less room for maneuver if the economy suddenly changes direction.

Low inflation seems great for consumers, but it still remains a long-term headache for the Fed. /VCG Photo

Trump's view: low inflation is a beautiful thing

Low inflation usually also means low wage growth – but that's not the case this time around.

Salaries have increased by more than 3.0 percent for 10 consecutive months, and March consumer spending data saw its highest monthly increase in 10 years.

For Trump, this is a trend that he will be keen to maintain for as long as possible. U.S. workers have jobs, are taking home more money and prices aren't really going up. The president would even like to see inflation fall further, and has frequently called on the Fed to cut interest rates.

The Fed came under pressure to cut rates after last week's disappointing employment data, and has been at loggerheads with Trump throughout his presidency over economic policy.

With inflation so low, does the Fed have enough policy room to tackle a potential downturn? /VCG Photo

The Fed's view: low inflation is a major challenge

A major concern for the Fed is how the U.S. would handle a sudden downturn. If the Fed cuts interest rates further in a bid to boost inflation, it would have fewer tools in its war chest to fight off a recession.

If Trump has his way and the Fed cuts rates to or near zero percent, the only moves left against a recession would be a return to the policies of the post-2008 crisis era.

A return to quantitative easing would suggest the U.S. has fallen into a trap of crisis followed by stimulus followed by crisis, with the stimulus becoming less effective on each cycle.

A significant downturn could even turn low inflation into deflation, a situation that hasn't happened since the Great Depression.

Low inflation and the U.S. 'sweet spot'

For now, the U.S. economy is in a sweet spot. Low inflation and low interest rates benefit Wall Street and low-wage workers alike, with the latter the most vulnerable group to any price rises.

But the U.S. economy has been expanding for 10 years, a particularly long time in the business cycle. The inverted yield curve is seen by many as just one sign that a contraction is overdue.

The Fed and Trump have different priorities for 2019 and 2020 – the former wants to maintain stable long-term growth while arming itself against potential recession. The latter has eyes on the 2020 election – meaning the president will likely do everything in his power to make sure the current sweet spot lasts as long as it possibly can.

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3