Editor's Note: Tom Fowdy is a British political and international relations analyst and a graduate of Durham and Oxford universities. He writes on topics pertaining to China, the DPRK, Britain, and the U.S. The article reflects the author's opinions, and not necessarily the views of CGTN.

Lost in the sweeping news pertaining to Trump's dealings with China and the DPRK came a quiet yet significant announcement.

Over the weekend, the European Union announced the launch of what it describes as the "INSTEX" system which will allow member states, and third countries to engage in non-dollar transactions with Iran.

Helga Schmid, Secretary General of the European External Action Service, stated that the system was designed to permit European countries to "facilitate legitimate basis" with the Middle Eastern country, which has been slapped with extensive unilateral sanctions by the Trump administration despite its compliance with Joint Comprehensive Plan of Action (JCPOA), which was signed in 2015.

The operation of such a system is not only a significant blow to Trump's policies against Tehran, but also poses long term strategic and political consequences for America.

That being said, the universality of the dollar system, which has long dominated global markets, is now being broken.

With the Trump administration weaponizing and abusing unilateral designations on an industrial scale, even when their cause has not been legitimate, states have grew to recognize that such moves are an affront to their national interests.

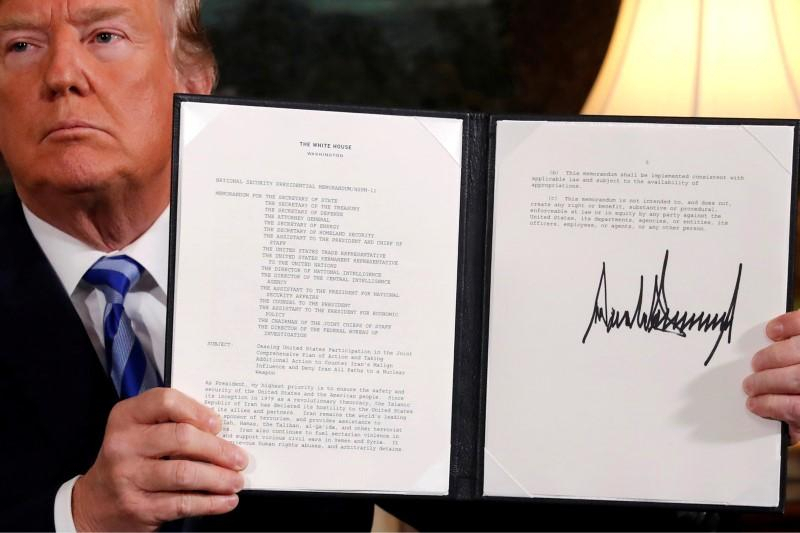

U.S. President Donald Trump holds up a proclamation declaring his intention to withdraw from the JCPOA Iran nuclear agreement after signing it in the White House, May 8, 2018. /Reuters Photo

Never has this been truer in the scenario of Europe and the Iran deal.

Consequentially, the White House's behavior is in fact undermining and weakening the dollar, creating a world more eager to hedge against American unilateralism.

What is an American "unilateral designation?" When we use the term "unilateral" in terms of diplomacy, we refer to a single country acting on its own accord, without others. This is opposed to "bilateral" (two countries) and "multilateral" (a group of countries).

Therefore, when America makes a decision without others, it is unilateral. Designations in the U.S sense refers to a scenario whereby the Treasury of the United States blacklists an individual, organization or entity from access to all transactions using the U.S. dollar.

This makes it illegal for the target to do any kind of business which uses that currency, be it within the United States itself or abroad.

The global power of the U.S. dollar, of course, makes the usage of such designations an incredibly powerful weapon. Once something is blacklisted, you are already removed from some of the world's key markets.

Azadi avenue in Tehran, Iran, November 3, 2018. /VCG Photo

First of all, finance. As the dollar is the world's largest and most prominent reserve currency, banks will no longer deal with the target and can face severe dollar penalties.

Secondly, which is most prominent related to Iran: energy. The dollar is the world's global oil and petroleum currency. You lose that and you lose access to the market. Such sanctions cannot be taken lightly.

Thus, while such sanctions can be a force for good in their ability to crack down on terrorists, international criminal organizations and other threats to global peace, the Trump administration is abusing them in an overtly inappropriate way, that as a tool of coercion against other countries to force them into following Washington's will.

Iran is the paramount example.

Despite that the JCPOA is international law as endorsed by the United Nations and other great powers, including the EU, the Trump administration decided to withdraw from the agreement unilaterally in 2018 and return to a campaign of pressure against Iran. This happened despite Tehran's compliance with the deal.

In doing so, it has weaponized unilateral sanctions to forcefully cut off Iran's oil exports and major investors, pushing allied countries to follow suit with the threat of further measures on anyone who doesn't comply.

Diplomatic efforts from European nations to uphold the deal were ignored, with Washington imposing more and more unilateral sanctions upon Tehran regardless.

Perceiving the whole saga as illegitimate, the EU subsequently started looking into alternatives to the dollar to uphold business that it perceived was in the continent's legal rights to do so.

The result is the INSTEX, the most prominent non-dollar payment system, as well as the first continental one of such a kind ever created. Its specified objectives are so that legitimate trade and transactions with Iran can continue unabated, beyond the threat of American sanctions.

An oil tanker passes through the Strait of Hormuz, December 21, 2018. /Reuters Photo

Given this, such a system poses to challenge the universality of the U.S. dollar in ways that have never been done before.

While the White House believed that it could use unilateral sanctions as a simple tool to get its own way by force, the outcome is in fact that other countries are now responding with payment and diversification methods which in fact weaken and reduce the influence of the world's most prominent currency.

Therefore, the abuse of unilateral sanctions by the current administration may pose to be a long term affront to American interests and strategy.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3