From July 1 to 22, 1944, 730 delegates from all 44 Allied nations gathered in Bretton Woods, New Hampshire, United States for the purpose of regulating the international monetary and financial order after World War II.

This year marks the 75th anniversary of the Bretton Woods conference, where the richest nations at the time came together and set up a post-war monetary system. It gave birth to two global institutions that are still standing today: the International Monetary Fund and the World Bank. Since then, under the spirit of Bretton Woods, international economic institutions have been playing an important role in safeguarding world economic growth. As protectionism rises, global cooperation is facing fresh new challenges. Is the Bretton Woods system still relevant today?

"I think the institutions are still, especially the IMF, very functional, very relevant, particularly as a risk-reducing mechanism on a scale that's global. There's no other institution (which) can do that," said Hilton Root, a member of the faculty at the George Mason University School of Policy and Government.

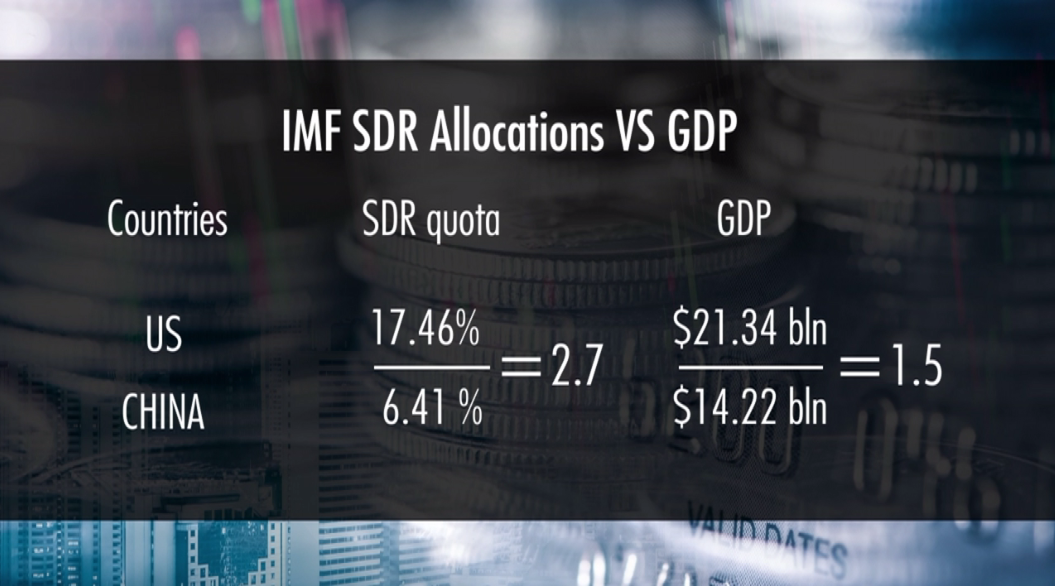

Special Drawing Rights (SDR) are allocated to IMF member countries in proportion to their existing Fund quotas, which are based on their relative size in the global economy. As of 2019, the U.S. has 17.46 percent of all SDRs, 2.7 times higher than China's 6.41 percent.

However, the U.S.' annual GDP is only 1.5 times higher than China's, meaning the amount of SDRs is disproportionate.

CGTN Photo

Some say that is only one example. There are others of emerging and developing countries versus existing developed economies. Is that a big issue? If we see a continuation of the functions of the IMF, does that situation need to be changed in a timely manner?

"Yes, it's clearly a provocation to the countries who are underrepresented in both the voting rights and the numbers of SDRs, because they feel they don't have enough say in the governance of the international system, " said Iain Begg, a research fellow at the European Institute of the London School of Economics and Political Science.

Since the IMF was created by Europeans, it has been seen as a seat for a European Union president, so the Europeans have a big say in the system.

"It's quite hard to say to somebody, we're going to diminish your weight in this system so we can give more to China. Because if you say to me, I want to take something away from you, guess what? I say, 'Oh, no, you don't'," Professor Begg said.

A lot of the European economies have bigger shares than their developing and emerging counterparts. Now Washington's idea is to let the Europeans give out more proportionally to emerging and developing countries. Of course, the Europeans might not necessarily like that. So what is the solution for them?

"That is right. the real problem is not so much the imbalance between the U.S. and China, but between China and other emerging markets, and the European nations, which have inherited from the past very large shares. Germany is very similar with that of China, although the Chinese economy is several times larger, "said Daniel Gros, director of the Center for European Policy Studies.

According to Gros, there are two things the Europeans should do. "They should, first of all, unite their shares in the euro area, because they share one currency. And they also have now some physical body which could represent the euro area, the IMF and then the share of the euro area should be much reduced compared to the shares of the independent European nations. And that would free up space for China which is important to realize.

"The Chinese quota is also somewhat low, because China has not yet opened its capital account. If China were to open its capital account and let the RMB become a global currency, then the share of China would increase. The seat of the IMF should be in the country which has the largest share. So over time, the IMF might have to move to Beijing."

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3