China's leading game streaming platform DouYu International Holdings Ltd. made its Nasdaq debut on Wednesday, with shares of the company trading at 11.5 U.S. dollars, at the low end of its target range. After dropping 4.2 percent, the shares rose slightly above the IPO price, and later returned to 11.5 U.S. dollars at the market closing.

Douyu, originally a spin-off of video-sharing platform AcFun, is now one of the two largest game streaming platforms in China. The company filed for an IPO in April earlier this year but decided to postpone it purportedly due to concerns about a broader market sell-off.

Douyu's IPO comes at a time when China's game streaming industry is experiencing a tumultuous transformation. The cash-intensive nature of the business has led many smaller-scale platforms to squeeze out from the market. Originally home to hundreds of game streaming platforms in its heydays of 2016, the market is now dominated by Douyu and Huya, both are backed by video gaming giant Tencent.

Popular streamers play video games live on Douyu's platform. /VCG Photo

"A drop in Douyu's shares on the first day shows that the market still has doubts about its profit-making ability," Liu Jiehao, an analyst at iiMedia Research told CGTN, adding "Douyu was embroiled in tens of millions of net losses for three consecutive years. Though it turned profitable before its IPO, in the short term the market still has reservations regarding the sustainability of its profit making."

Its updated IPO prospectus shows that in the first quarter of 2019, Douyu's total revenues soared 123.4 percent year on year, among which 91 percent came from its streaming service. Advertising revenue, on the other hand, accounted for only nine percent of the told revenue.

But for three years, Douyu was mired in an unprofitable condition. From 2016 to 2018, its net losses totaled around 2.2 billion yuan (320 million U.S. dollars). The bulk of its revenue stems from the sales of virtual gifts - internet users buy virtual gifts for their favorite live streamers to show support.

Streamers who brought maximum profit to the streaming platform are also the maximum loss generators.

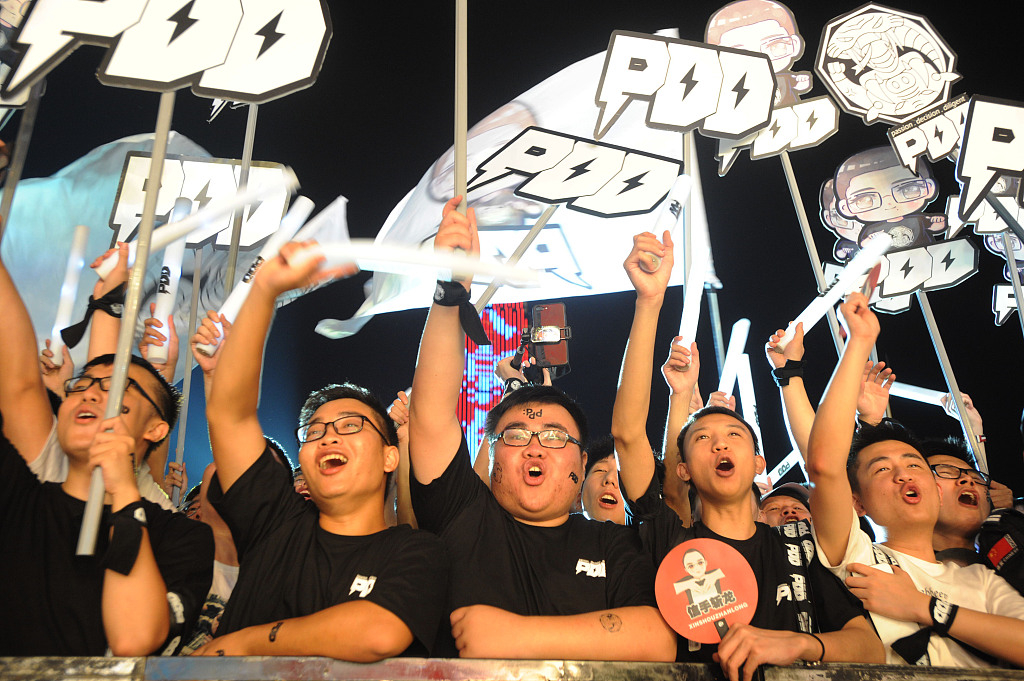

Fans of a popular live streamer at Douyu Streaming Festival in Wuhan, central China's Hubei Province. /VCG Photo

Hefty payouts for celebrity streamers suppressed the company's margins. Since the top celebrity streamers attract the most views, platforms rushed to sign exclusive million-dollar deals with top streamers. Panda TV, the once third-largest game streaming platform filed for bankruptcy in March this year after failing to raise funds to sustain its cash-intensive business.

Heavy investments on celebrity streamers failed to bring loyalty to the platform. Streamers jumping from one platform to the other is very common in the industry, leading to numerous litigation surrounding the exclusive contract they signed with the platform. When top streamers left, the majority of their fans also tended to switch to the new platform, incurring significant losses to the old platform.

But the chaos surrounding the exodus of top streamers is likely to be temporary, Liu told CGTN. As the game streaming market turns bipolar, stability is coming back to the industry. More standardization is likely to be introduced to the management of streamers, and those streamers who hop on and off platforms frequently are likely to face greater cost for breach of contract.

"Streaming platforms will focus more on incubating their own top streamers instead of counting on a few celebrity streamers to bring quick cash," Liu added.

A national e-sport tournament launched by the State Administration of Sports was held in Chengdu, southwest China's Sichuan Province, in 2017. /VCG Photo

Facing consecutive net losses, Douyu sought to diversify its revenue stream when it introduced paid subscriptions. By the end of the first quarter of 2018, 3.8 percent of its viewers were paid subscribers, an increase of 66.7 percent from the previous years.

China is now the world's biggest mobile gaming industry, and e-sports has gained great prominence in recent years after the e-sport team Invictus Gaming won the first League of Legends World Championship for China. The popularity of mobiles games, game streaming and e-sport are feeding into each other, making the game industry a multi-billion-dollar business in China.

"While the injection of capitals into the streaming market will help promote the future development of the industry, it also raises the bar for the profit-making ability of the industry," Liu said.

The fast development of AI and growing application of 5G can bring new growth potential to the industry, and how platforms respond to that changing configuration in the industry is likely to decide their future trajectory.

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3