U.S. Federal Reserve lowered interest rates on Wednesday for the first time since the 2008 global financial crisis, amid rising concerns over trade tensions, a slowing global economy and muted inflation pressures.

The Fed's rate-setting body trimmed the target for the federal funds rate by 25 basis points to a range of two percent to 2.25 percent after its two-day policy meeting, which had been widely expected.

The Fed said it will "continue to monitor" how incoming information will affect the economy and "will act as appropriate to sustain" a record-long U.S. economic expansion.

Fed Chairman Jerome Powell held a press conference shortly after. He said, "Through the course of the year, weak global growth, trade policy uncertainty, and muted inflation have prompted the FOMC to adjust its assessment of the appropriate path of interest rates."

Despite strong job growth and solid consumer spending, Powell pointed out that manufacturing output has declined for two consecutive quarters, business fixed investment fell in the second quarter, and domestic inflation shortfall has continued.

A variety of rationales in play driving Fed's pre-emptive move

Compared to previous four major rate cuts since 1989, which represented a turning point for the Fed to shift direction to move rates lower resulted from relatively more direct reasons, the rate cut of this time was driven by multiple factors.

Signs of economic slowdown appeared globally. The U.S. second-quarter growth came in at 2.1 percent last week, a big drop compared to 3.1 percent in the first quarter. The GDP also showed substantial softness in business investment.

China's gross domestic product slowed down to 6.3 percent year-on-year in the first half of 2019.

The slowdown in Europe is substantial. The economies in the eurozone countries grew by 0.2 percent over the preceding quarter, half the 0.4 percent growth rate posted in the first quarter of the year, according to Eurostat. On an annual basis, the economy rose 1.1 percent from the same quarter a year ago, New York Times reported.

Uncertainties raised risks to global growth. Trade talks between U.S. and China are still making efforts to get progress. New leader of the UK is leading the way to no-deal Brexit.

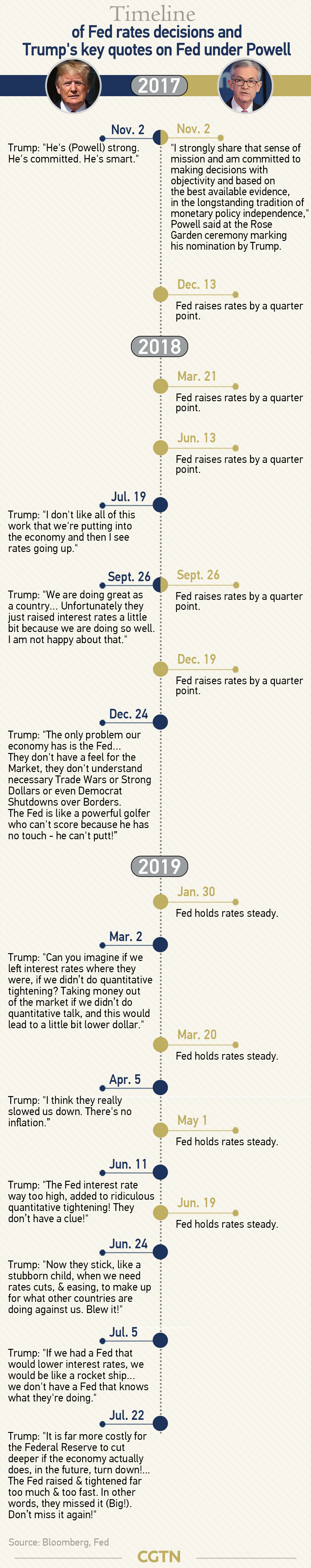

The Fed has been pressured to meet Trump’s stronger wish for a greater ease policy, reflected by his increasingly intensive criticism on the Fed since Powell came to the Fed's office in 2017.

U.S. rates cut generally favorable to emerging markets

The impact of Fed rates decision will not only be felt in the U.S. but also outside of it.

A weaker dollar is generally favorable for emerging markets, especially for those that are heavily reliant on foreign inflows to fund fiscal or current account deficits. Additionally, lower U.S. interest rates makes it easier to service dollar-denominated debt.

In 2018, the U.S. interest rates hiked four times. From the perspective of financial transmission channels, the Fed's interest rate hike and the appreciation of the U.S. dollar would make U.S. dollar assets more attractive, resulting in a large amount of international capital flowing back to the U.S., and capital outflow from the emerging markets, according to Zhu Min, former deputy managing director of IMF and dean of the National Institute of Financial Research of Tsinghua University.

For example, investment portfolio capital flows in emerging markets have fallen from an average of 31 billion U.S. dollars per quarter in 2017 to less than 17 billion U.S. dollars in 2018. After the tightening policy shift in 2019, investment portfolio capital inflow to emerging markets in the first quarter has rebounded to 36 billion U.S. dollars, he said.

If interest rates continue to fall, capital inflows to emerging markets will accelerate and their stock markets will be pushed up, however, this is undoubtedly increasing the risk and vulnerability of global financial markets at the same time, Zhu added.

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3