Global attention has been focusing on rare earths, a series of elements that are essential components of global supply chains, after China, the world's largest supplier, announced plans to roll out new policies on the strategic resources amid ongoing trade frictions with the United States.

The Association of China Rare Earth Industry last week protested against the U.S.' additional 10 percent tariff, calling it "bullying," and noted that the costs need to be paid by the U.S. consumers and market. It didn't mention a possible ban on rare earth exports, but it said it firmly supports China's necessary counter-measures.

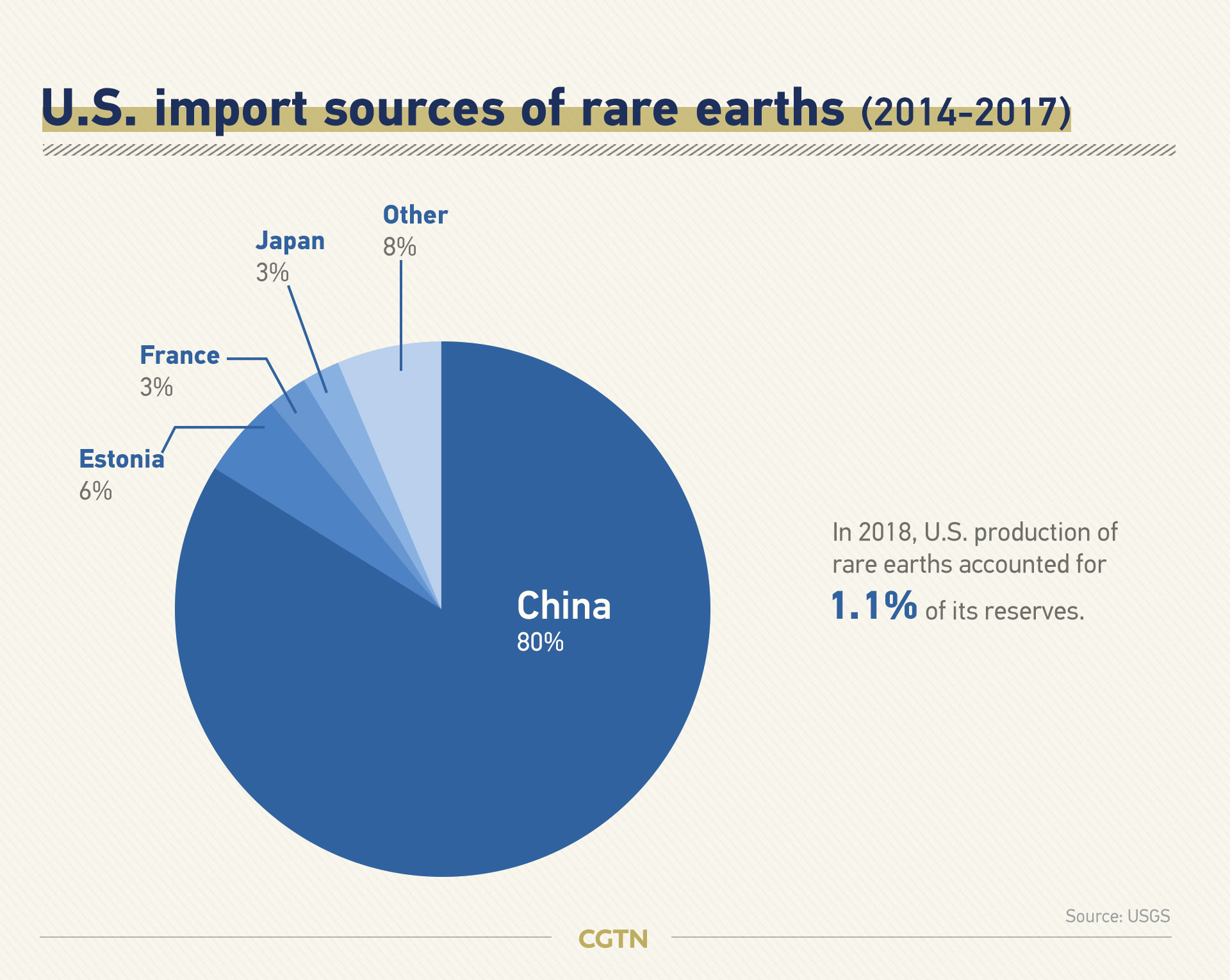

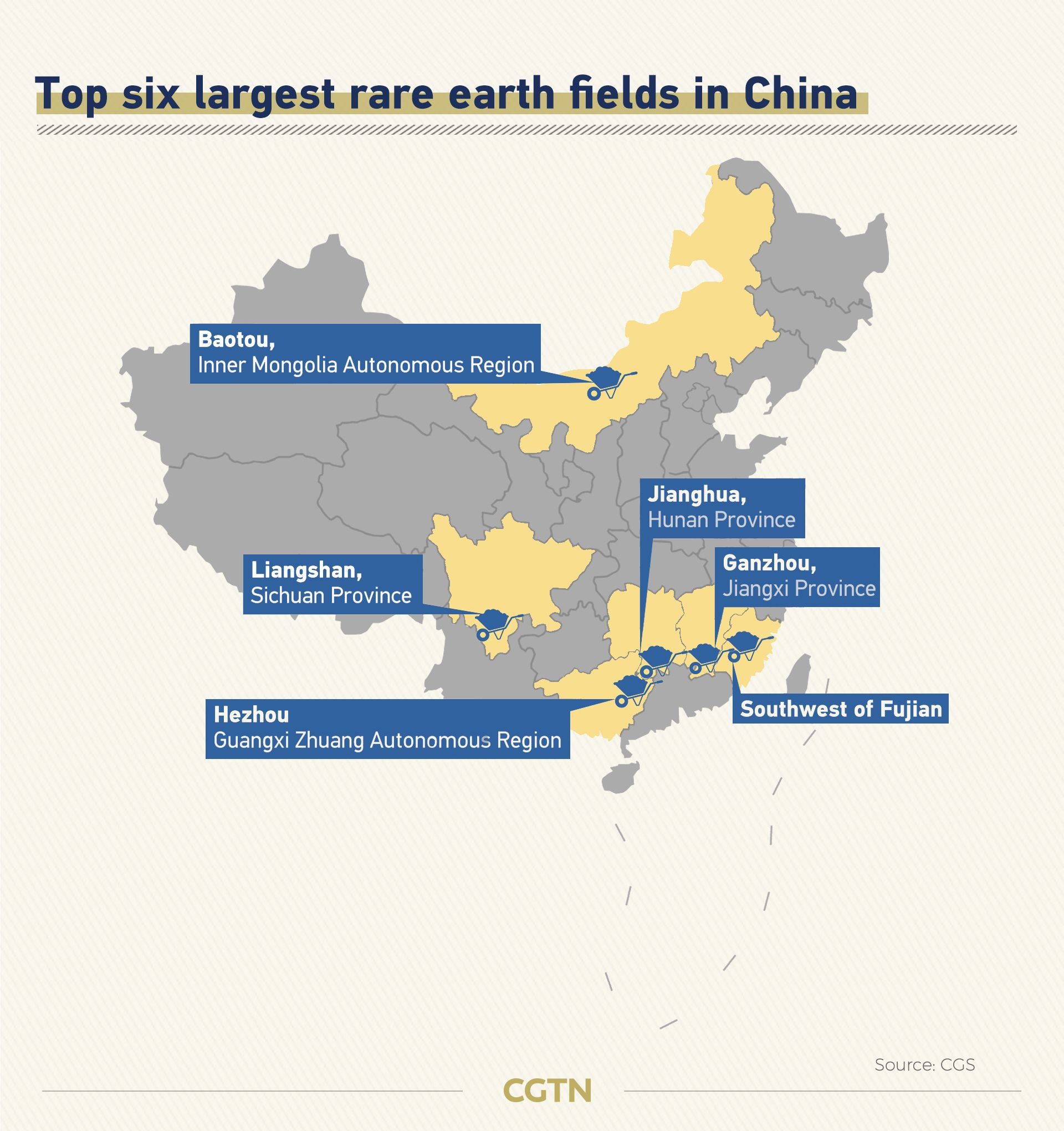

The U.S. is heavily dependent on foreign supplies of rare earths, with 80 percent of its imports coming from China. Chinese President Xi Jinping's visit to a rare earth production plant in Ganzhou, east China's Jiangxi Province, in late May unleashed all sorts of speculation and stirred up the global market.

When asked whether rare earths will become a counter-measure in ongoing China-U.S. trade frictions, China's top economic planner reiterated in June that China is willing to meet global demand for rare earths, but is opposed to those who use products made with the country's rare earths to curb its development.

What are rare earths?

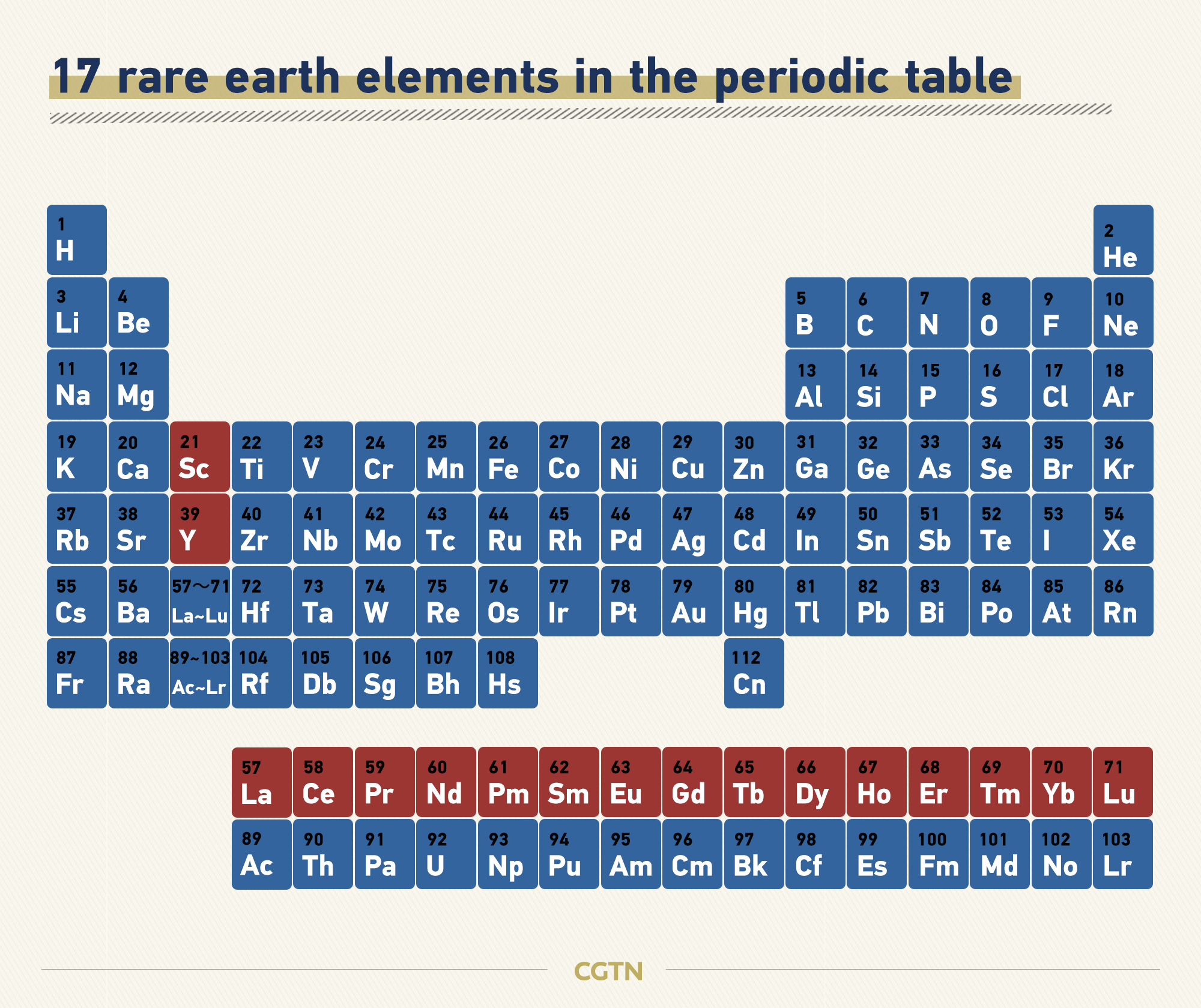

Rare earths are a group of 17 chemical elements found in minerals. With magnetic and optical properties, they are used in small doses to produce powerful effects, giving them the nickname "vitamins of chemistry."

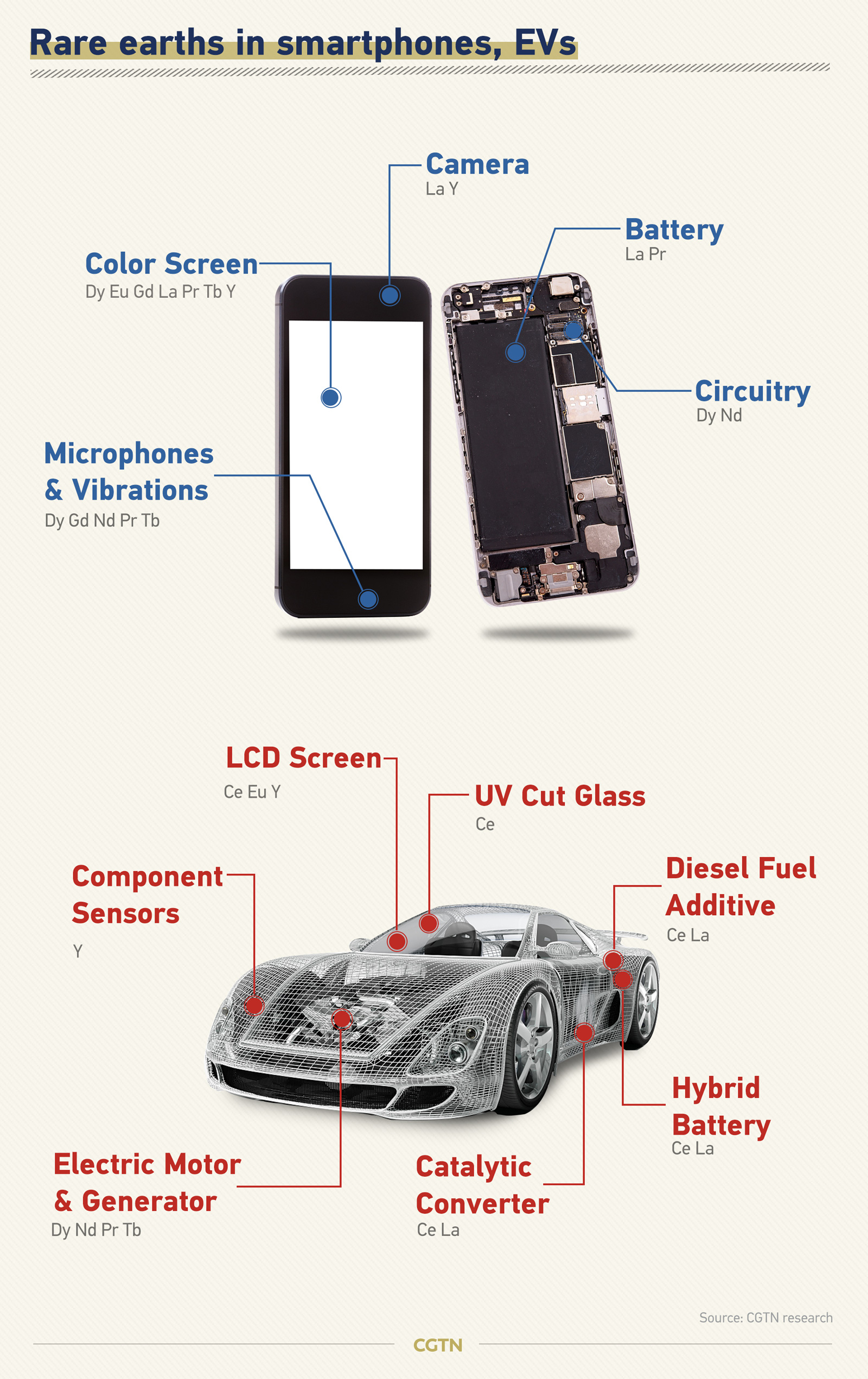

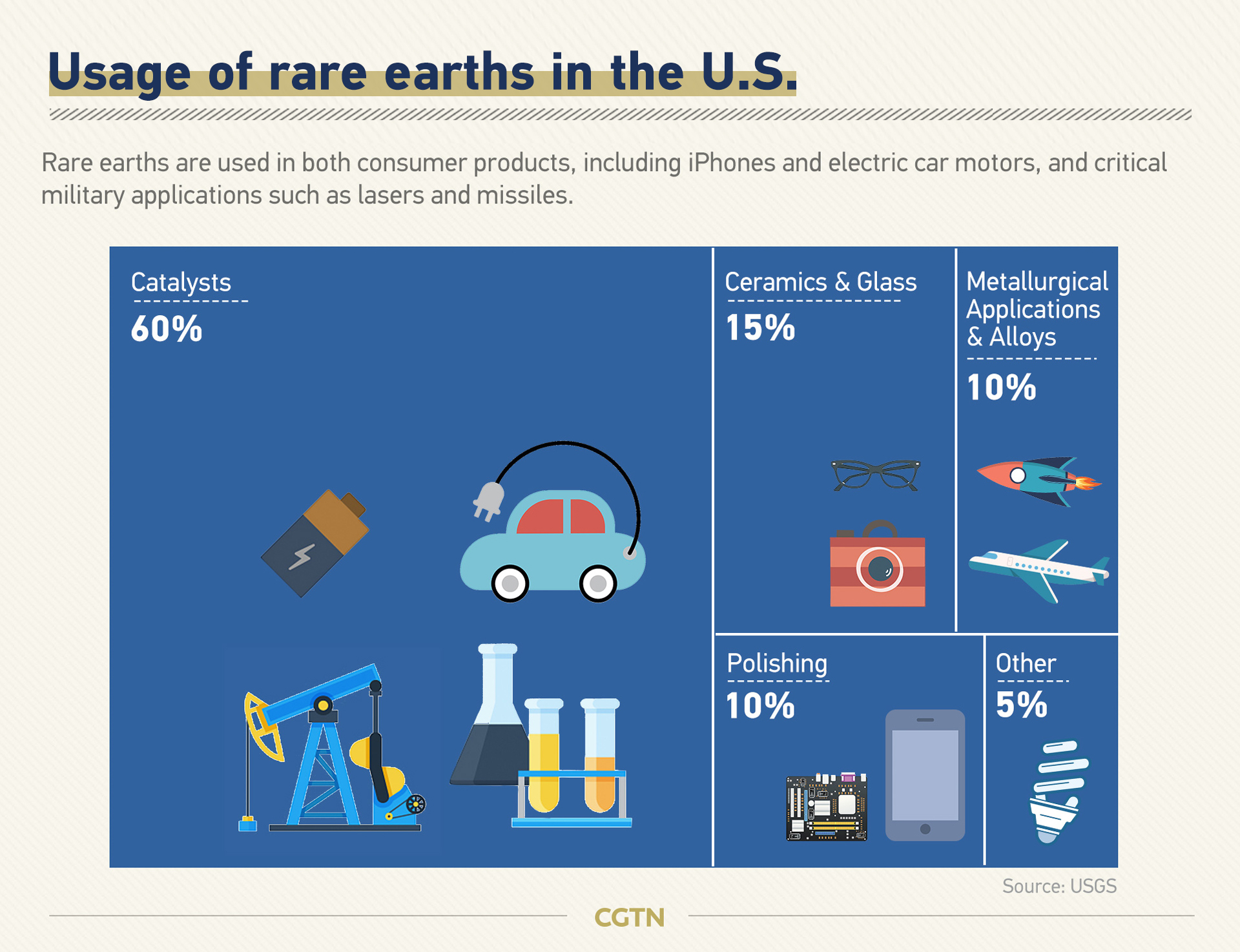

They are crucial raw materials in consumer products like smartphones and electric vehicles.

Rare earths are also used in products like laptops, camera lenses, X-rays, LED equipment, solar panels, wind turbines, lasers, aircraft engines, missiles and nuclear reactors. They are part of a list of 35 minerals deemed by the U.S. Department of Commerce as critical to U.S. economic and national security.

Although rare earths are non-renewable resources, they are actually not as rare as gold or silver. But they are usually so intermixed with other minerals that their extraction and refinement is difficult and costly.

Who supplies rare earths?

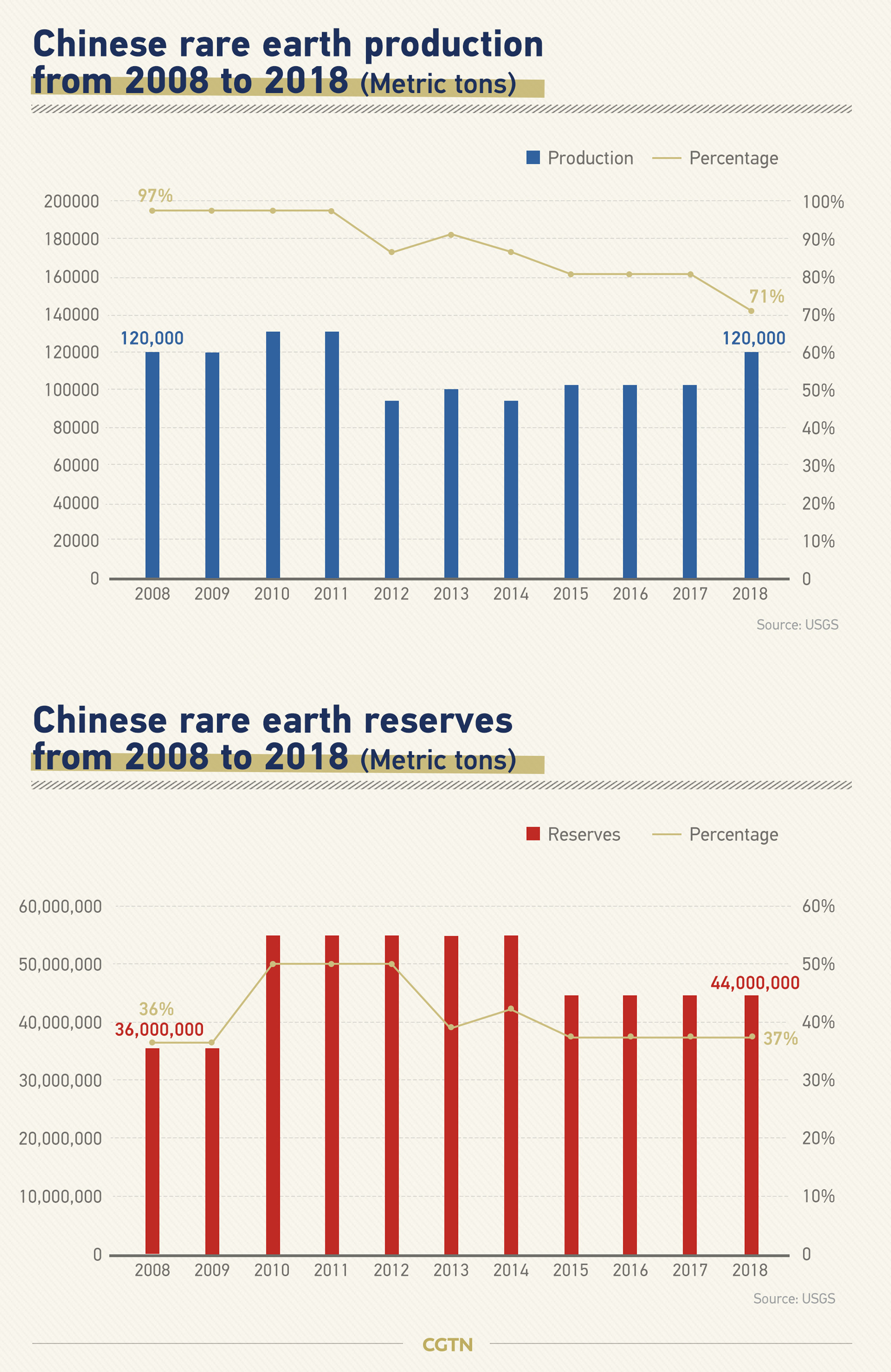

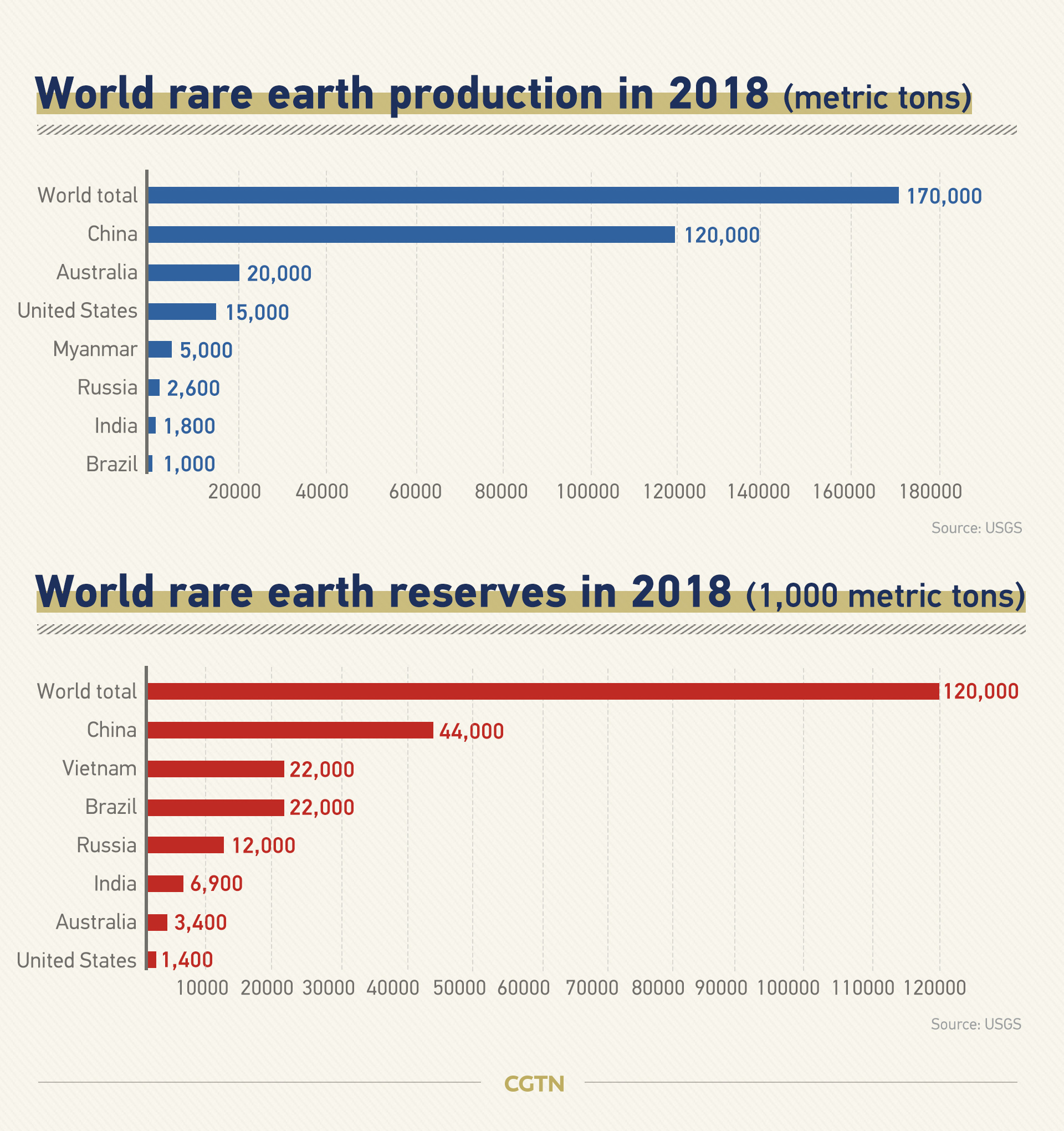

China is the primary source of rare earths for most countries. In 2018, China held 37 percent of the world's rare earth reserves, and produced 71 percent of global supply. It is also the only country that can provide all 17 rare earth elements.

The country has a global lead in rare earth production because of high efficiency and low costs, according to Mei Xinyu, a researcher from the Chinese Academy of International Trade and Economic Cooperation.

Since 2011, the number of China's rare earth patents has surpassed the rest of the world put together. Although it began to apply for rare earth patents 33 years later than the U.S., it has already accumulated 23,000 more, according to consultancy ThREE.

Rare earth reserves also exist in countries like Vietnam, Brazil and Russia. The three countries have over 10 percent of the world's reserves each, but meet just two percent of global supply totally. Australia is the second largest source of rare earths, providing 12 percent of global supply.

Who's an unreliable supplier?

The U.S. Commerce Department released a report in June, warning a potential Chinese rare earth ban would cause "significant shocks" to the U.S. and foreign supply chains. The U.S. alarm came after China's top economic planner announced plans to roll out new related policies.

Global supply chains are closely linked, and China actively safeguards the multilateral trading system and supports economic globalization, according to the country's top economic planner.

Both sides are important parts of global supply chains, and U.S. tariffs on imported products from China will hurt both as well as other countries, because those products contain many intermediate parts from other countries, said a Chinese white paper published in June.

The white paper added that the U.S. tariff hike has led to an increase in global supply chain costs, affecting the stability and security of the chain, and thus some companies have been forced to adjust their global structure, resulting in a non-optimal allocation of global resources.

Animation: Wang Li, Pan Yongzhe

Voiceover: Nick Moore

Infographics: Liu Shaozhen

(Hu Yiwei and Huo Li also contributed to the infographics)

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3