Editor's Note: Jimmy Zhu is chief strategist at Fullerton Markets. The article reflects the author's opinion, and not necessarily the views of CGTN.

Investors need to be aware that there are no central banks around the world that currently view monetary policy as an option capable of boosting the global economy. Instead, monetary policy could even weaken the stock market.

Here is what the chiefs of some of the world's major central banks said over the weekend:

- The Fed's Jerome Powell said at Jackson Hole that monetary policy is a powerful tool to support consumer spending, business investment and public confidence, but it can't provide a settled rule book for international trade.

- The Bank of England's Mark Carney said neither Fed policy nor global financial conditions are harming global growth, but rather it's the trade war that the U.S. is pursuing.

- The Reserve Bank of Australia's Philip Lowe pointed to the limited ability to cushion the global economy from mounting political uncertainties.

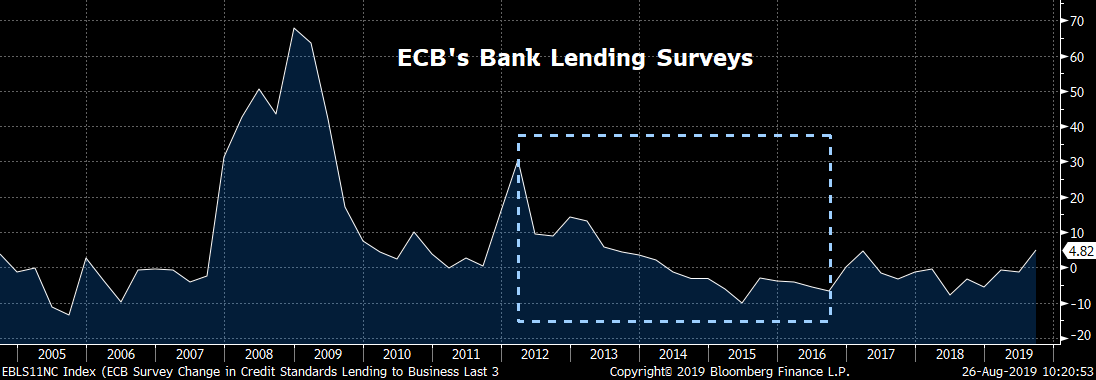

Referring to historical experience in past years, rate adjustments have failed to boost economic and lending activities in Western economies. The European Central Bank cut its benchmark lending rate from 2011 to 2016, but lending activities still slowed down in this period. The slowdown was mainly due to subdued domestic demand before and after the regional debt crises.

Source: Bloomberg

In its last easing cycle from 2007 to 2008, the Fed cut rates by 500 bps in just one year. Despite such aggressive moves, the U.S. economy failed to escape the financial crisis triggered by the collapse in Lehman Brothers.

The Fed's independence has been more or less eroded after nonstop pressure from President Trump to cut rates, and he tried to lobby the Fed for a further 100bps cut a week before the Jackson Hole meeting. The bank is expected to cut rates by another 75bps toward the end of the year, according to the futures market.

Rate cuts are a crisis management tool. Unlike the ECB's cut in 2011 and the Fed's 2007 cut, there is no visible evidence that the U.S. economy is entering a recession, except for the inversion of the yield curve. The labor market is still expanding according to monthly nonfarm payrolls and unemployment is still at a multi-decade low. Recent inflation data also show that the latest core CPI topped forecasts and grew 2.2 percent.

Any unnecessary Fed rate cut, at this stage, would be a big policy mistake. Since major central banks view rate cuts as irrelevant to mitigating the impact of the trade war, the Fed should not "waste its bullets" now but preserve some policy room for future uncertainty, the potential for which has risen in recent months.

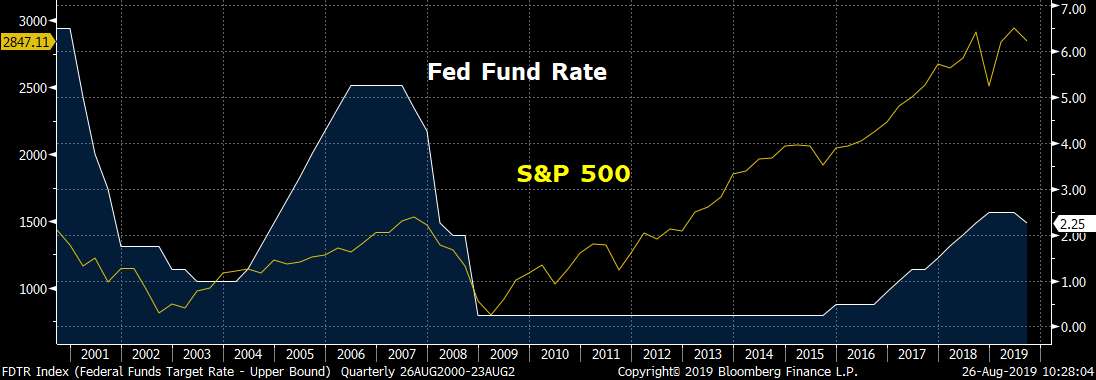

On the other hand, stocks have tended to drop during recent Fed easing cycles, with fund managers overwhelmingly flocking towards the bond market.

From 2007 to 2008, the Fed cut the benchmark rate by 500bps to 0.25 percent. At the same time, the S&P 500 slumped over 40 percent, while the 10-year Treasury yield slid over 250bps to 2.21 percent by the end of 2008. From 2000 to 2003, the U.S. central bank cut its policy rate by 550bps, coinciding with a 28 percent slump on the S&P 500.

Source: Bloomberg

Today, history is repeating itself yet again. Since the Fed cut interest rates last month for the first time since 2008, the S&P 500 has dropped 4.5 percent.

The value of the stock market is mainly driven by liquidity and corporate earnings. Extra liquidity won't help boost value by much when U.S. financial conditions remain so loose, as current levels are far from their historical peak, and bond yields have slid substantially in recent months.

Extra liquidity doesn't help, but escalating trade tensions hurt U.S. business confidence, and Trump's latest plans to increase tariffs on Chinese imports will soon dampen U.S. consumer sentiment. Lower rates, Trump's preferred strategy, will also shrink consumers' wealth, as their banks' saving rates will also drop.

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3