The MSCI has raised the inclusion factor of Chinese large-cap stocks from the current 10 percent to 15 percent, after markets closed on Tuesday.

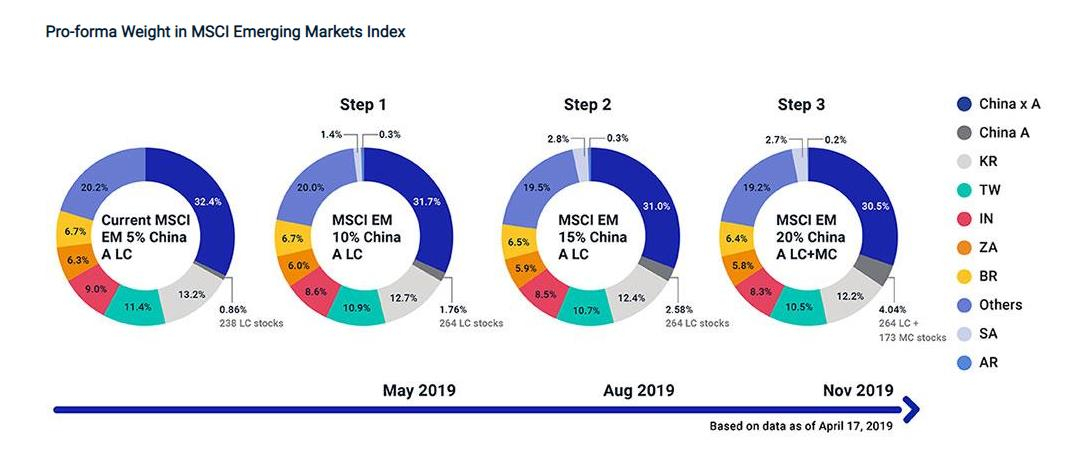

The move is expected to draw 22 billion U.S. dollars of fresh foreign inflows to the world's second largest economy. It follows the MSCI's decision in March to increase the inclusion factor of Chinese large-cap stocks to 20 percent from five percent in three steps, with increments of five percent in May, August and November.

MSCI also said it will add Chinese A Mid-Cap shares, including eligible ChiNext shares, with a 20 percent inclusion factor to the MSCI indexes in November.

Impacts of the weight increase

On completion of the three-step implementation, there will be 253 Large and 168 Mid Cap China A shares including 27 ChiNext stocks on a pro forma basis in the MSCI Emerging Markets Index.

That represents approximately a weight of 3.3 percent in the pro forma index.

Screenshot of MSCI official website.

According to Bloomberg, analysts say that the move will attract huge foreign buying of Chinese A-shares, as it provide a broader range of selection for the global investors when they try to access the China market.

Meanwhile, ChiNext stocks will become eligible in the integrated MSCI China, and will be treated the same as any other newly eligible China A shares.

Shares jump as investors cheered by MSCI expansion

Lifted by upbeat industrial profits in July and MSCI's expected A-shares' weighting increase in its indexes, Chinese stocks rallied Tuesday,

The benchmark Shanghai Composite Index climbed 1.35 percent to end at 2,902.19 points. The Shenzhen Component Index closed 1.86 percent higher at 9,443.18 points.

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3