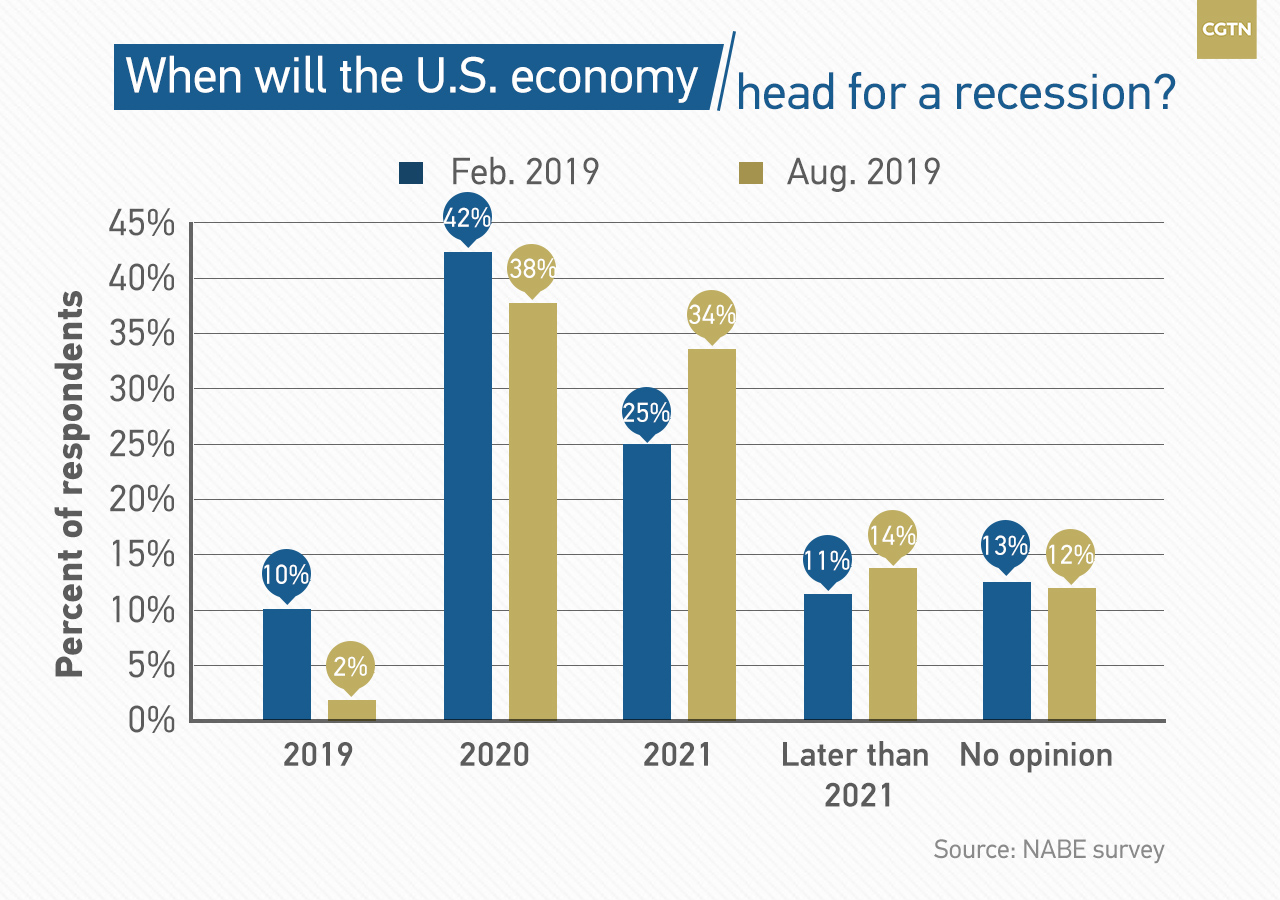

Most economists believe that the U.S. economy will slip into a recession in the next two years, according to a survey by National Association for Business Economics (NABE).

The survey conducted in August showed that two percent of respondents expect a recession to begin in 2019, 38 percent of respondents predict a recession in 2020, and 34 percent of them predict a recession in 2021. In other words, over 70 percent of the economists surveyed believe the U.S. economy will tumble into a recession before the end of 2021.

Around half of respondents find current Federal Reserve policy "too stimulative" and over a third consider the policy "about right".

An overwhelming 88 percent of respondents believe future fiscal policy should be used to reduce the federal budget deficit as a share of GDP. The Congressional Budget Office (CBO) predicted federal public debt will be 78 percent of GDP in 2019, which is nearly twice the average over the past 50 years, according to the survey.

The Federal Reserve on July 31 lowered interest rates for the first time since the global financial crisis in 2008, amid rising concerns over trade tensions, a slowing global economy and inflationary pressure.

On August 14, the U.S. Treasury yield curve temporarily inverted, with two-year note yields exceeding 10-year yields. The inversion, which happened for the first time since June 2007, is broadly viewed as an indicator for a looming recession.

In the second quarter of this year, U.S. economic growth slowed to 2.1 percent, a sharp drop from the 3.1-percent expansion in the first quarter. Despite strong job and consumption data, manufacturing output has declined for two consecutive quarters, and business fixed investment also dropped in the second quarter.

A U.S. freighter docking at a port in Qingdao, east China's Shandong Province, April 1, 2019. /VCG Photo

Tariffs weighing on the economy

More than 150 business groups representing a wide array of industries on Wednesday wrote a letter to the Trump administration, urging for a postponement of U.S. tariffs on Chinese imports scheduled to take effect later this year until at least 2020.

They warned that the tariffs will damage the economy, which is mainly driven by consumers, CBS reported.

In addition, a fifth of U.S. companies are reassessing or postponing existing investment plans due to tariff concerns, according to a study by the Federal Reserve Bank of Atlanta. It showed that about two-thirds of the companies are reassessing their 2018-2019 investment plans and 31 percent have decided to postpone investment.

A global recession could start within nine months if the 25 percent tariffs on an additional 300 billion U.S. dollars of Chinese exports take effect and Beijing retaliates, said Chetan Ahya, chief economist at Morgan Stanley, Bloomberg reported.

Ahya said that if the conflict continues, economic growth will be affected as costs increase, consumer demand slows, and companies' capital spending decreases.

Goldman Sachs also warned about the risk of recession amid trade tensions, and lowered its fourth-quarter growth forecast by 0.2 percentage points to 1.8 percent in its latest forecast.

Bank of America Merrill Lynch economists called the tariff move dangerous, saying "We worry about an adverse feedback loop where the trade war hinders economic growth, therefore prompting additional Fed easing, which in turn allows for greater trade escalation," the Washington Post reported.

Fed chief Jerome Powell, July 31 2019. /VCG Photo

Sitting on a tower of corporate debt

Accumulating corporate debt stands as another factor in the slowing economic growth. Companies with too much debt find it difficult to repay their loans, finally running into bankruptcy.

The U.S. companies accumulated 6.3 trillion U.S. dollars in debt in the decade-long post-2008 quantitative easing program, driven by extremely low interest rates, according to data released by S&P Global Ratings in 2018.

The rating agency estimates that 10.23 trillion U.S. dollars in corporate debt is set to mature globally through 2022.

When the economy is in a downturn, highly leveraged businesses will greatly increase the negative effects of a slump, because they will be forced to lay off employees and cut investment, said the Fed chief Jerome Powell in May.

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3