Editor's Note: Jimmy Zhu is chief strategist at Fullerton Markets. The article reflects the author's opinion, and not necessarily the views of CGTN.

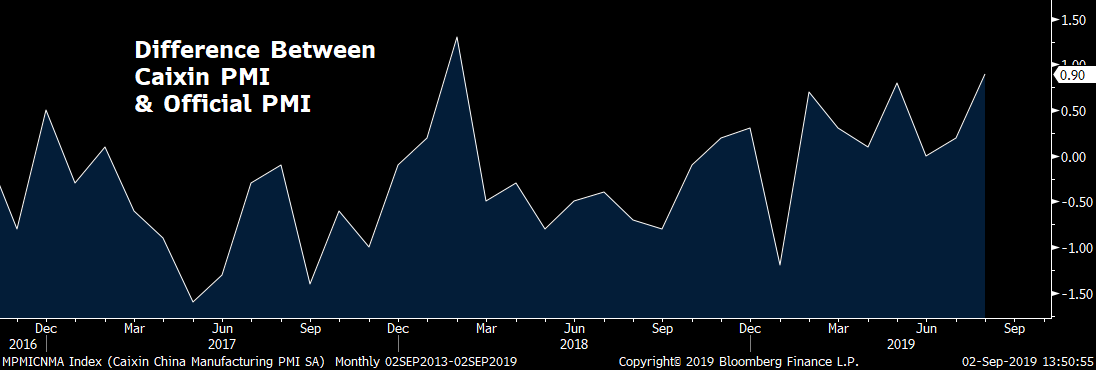

Caixin manufacturing PMI, a gauge that focuses more on the private sectors, has exceeded the official factory PMI most of the time since February 2018.

Source: Bloomberg

Global economic condition remains challenging, even with visible improvement in Caixin PMI

Caixin manufacturing PMI last month rose 0.5 to 50.4, the highest reading since March; official manufacturing PMI dropped 0.2 to 49.5 in this period, according to data released over the weekend. While the global economy slows down, the divergences between the official and Caixin PMI may be worth comparing in order to find out which one reflects a more accurate external environment.

Correlation between the JP Morgan global PMI and official manufacturing PMI stands at 0.779 in the past five years, while the correlation between the JP Morgan global PMI and Caixin factory PMI stands at 0.685. Having said that, the better reading in export-oriented Caixin PMI doesn't mean the external environment has started to improve.

According to the Caixin PMI statement for August, new orders remained in expansionary territory though it didn't specify the exact figure, but Caixin noted that it inched lower. However, the new export orders remained in contractionary territory and fell at a faster face, reflecting further weaker global demand amid an intensifying trade dispute between China and the U.S., and most of the major economies are in the late cycle.

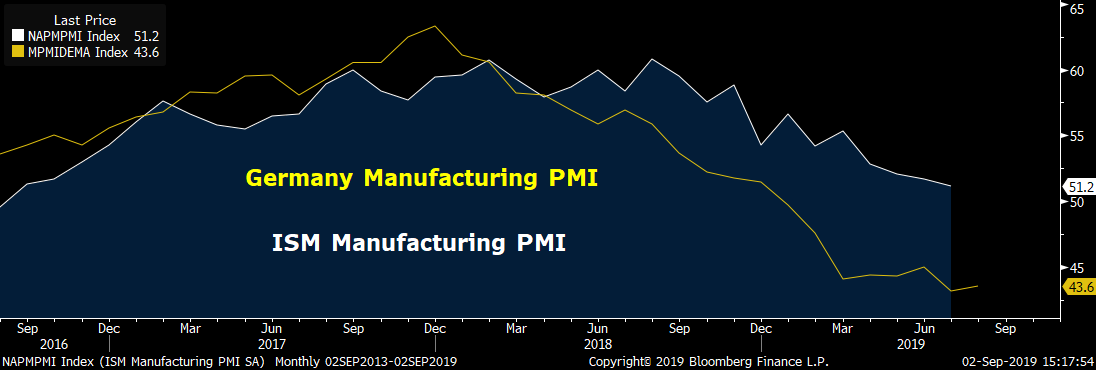

Recent trade data shows tepid growth of China's exports to the U.S. and European Union, while most of the growth is from its outbound shipment to the ASEAN region. Still, economic conditions in those advanced economies are more important to Chinese exporters, as data shows that Chinese exports to advance economies count for 65 percent in the first quarter of this year. When most of the Western countries manufacturing activities are slowing down, Chinese authorities are expected to accelerate the pro-growth measures in the coming months to offset the external weakness.

Source: Bloomberg

Another indicator also shows that the global environment has become more challenging. Global shipping companies' valuation has been shrinking since the beginning of 2018, and still shows no signs of improvement. Slower shipping activities are another sign that exports activities will continue to slow down in the near term.

Source: Bloomberg

Fiscal measures could be much more needed than the monetary policies in Q4

When the Fed is widely expected to lower its target rate by 25 bps again this month, PBOC may not follow suit because monetary conditions in China are already quite loose, thanks to the weaker Chinese yuan and lower interbank money market rates. Bloomberg monetary condition index stood at 90.79 on July, staying well in the upper-bound readings in the past five years.

Source: Bloomberg

While broad-based monetary measures are seen as unnecessary, the Chinese central bank, known as the People's Bank Of China (PBOC), is likely to continue encouraging the lenders to provide more support to smaller companies which could be more vulnerable upon any escalation in the China-U.S. trade tension. Since the Chinese New Year, China factory PMI for the small companies started to improve, scoring at 48.6 on August, substantially higher than the figure 45.3 in February. Easier funding condition and lower borrowing cost are two of the major reasons behind the recovery.

Fiscal measures are expected to be more pro-active than the monetary measures in the coming months. Growth in imports from Australia, a gauge of the domestic industrial demand remains slow since the start of the year. Thus, officials may step up the infrastructure projects, special bonds issuance and the like to support the overall economic growth.

Likelihood of domestic demand is also very crucial to the Chinese yuan's value. When most of the sovereign bond yields in the advanced economy are close to zero or even below zero, increasing flows are expected to move into the emerging economies, including China. China-U.S. bond yields' spread has been widening since beginning of the year, and any improving domestic demand will further drive the flows into onshore, which will definitely increase the PBOC's room for monetary policy.

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3