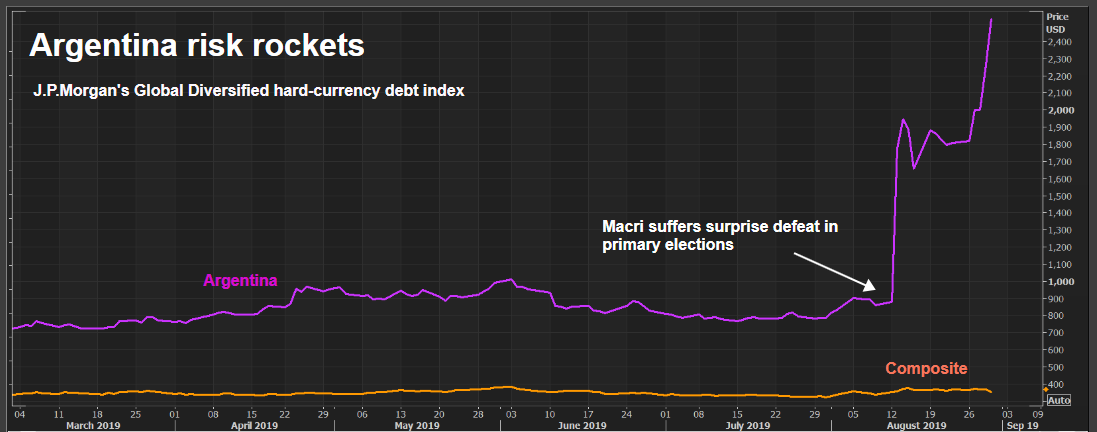

Argentine bond prices fell to record lows on Monday and the official and black market pesos diverged after the country imposed capital controls in a bid to stem a currency rout that is sharpening the risk of default.

The move on Sunday by President Mauricio Macri, a free-markets advocate who abolished capital controls after he came to power in 2015, was a sharp about-face for his administration after the conservative leader was pummeled in primary elections in August.

The country's peso, bonds and equities have since tumbled, forcing Macri to unveil plans to delay payments on around 100 billion U.S. dollars of debt as well as the currency controls restricting the purchase of dollars.

The peso closed 0.88 percent stronger in official markets, but closed 0.79 percent weaker in the black market at 63.5 per dollar, a divergence underscoring a loss of trust in the official price that was also helped by a market holiday in the United States.

"The dollar at this level is now strong enough," Treasury Minister Hernan Lacunza told a news conference. "All these measures have the central objective of stability."

Central bank president Guido Sandleris on Monday called Argentina's financial system "strong" and said the bank would adhere to its strict monetary policy, despite the currency restrictions.

Sandleris, speaking at a press conference, said the bank was in talks with the IMF to "redefine" the goals under its 57 billion U.S. dollars financing agreement for September, though there have not yet been any changes.

Read more: IMF pledges support for Argentina's currency controls amid debt crisis

The official peso had lost more than 23 percent since the August 11 primary election turned the country's politics on its head, with incumbent Macri getting thrashed by his populist-leaning opponent Alberto Fernandez.

The currency is down more than a third so far this year, following a more than 50 percent drop last year. The central bank has burned through nearly one billion U.S. dollars in reserves since Wednesday, but has failed to stem the peso's slide.

(With input from Reuters)

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3