Editor's Note: Jimmy Zhu is chief strategist at Fullerton Markets. The article reflects the author's opinion, and not necessarily the views of CGTN.

U.S. dollars sold off, treasuries gain after the U.S. releases its payroll numbers for August, and a below-estimate reading suggest another 25 bps rate cut by the Fed is almost a done case.

Nonfarm payrolls increased by 130,000 jobs, below the earlier estimate of 160,000 and previous reading at 159,000, while the unemployment rate was unchanged at 3.7 percent.

Slower growth in payrolls shows that U.S. companies are less willing to expand their business, and part of the reasons could be due to huge uncertainties from Trump's foreign policies.

The slower growth raises the question that whether any of the monetary stimuli are working. The cost of U.S. borrowing, since the beginning of the second half of the year, has been dropping quickly. U.S. 10-year government bond yields slid 50 bps since early July and now stand at 1.56 percent. However, many companies seem reluctant to expand their businesses. Data released on Thursday showed growth in U.S. durable goods orders further slowed to two percent from a year ago, below the estimates of 2.1 percent.

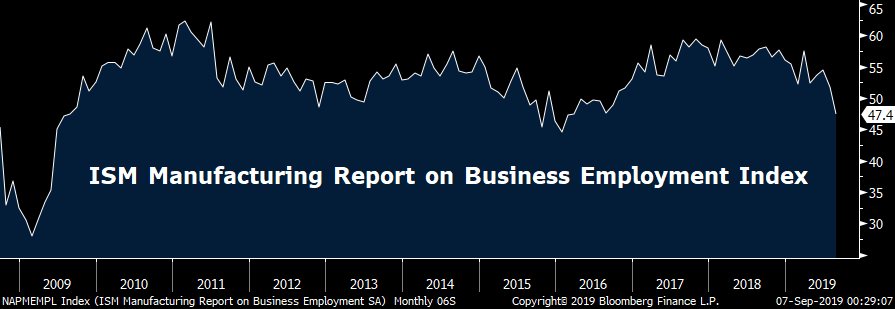

VCG Photo

At this stage, a lower borrowing cost is not attractive enough for U.S. companies to increase their spending, as most business owners would rather wait for further clues on the administration's trade policies. Besides that, lower interest rates and a flattening yield curve also reduce the commercial banks' profit margin, which may discourage banks from lending to the private sector.

The official payroll data for August contracted compared to the ADP reading, which unexpectedly grew 195,000 on Thursday night. This raised the question of whether the ADP's figures are still reliable enough to reflect the real situation in the U.S. labor market. Some other relevant indicators say the answer may be "no."

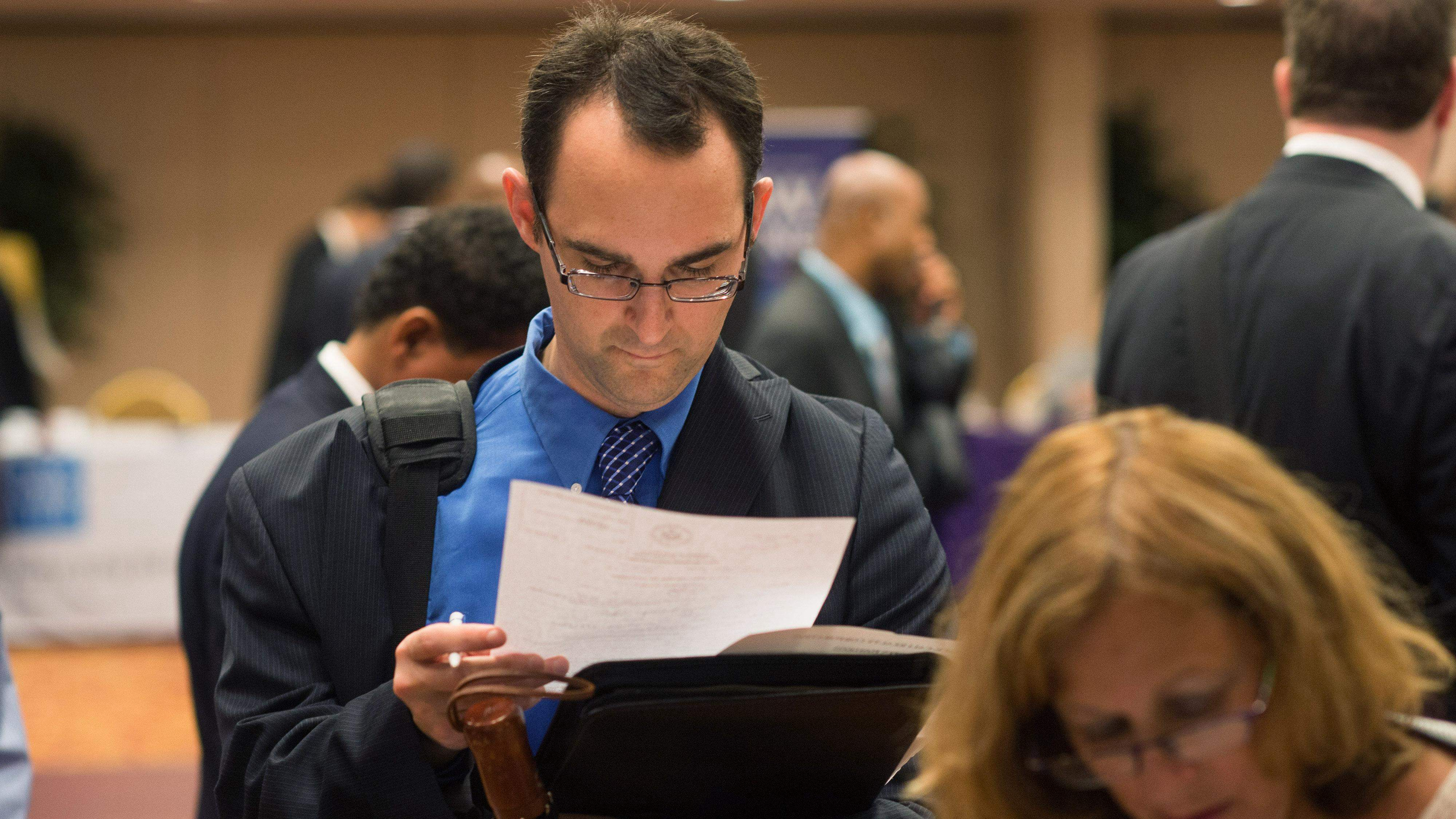

The Institute of Supply Management (ISM) published its monthly Manufacturing Report for August, the latest headline Purchasing Managers Index (PMI) was 49.1 percent, a decrease of 2.1 percent from 51.2 in the previous month, and the business employment index dropped sharply to 47.4 in August, well below the key threshold of 50. A number below 50 shows tepid hiring momentum in U.S. manufacturing, and this is in line with some indicators in officials' nonfarm payrolls. Manufacturing payrolls only added 3,000 jobs, further slower compared to the reading at 16,000 in July. On the other hand, ISM non-manufacturing PMI employment index also slumped to 53.1 from previous 56.2, lagging behind other sub-indices.

Source: Bloomberg

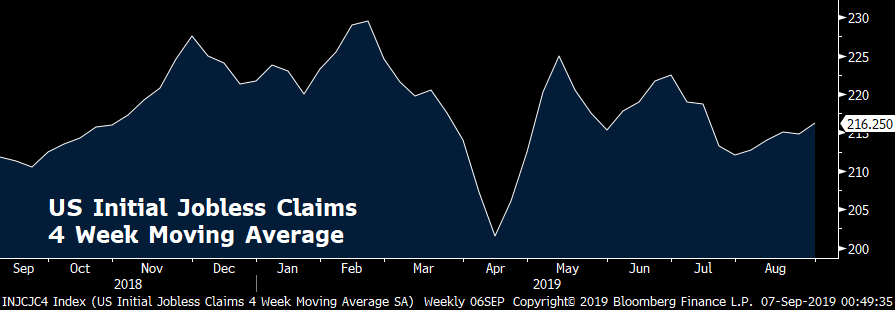

An increasing number of people also claimed jobless benefits in August. Average initial jobless claims rose to 215,000 per week last month, rising from 212,000 in July. The average figures may continue to rise if hiring momentum continues to moderate and drive the unemployment rate higher from the current 3.7 percent level.

Source: Bloomberg

Overall the jobs data suggest that an imminent recession is unlikely to arrive anytime soon, but a continuous slowdown looks intact. The Fed's Powell said overnight that manufacturing and business investment indicators have moved from sideways to slightly down, and the bad ISM manufacturing report earlier this week definitely caught the attention of Fed officials. He also said the most likely outlook for the U.S. and world economy is continued moderate growth, but the Fed was monitoring "significant risks."

Such comments mean another rate cut in the Federal Open Market Committee (FOMC) meeting this month is warranted, and it's likely to be another 25 bps cut instead of a size of 50 bps. The agreement between U.S. and Chinese delegates to meet next month in Washington is likely to boost some sentiments in risk assets, easing some fears on nonstop escalation amid the trade tension.

Curve inversion in U.S. three-month and 10-year treasury yields has narrowed to 40 bps from 49 bps a week ago.

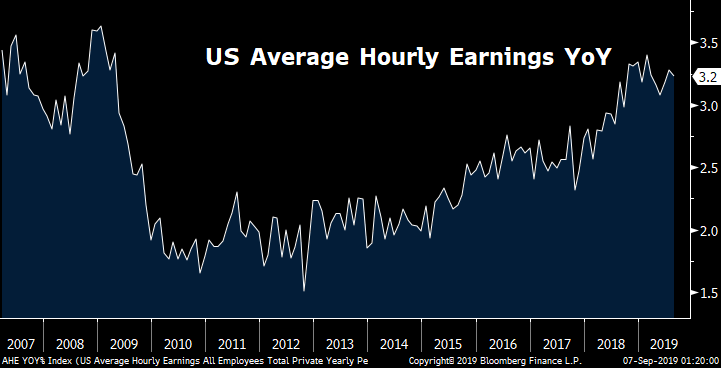

Wage growth in August's jobs report is another indicator that suggests a 50 bps rate cut this month is not justified. Average hourly earnings grew 3.2 percent on a yearly basis, and 0.4 percent from the previous month. The pace of wage growth remains near the quickest pace in the past 10 years, supporting the view that inflation growth in the largest economy remains stabilized.

Source: Bloomberg

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3