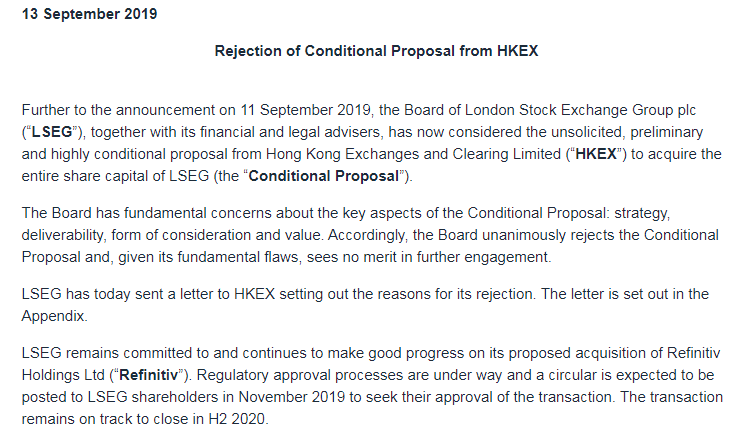

London Stock Exchange (LSE) rejected the 39 billion U.S. dollars takeover offer from Hong Kong Exchanges and Clearing Limited (HKEX) on Friday, opting to stick with its planned purchase of data and analytics group Refinitiv.

In a statement, LSE said management "unanimously rejects the conditional proposal." HKEX's valuation of the LSE falls "substantially short" and the "ongoing situation in Hong Kong" adds to uncertainty for shareholders, the London bourse added.

HKEX made its offer just two days after its officials traveled to London to present it to LSE Chief Executive David Schwimmer for the first time.

In a letter to HKEX CEO Charles Li and Chairwoman Laura Cha, LSE Chairman Don Robert said: "We are very surprised and disappointed that you decided to publish your unsolicited proposal within two days of receiving it."

"The (LSEG) board has fundamental concerns about your proposal," Robert said in the letter.

LSE's rejection statement of conditional proposal from HKEX. / LSE Screenshot

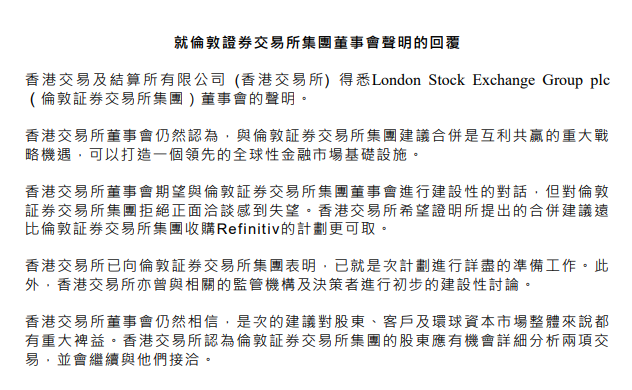

Hong Kong Exchange refused to give up on its bid to take over the London Stock Exchange after the British bourse emphatically rejected its 39 billion U.S. dollars takeover offer.

The Hong Kong Exchange said it would now hold more talks with LSE investors as it considers its next step, aiming to keep alive its hopes of becoming a more global player to rival U.S. giants ICE and CME.

"HKEX believes that shareholders in London Stock Exchange Group (LSEG) should have the opportunity to analyze in detail both transactions and will continue to engage with them," it said in a statement.

HKEX's statement for the rejection. /HKEX Screenshot

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3