Facebook's potentially groundbreaking Libra would not be a threat to national sovereignty, and will operate on top of existing currencies, according to the head of the project following a meeting with 26 global central bank representatives in Basel on Monday.

David Marcus, CEO of Calibra – the digital wallet that will be used for Libra transactions – took to Twitter after the meeting to say the coin would be "backed 1:1 by a basket of strong currencies," meaning that "there's no new money creation."

Marcus went on to describe strong regulatory oversight as "desirable," while affirming that he would be looking to "continue to engage with Central Banks, Regulators, and lawmakers to ensure we address their concerns through Libra's design and operations."

Calibra CEO David Marcus. /VCG Photo

Calibra CEO David Marcus. /VCG Photo

The Facebook executive's efforts to address concerns of central bankers and policymakers came after a conference on global "stablecoins", held by the Bank of International Settlements (BIS) in Switzerland.

While the names of the central bank representatives attending the event were not published, the Financial Times on Sunday reported that the Bank of England and the U.S. Federal Reserve would be in attendance.

According to the conference agenda, Libra gave a presentation to the central bank representatives, before a discussion on topics covering cybersecurity, regulations, fair competition and tax compliance.

Fnality International, a firm developing blockchain-based versions of five major fiat currencies including the U.S. dollar and euro, also pitched its vision of the future to the conference, while JP Morgan gave further details on its own JPM Coin.

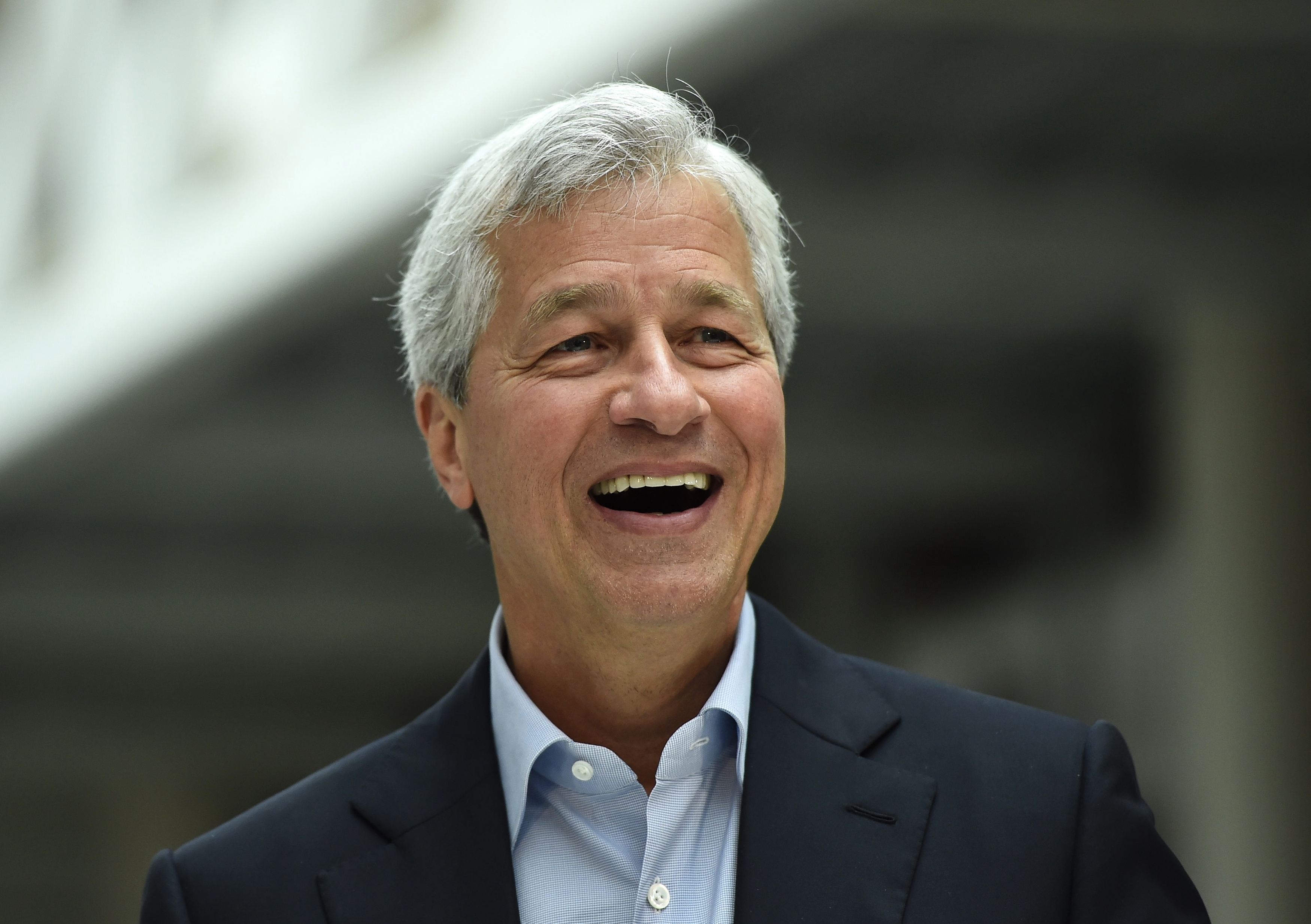

JPM Coin was announced earlier this year, and as a "stablecoin" it will be pegged 1:1 with the U.S. dollar. JP Morgan CEO Jamie Dimon has been highly critical of cryptocurrencies like Bitcoin, but his firm is backing JPM Coin to make cross-border transactions and securities trading instant and secure.

JP Morgan CEO Jamie Dimon, who has launched JPM Coin despite being hugely skeptical of existing cryptocurrencies like Bitcoin. /VCG Photo

JP Morgan CEO Jamie Dimon, who has launched JPM Coin despite being hugely skeptical of existing cryptocurrencies like Bitcoin. /VCG Photo

Despite the efforts of the three firms to assure central banks that their projects have the potential to transform the way the world pays and does business, there are still major stumbling blocks.

Benoît Cœuré, chair of the BIS' Committee on Payments and Market Infrastructure and a member of the Executive Board of the European Central Bank, said that for stablecoins the "bar for regulatory approval will be high," thanks to the serious risks that their untested technology poses to "public policy priorities."

That apprehension mirrors similar concerns from major economies, with the finance ministers of France and Germany warning last week against the "incalculable" risks of adopting Libra.

U.S. Fed Chief Jerome Powell warned in July that plans to develop Libra could not continue unless Facebook addressed major concerns "regarding privacy, money laundering, consumer protection and financial stability."