Editor's Note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

Federal Reserve Chief Jerome Powell's stance in the September meeting was much more hawkish than earlier market expectations, with few clues offered on what the Fed is going to do in upcoming meetings. Some people, including U.S. President Donald Trump, say the Fed chief is clueless, but actually he is now taking back control.

The Fed's dot plot suggests there will be no more cuts this year or next, and there will even be higher rates in 2021 and 2022. Besides that, a usual split with the FOMC participants also reflects the increasing views that the current pace of rate cuts is too fast without much basis. At the same time, Powell ruled out a negative rate environment for the U.S. during his post-meeting press conference.

The future market currently shows the possibility of another rate cut in December stands at 71.3 percent, down from 100 percent before the FOMC meeting. A more divided view in the rates market will be easier for the Fed to manage investor expectations, as volatility will be limited upon any policy decision to be made. If everyone expects the Fed to continue easing in December, the Fed may have to do just that if it wants to avoid the "tantrum."

Fed's attempt to fix the yield curve falls short

Since early July, escalating trade tensions between the U.S. and China and slower global economic growth have increased fears of a potential recession. The inversion in the yield curve has accelerated, so the Fed, under pressure from the bonds market, has no choice but to ease monetary policy, despite many economists not expecting a rate cut to materialize.

One of the explanations for the inversion of the yield curve is that long-term yields are falling at a faster pace than short-end rates, with short-end rates more sensitive to the rates outlook and long-end rates tied more closely to the economic and inflation outlook. In other words, current policy support is not enough to offset the downside risk in the economy. Inverted yield curves have historically been good predictors of upcoming recessions, and that's why the Fed has been trying to fix the curve by adjusting its policy rate.

However, the Fed failed to achieve that in its July meeting. The inversion between the U.S. 10-year and three-month government bond yield almost reached 60bps in late August after the Fed cut the policy rate on July 31, when the curve looked to be leveling out.

One of the issues here is that the Fed's rate cut only makes other central banks more likely to ease monetary policy, and increasing negative bond yields in other markets are forcing U.S. bond yields to fall, especially those with a longer tenor. To some extent, the more rate cuts made by the Fed, the more the yield curve could further invert.

Economic data calls for Fed to take a "time-out"

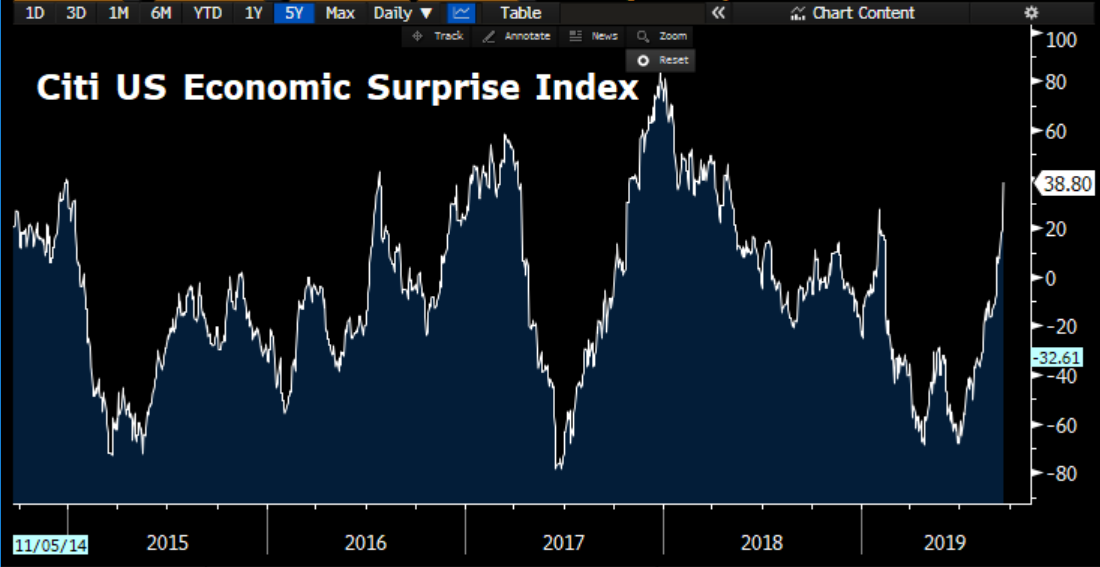

The Fed has been stressing that its rate policy should be data-dependent for many years. Economic data released in recent weeks showed that earlier fears of an imminent recession were excessive. The Citi U.S. Economic Surprise Index has been rising for 12 consecutive weeks, and now stands at its highest level since early 2018. The sharp rise in the index reflects that actual economic conditions are much better than earlier expectations, raising questions over whether the Fed should pause its monetary easing for the time being.

Improving economic conditions are also being reflected in the Treasuries' yield curve, which has historically served as a reliable indicator of U.S. economic strength. The inversion in the yield curve, one of the major factors behind the Fed's rate cut in July, had much improved before the FOMC meeting. The gap between the 10-year government bond yield and three-month yield narrowed to -16bps from -49bps at the beginning of the month. The decreasing inversion in the curve actually reduces the urgency for the Fed to act.