Wall Street stocks ended flat after a choppy session on Monday amid lingering questions over trade and U.S. Federal Reserve interventions to ensure financial market liquidity.

After three straight weeks of gains, major indices fell last week amid continuing worries over the U.S.-China trade dispute and a spike in oil prices after an attack on Saudi Arabian oil assets that the U.S. has blamed on Iran.

Analysts said weak European manufacturing data weighed on sentiment somewhat, but "U.S. stocks remain very strong in an international comparison," said Gorilla Trades strategist Ken Berman.

The Dow Jones Industrial Average finished at 26,949.99, up 0.1 percent.

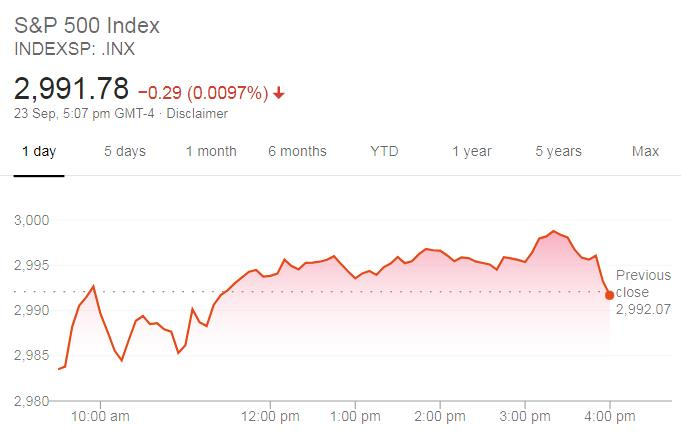

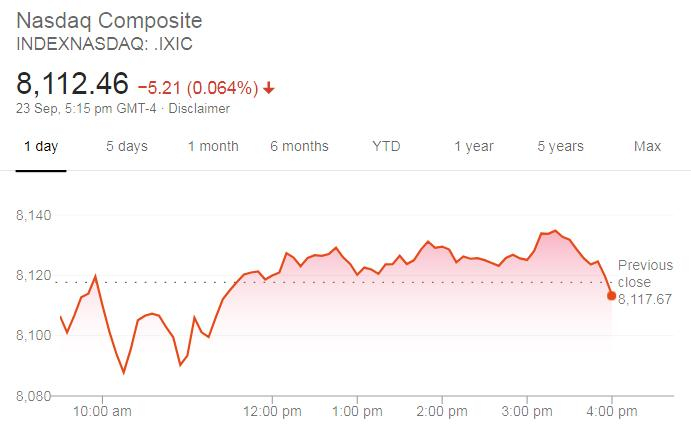

The broad-based S&P 500 ended essentially flat at 2,991.77, while the Nasdaq Composite Index dipped 0.1 percent to 7,818.61.

Analysts cited remarks late Friday from U.S. President Donald Trump downplaying the odds of a China trade deal before the 2020 presidential election as adding downward pressure to markets.

Investor confidence has also been challenged by sudden moves by the New York Federal Reserve to boost liquidity in the financial system and prevent short-term interest rates from rising too high.

New York Federal Reserve Bank President John Williams defended the moves.

"We were prepared for such an event, acted quickly and appropriately and our actions were successful," Williams said.

But he said it remains important to "examine these recent market dynamics" that led to the situations, and "we will continue to monitor and analyze developments closely."

But St Louis Fed President James Bullard said there is a risk the economic slowdown will be "sharper than expected," and warned the trade uncertainty will be a feature for years ahead so the world "should prepare for a future with somewhat higher tariffs and non-tariff barriers."

Source(s): AFP