07:16

Whether it's learning English through your phone on the subway, or speaking to a real native speaker thousands of miles away through video chat, China's online education sector has developed rapidly in recent years.

Thanks to growing incomes, the industry is set to expand, as spending on online education continues to increase. Currently, eight of the world's 15 largest listed education companies are Chinese.

Consultancy firm iResearch estimates that online education makes up less than 10 percent of the total market share of the education industry, but has grown into a 36 billion U.S. dollar business in China in 2018.

There are 135 million paying users of online education services in China, a number which is expected to more than double to 296 million by 2020. By then, the market is expected to be worth as much as 433 billion yuan (62 billion U.S. dollars).

01:15

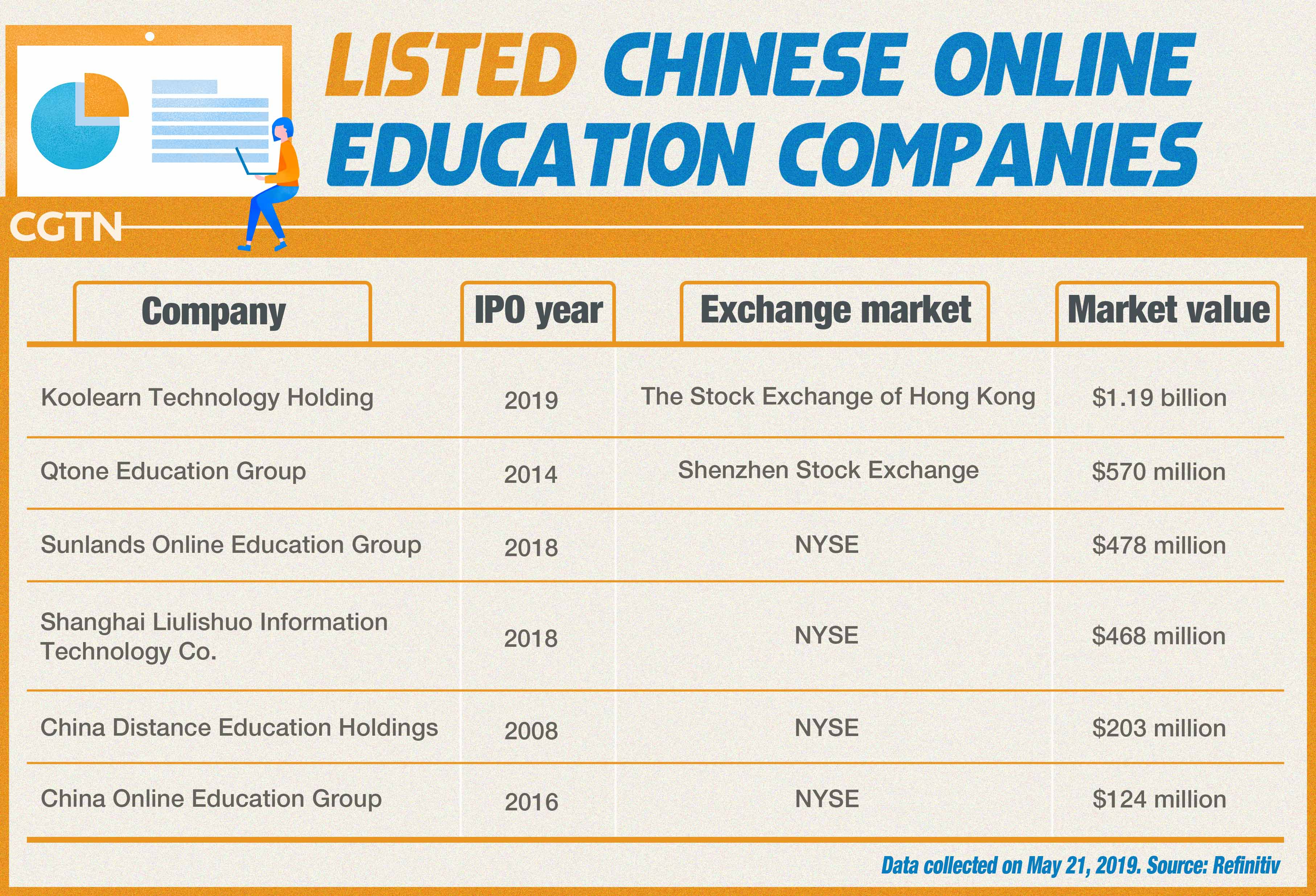

Seven online education companies are listed, with Koolearn, a subsidiary of New Oriental, the latest to launch an IPO in March.

Moving teaching online and away from physical classrooms cuts rental costs for education companies, while easy internet access has propelled growth in the sector. China's active online population reached 802 million in 2018, a whopping 98 percent of whom are mobile users, according to the China Internet Network Information Center.

High costs

However, the inability to make a profit remains a common dilemma for online education companies. FreesFund partner Li Feng told CGTN that high marketing expenses is the leading cause.

"It's quite challenging for an education company if it spends too much on marketing and also its customer renewal rate is low," Li said.

While marketing is essential for customer acquisition, it also leads to high losses. Li added that this business model is unlikely to change for some time.

Shanghai Liulishuo Information Technology Co, a spoken English learning app, had 25 million paying subscribers in 2018, a substantial increase from 810,000 in 2017 and 70,000 in 2016. However, its accumulated net losses hit 487 million yuan in 2018, twice as much as 2017.

00:42

VIPKID, which connects English language teachers in North America with Chinese students online, claims to be one of the world's biggest online education companies. However, it was struggling to raise a fresh 500 million U.S. dollar round of funding as investors last month raised concerns about the high cost of user acquisition, according to the Financial Times.

Regulation hurdle from WeChat

Incentivizing users to share posts on WeChat Moments was, until recently, one of the fastest and cheapest ways for companies to gain new users. Firms would encourage subscribers to share links with their WeChat contacts in return for benefits like tuition rewards and physical books.

However, WeChat in May reiterated its rule banning companies from enticing users to share advertising-related links and QR codes to prevent such posts from flooding users' WeChat Moments.

Some supported the measures to prevent spamming, while others insisted that WeChat's move prevented them from tracking their own learning progress.

The companies denied forcing users to do marketing for them, saying they only wanted to encourage academic progress. However, the "sharing to Moments" requirement for users to complete their daily lessons has since been canceled. WeChat's regulation put further pressure on online education companies to gain users through word-of-mouth.

AI teacher

Beyond spending on marketing, several online education firms are investing in technologies like big data and artificial intelligence to improve their services. Liulishuo offers voice recognition and an AI phonetic detection platform, which allows users to read English content on their phones and receive real-time feedback generated by the system's algorithm.

For some users, the benefits of these online platforms are how they can be used sporadically through the day to learn on their phone. Others are enticed by adverts which promise to elevate users' language ability and confidence when it comes to ordering in a foreign restaurant or dealing with English-speaking clients over the phone.

However, others have complained that these apps are still not as effective as face-to-face learning with a teacher, as the algorithms can still miss mistakes.

A lecturer from a leading online education company told CGTN that even though students can ask questions online, it's still hard to assess the real needs of individual students.

In recent years, TAL Education Group and New Oriental Education & Technology Group, China's top two education players, have transformed from offline to online, putting great emphasis on online education.

Fleeing fierce market competition in bigger cities, companies like Liulishuo and 51talk are cultivating other markets. Wang Yi, chief executive of Liulishuo, told CGTN that a considerable proportion of the platform's users are not from first and second-tier cities.

The cash-for-knowledge industry has grown rapidly in China since 2016. Beyond merely paying for their kids' education, Chinese white-collar workers are actively pursuing adult learning. Mature students make up 45 percent of Liulishuo's user base, compared to 30 percent who are kindergarten and school-age.

Read more: The eye of AI

The intelligent underwater vehicles

Consumption upgrade in full swing in China

(If you want to contribute to this series, please contact us at chinastartup@cgtn.com.)

Project Manager: Zhou Yiqiu

Director: Zhou Yiqiu, Zhao Yuxiang

Article: Huo Li

Editor: Zhou Yiqiu, Zhao Yuxiang

Filmed by: Zhao Yuxiang, Xu Haoming, Huang Yichang, Qi Jianqiang

Animation & Special Effects: Wangli, Pan Yongzhe

Designer: Zhang Xuecheng

Copy Editor: Nick Moore

Producer: Wen Yaru

Supervisor: Zhang Shilei