Editor's Note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

Global financial markets experienced a volatile session in the third quarter, mainly spurred on by recession fears in some major economies. Moving into the final quarter of the year, global central banks' policies are expected to stay dovish, as one indicator suggests the current bearish sentiment might be justified.

Key economic, financial events that have triggered global recession fears in the past three months:

- U.S. IMS manufacturing PMI slumped to 49.1 in August, the first below-50 reading since August 2016. A sub-50 reading means manufacturing activities in the largest economy are in contraction territory.

- U.S. 2-10 year Treasuries' yield curves inverted in August for the first time since 2007. Inverted yield curves have preceded each recession in the past few decades.

- Brexit uncertainty.

- An increasing number of major economies' government bonds are yielding negative, meaning global growth prospects are deteriorating.

With a particularly complex global environment, it's hard to gauge how big a threat these events pose in terms of causing a recession. Much of the current economic data is not able to predict upcoming trends, when political voices are louder than economic fundamentals. Against such a backdrop, the global capital market has been volatile in this quarter. This raises the question of whether current asset prices fairly reflect current global growth.

The performances of individual stock indices in different countries have varied, making it even harder to judge global sentiment as a whole. However, the ratio of copper and gold prices can be used to gauge "emotion" in capital markets, as prices of these two metals reflect two very different perspectives.

Copper is a raw material widely used in construction and machinery because it is a good conductor of both heat and electricity. Higher copper prices indicate strong industrial demand, and vice versa. Gold on the other hand is a benchmark safe haven asset and a good indicator of fear and negativity in the capital market. Its price has surged 6.2 percent this quarter amid rising global uncertainty.

The copper/gold ratio currently stands at 0.1735, 13.4 percent lower than the beginning of the year, and is at its lowest level since October 2016. In other words, current market sentiment is at its lowest point in three years. The chart below shows the copper/gold ratio has moved consistently with the JP Morgan global PMI, one of the most reliable indicators gauging the strength of global growth activities.

In the first six months of the year, the ratio was higher despite the falling global PMI, suggesting markets at that time were not pricing in the upcoming expected economic downturn. However, the copper/gold ratio has still been moving in tandem with global manufacturing activity, showing current market sentiment remains "quite reasonable."

Stronger dollar after rate cuts means more central banks are set to follow suit

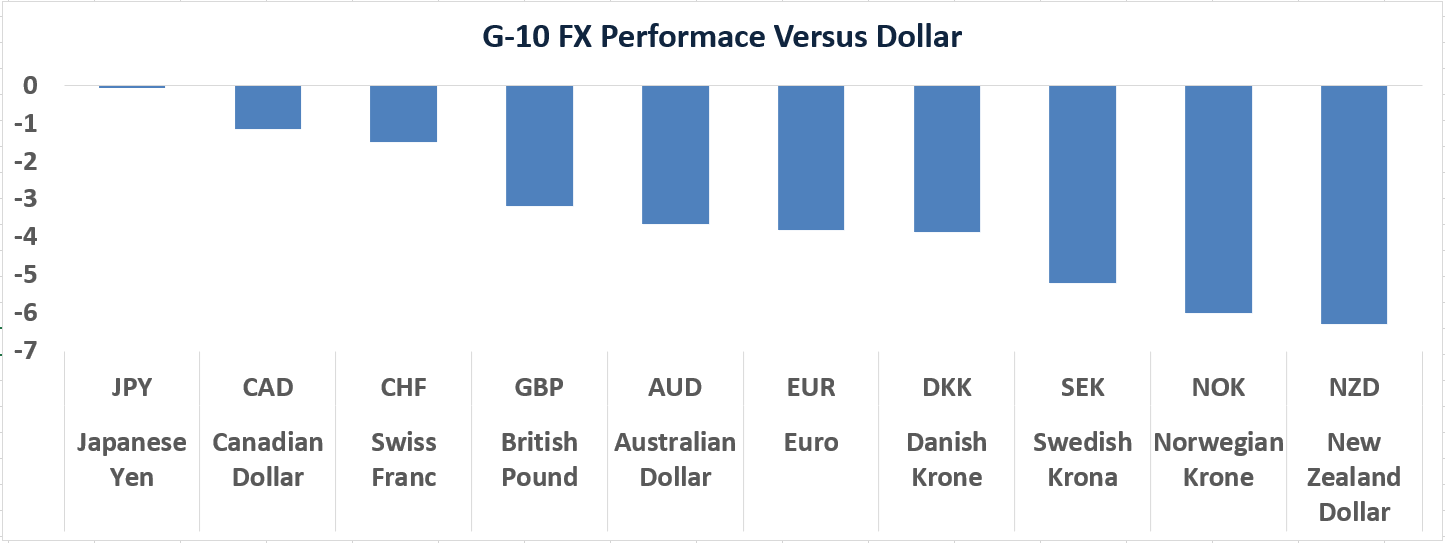

The U.S. dollar appreciated against all G-10 currencies in the third quarter, even with the Fed cutting its policy rate twice. The safe-haven Japanese yen outperformed all other currencies in the last three months amid an ongoing soft outlook on the global economy.

There has been increasing criticism of the Fed's recent rate cut policy, amid concern that the Fed's independence has been eroded, or its policy is simply being led by market pricing. However, if the current market sentiment is a fairly accurate reflection of the actual economic outlook, then the Fed's "insurance rate cut" can be considered a reasonable move, and can be seen as an opportunity for other central banks to ease further, even at a more aggressive pace.

Below is a table showing the high probability of five major central banks cutting policy rates in the next six months, based on the current rates market.

With the global economy still showing no signs of a possible rebound, betting on a recovery in equities may not be a wise move. If current predictions in the rate market are accurate, a synchronized easing from global monetary authorities will definitely be friendly to the bonds market.