The editorial board of The Wall Street Journal (WSJ) warned that banning Chinese companies from U.S. stock exchanges would hurt U.S. capital markets and American businesses.

"The delisting of Chinese companies is especially foolish. American financial exchanges are sources of U.S. economic strength, but they compete in a global market," the newspaper wrote in an editorial titled "The Worst China Trade Idea" published on Monday.

"The damage to the Chinese firms would be minor because investors would still be able to raise capital elsewhere," it said, adding foreign firms can choose to list in London or Hong Kong or Frankfurt as easily as on the Nasdaq or the New York Stock Exchange.

The editorial came after multiple news outlets on Friday reported that the White House was considering restrictions on U.S. investments in China, including blocking Chinese companies from listing on U.S. stock exchanges.

In response to the reports, U.S. Treasury spokeswoman Monica Crowley said Saturday in a statement that "the administration is not contemplating blocking Chinese companies from listing shares on U.S. stock exchanges at this time."

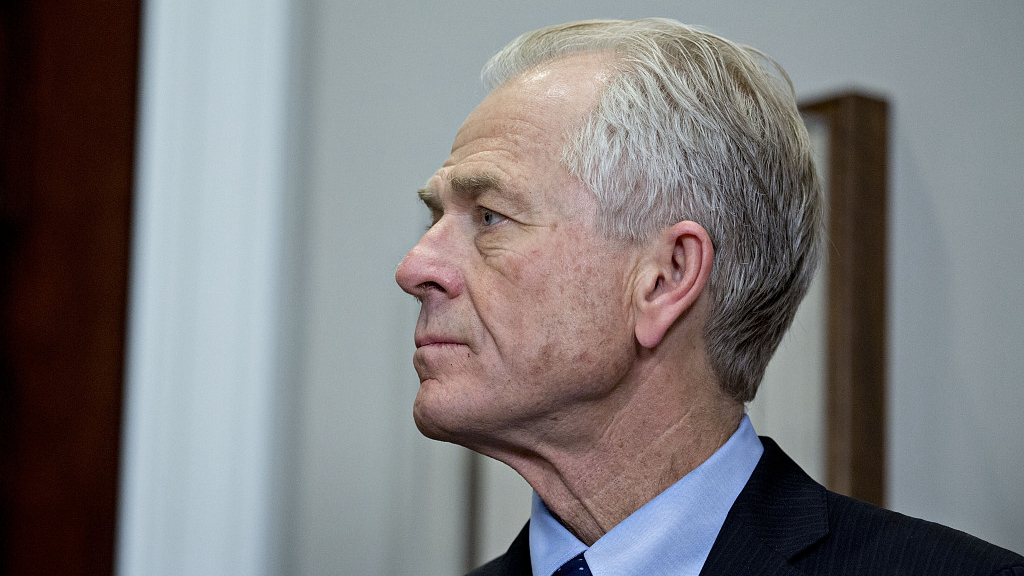

White House trade advisor Peter Navarro. /VCG Photo

White House trade advisor Peter Navarro. /VCG Photo

In an interview with CNBC on Monday, White House trade advisor Peter Navarro also characterized these reports as "highly inaccurate" and "really irresponsible."

"This story was just so full of inaccuracies. And in terms of the truth of the matter, what the Treasury said, I think, was accurate," he said.

Stephen Roach, senior fellow at Yale University and former chairman of Morgan Stanley Asia, warned that "it would be an unmitigated disaster" if the White House were to go through restrictions on U.S. investments in China.

"Open access to each other's markets (is) really important, especially with China likely to be the biggest consumer market in the world in the first half of this century," Roach told CNBC on Friday.

The WSJ also warned that a political ban on two-way capital flows will accomplish little beyond damaging America's economic growth.

"Hundreds of American firms already do business in China, many of them profitably, and they will need to keep investing to stay competitive," the newspaper said, adding the United States also benefits from Chinese investment.

Source(s): Xinhua News Agency