Editor's Note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

Volatility in the U.S. capital market may soon return this month, with there still being a chance that the Fed will disappoint traders by not further cutting rates. U.S. economic data released last week was bad, but Fed chief Jerome Powell shows little desire to fix it.

September's U.S. top tier economic data show greater recession risk

The Citi U.S. economic surprise index dropped 21.1 points, its biggest weekly decline in four months, to 23.20 last week. Most top tier economic data released in recent days surprised by coming in below earlier estimations.

- ISM U.S. manufacturing PMI for September further declined to 47.8, a second month below 50 and the lowest level since 2009. Its business employment index dropped for a third consecutive month to 46.3, with a reading below 50 meaning the manufacturing sector is slashing jobs.

- ISM non-manufacturing PMI slid 3.8 percentage points, the biggest decline since August 2016, to 52.6. The heavy fall in the services PMI raised concerns that a slump in manufacturing activity is spreading into the service sector. Its business employment index dropped to 50.4, the lowest level since February 2014.

- Friday's jobs data showed that the U.S. only added 136,000 non-farm jobs last month, the lowest figure since May and well below the five-year average of 202,000. Deep into the payrolls data, the private sector only added 133,000 jobs in September, nearly 100,000 lower than January's 227,000. The U.S. retail sector has been slashing jobs for eight consecutive months, which shows that the consumption may have started to slow down in the third quarter after robust growth in the first half of the year. Wage growth was 2.9 percent year-on-year, the slowest growth since July last year.

No matter what the Fed does this month, the market will not be satisfied

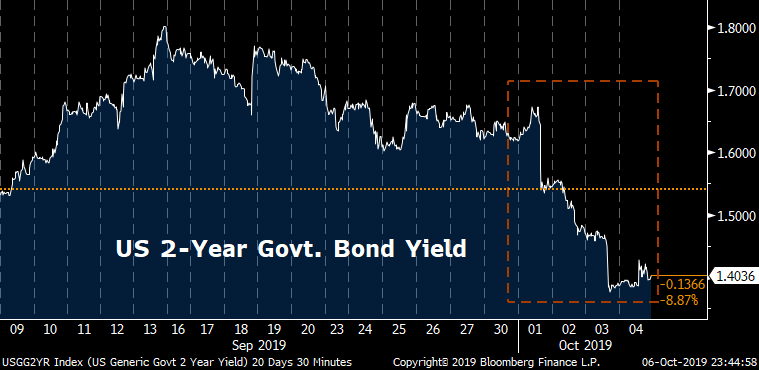

The poor U.S. economic data put the Fed into a difficult position again this month, after earlier revealing a reluctance to further cut rates during the latest FOMC meeting. The probability of the Fed cutting rates again this month suddenly surged to 72.9 percent based on the rates market, after being only 43.4 percent a week ago. Once again, traders are united in pressuring the Fed to ease again. The two-year government bond yield, one of the most relevant push factors on the Fed's policy rate, dipped over 23bps last week.

However, Powell has shown little willingness to act immediately. After last Friday's payrolls data, he said the U.S. economy is in a good place as unemployment is near a half-century low, and inflation is running close to the Fed's two-percent objective. Powell added that the Fed actually wants inflation to be just a little bit higher from current levels.

Opinions over a rate cut were split at the Fed's September meeting, with some committee members not willing to increase the pace of easing. If the Fed decides to cut the rate again this month, the FOMC will actually signal a negative outlook on the economy as more members agree to implement further measures to arrest slowing growth. If that happens, the knee-jerk reaction in the market would be to sell stocks and buy bonds amid a further deteriorating economic outlook.

If the Fed chooses to hold rates later this month, stocks and bonds are likely to face a heavy sell-off given the probability of a rate cut now stands above 70 percent. By doing so, the Fed will really struggle to calm the market sentiment because traders will question again whether or not the central bank fully understands the current economic backdrop and has sufficient tools to boost growth activities.

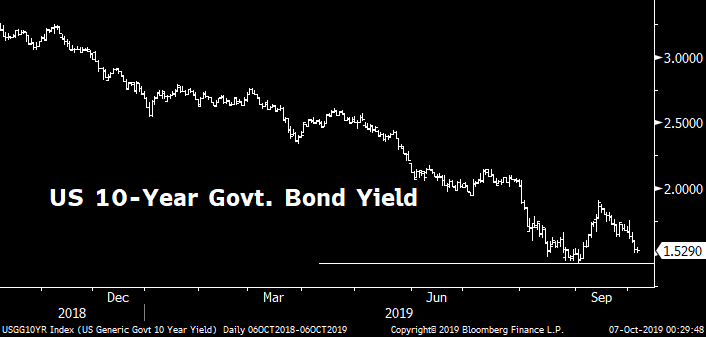

The current U.S. 10-year Treasury yield at 1.5290 percent is only 10bps higher than the lowest level of this year, seen in early September. Capital flows may continue to favor safe-haven assets as the trade outlook and Fed policy remain uncertain, meaning a new-low in the 10-year bond yield could be seen later in the month.