The semiconductor chip is well regarded as an essential component in the global advancement of technology. However, its critical role in innovation has been bogged down by the China-U.S. trade conflict, with the semiconductor industry, a key driver of America's technological competitiveness, left mired in the abyss.

Americas Market Declines Sharper

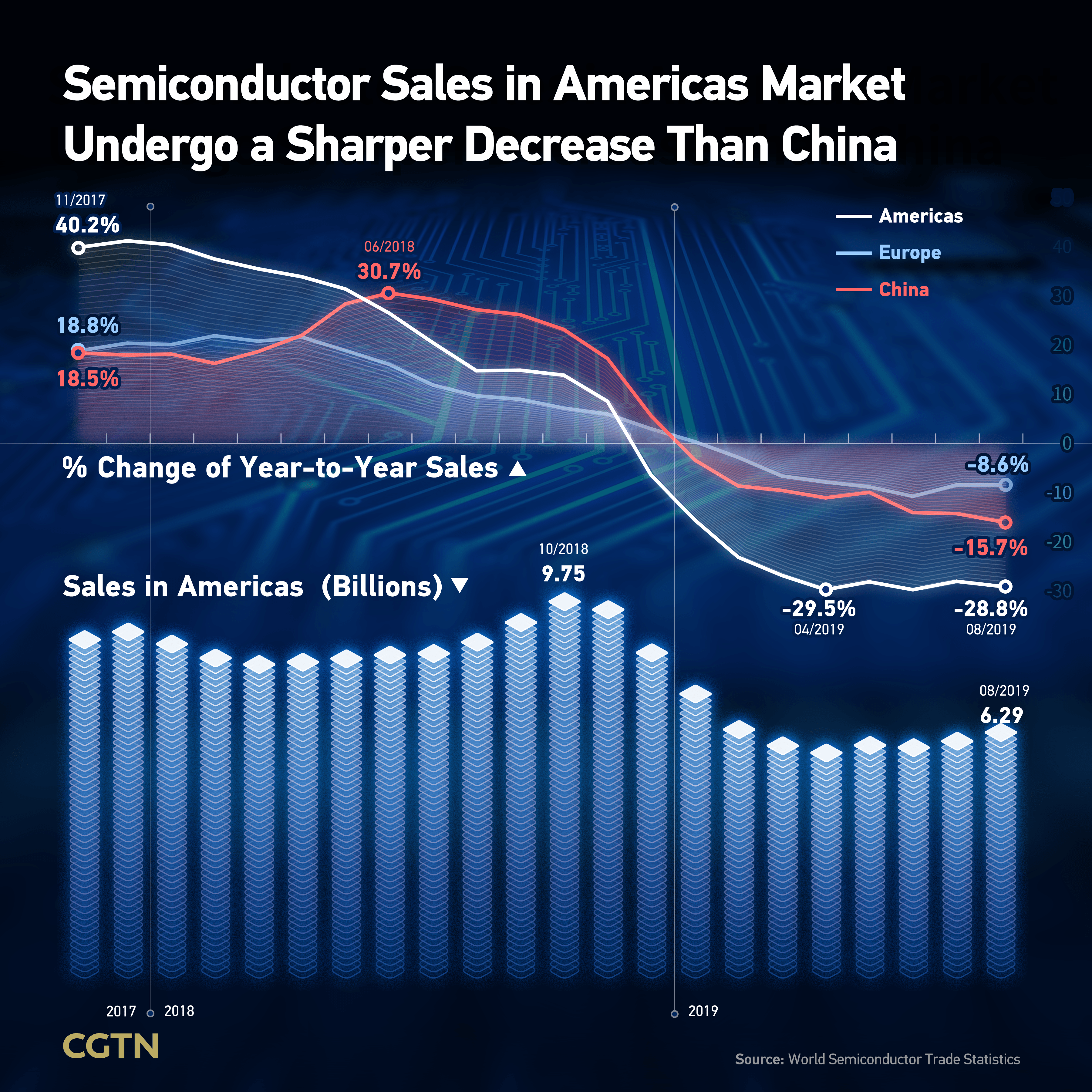

The latest monthly data from the Semiconductor Industry Association (SIA) reported semiconductor sales in the Americas market at 6.29 billion U.S. dollars in August, down 28.8 percent year-on-year from 2018. The drop was heavier than the 27.8 percent fall in July, but a slight improvement on the 29.5 percent slump in June.

Back in December 2017, semiconductor manufacturers in the Americas region could never have predicted the problems facing the industry today, with the sector back then seeing growth as high as 41.4 percent. Just one year later, the growth rate in the Americas market had turned negative, with the region's decline since then more drastic than that in Europe and China.

The downturn sweeping across international markets was especially ferocious in the Americas. In the U.S. in particular, the stagnant semiconductor market coincided with plummeting PPI readings, a key indicator of industrial activity. Between January and March, the PPI readings of the semiconductor industry and other electronic component manufacturing plunged to 55.1, the lowest in three decades. The readings have remained low, hanging at 55.5 by August.

Imports Drop, Exports 'Rampant'

Amid the overall market slump, the tug of war between China and the U.S. has loomed large.

In fact, U.S. is the largest manufacturer in semiconductor area. In 2018, nearly half of the total semiconductor market occupied by firms based in the U.S., according to the Factbook2019 of SIA.

Complementarily, China was the world's largest semiconductor single country market. In 2001, when electronic equipment production moved to the Asia Pacific region, by far, China accounted for more than one-third of the total global market.

Back in 2017 before the trade tensions broke out, as the second largest market to the U.S., China was also the No.1 supplier of U.S. semiconductors and other electronic components, seizing 28.6 percent of the country's total customs import value in this field.

However, semiconductors and related devices have featured since on the tariff lists of both China and the U.S., which had run very closely in the semiconductor industry throughout years. It is just like one delicate integrated circuit on a chip. If violently separated into two pieces, possibly both sides would become partly function or even useless.

After the U.S. launched its third round of tariffs on Chinese imports in September last year, the total amount of semiconductor imports from China to the U.S. dropped from 2.2 billion U.S. dollars to 1.3 billion U.S. dollars in the space of one month. The drop of nearly 0.9 billion U.S. dollars represented a month-on-month decrease of 41 percent.

In the first eight months of this year, China's share of U.S. total semiconductor customs import value was only 14.9 percent, down 17 percentage points from last year. The number further shrank to 13 percent in August.

On the one hand, semiconductor imports from China to the U.S. practically fell off a cliff. On the other hand, however, U.S. exports to China were "rampant".

According to statistics released recently, this August, U.S. exports of semiconductors to China represented 16.1 percent of the country's total semiconductor exports value. The number nonetheless took off from 14.3 percent in January – when China- U.S. trade talks started – and skyrocketed to 20.1 percent and 18.6 percent in the following two months, coinciding with a nosedive on the PPI index.

The surge in U.S.-made semiconductors flooding to China and the unremitting import ban on Chinese products combined to hit the U.S. market.

Companies Suffer Winter Period

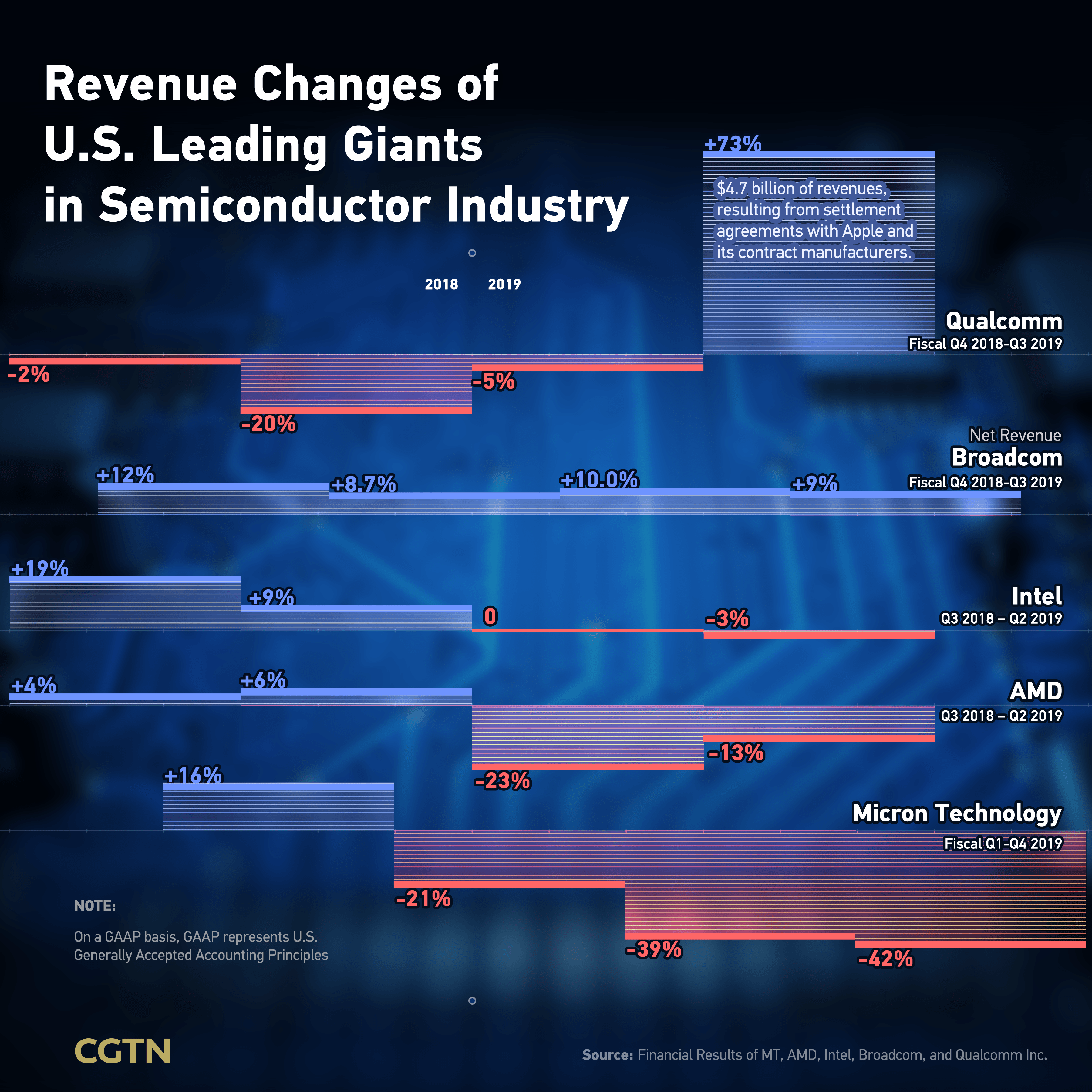

The "calamity" was obvious in the latest financial reports of U.S. semiconductor giants.

Micron Technology showed in its latest data release on September 26 that fiscal Q4 2019 revenue was just 57.7 percent of that in the last fiscal year, slumping from 8.44 billion U.S. dollars to 4.87 billion U.S. dollars. The gross margin as a percentage of revenue was even halved from 61.0 percent to 28.6 percent.

In light of this, Micron Technology President and CEO Sanjay Mehrotra said "we are encouraged by signs of improving industry demand, but are mindful of continued near-term macroeconomic and trade uncertainties.”

Other leaders seemed less confident in the face of the floundering market. Hock Tan, president and CEO of Broadcom Inc. said "Looking at the semiconductor solutions segment, we believe demand has bottomed out but will continue to remain at these levels due to the current uncertain environment."

Broadcom is one of those companies which rely heavily on the China market. In its Annual Report 2018, its net revenue of 10,305 million dollars, nearly half of the total, came from China, compared to that of only 2,697 million dollars earned in the U.S.. This means these semiconductor companies are highly sensitive to every move of both countries.

Furthermore, the U.S. would lose one major revenue source if the economic engine of its semiconductor industry was powered off. U.S. Census Bureau statistics indicated that the total exports value of semiconductors and other electronic components in 2018 yielded 59.4 billion U.S. dollars, some 3.6 percent of all commodities exports value, ranking seventh in over 100 categories in detailed NAICS commodities.

Writers: Liu Jing, Huo Li, Han Mo, Suyan Ru

Data collection: Zuo Lin

Designer: Pianyi Yu

Copy editor: Nick Moore

Cover photo designer: Liu Shaozhen

Chief editor: Li Shou'en

Supervisor: Mei Yan