The global economic uncertainty is weighing heavily on Africa.

In its Africa's Pulse report for October, the World Bank cites renewed intensification of trade tensions among issues contributing to sluggishness in growth on the continent.

The bank is cutting its 2019 growth forecast for Sub-Saharan Africa to 2.6 percent, 0.2 percentage points lower than its April estimate.

Another new report, EY's (Ernst & Young) Attractiveness Program Africa, pinpoints the same concern about the impact of external developments.

It says the rising trade war tension between the United States and China will likely result in much slower trade between Africa and its major markets.

The prices of most of Sub-Saharan Africa's commodity exports have weakened since the second quarter of 2019, the bank says, while prices of crude oil and base metals are also expected to remain below their 2018 peak.

But there are other headwinds as well. Growth in the U.S. economy has started to slow and problems surrounding Brexit and weakness in the eurozone are well documented.

At the same time, capital inflows have remained modest, though steady, as the trade policy uncertainty continues to stifle investor sentiment.

The EY report devotes a large section on foreign direct investment (FDI), which Africa needs more of if it is to reach its full potential.

FDI jobs at 5-year high

"In 2019 we have seen a further spread of political reform and adoption of continent-wide trade agreements that create an enabling environment for economic growth and attraction of FDI," it says.

By global standards, FDI into Africa remains small, but prominent in relation to total economic output, highlighting outsized importance to the continent.

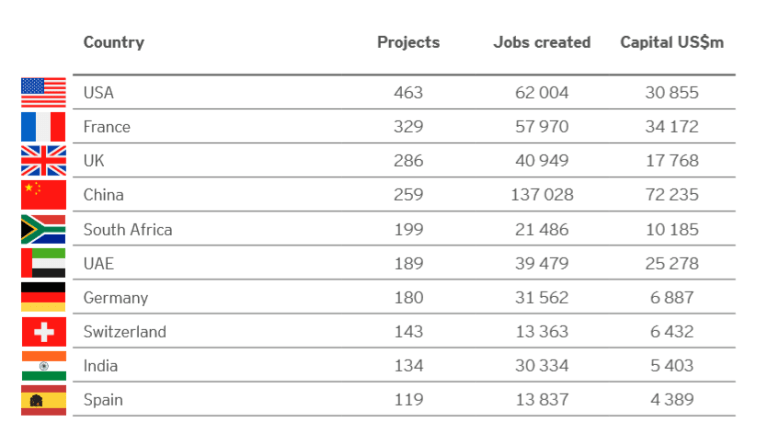

Last year, according to EY, 170, 000 new jobs were created through foreign investment, a five-year high.

China topped the list of investors by funding allocated in 2018, the report says, with twice the allocation of the U.S.

Africa FDI 2014-2018 by source: 10 largest investors. /Graphic via EY Africa Attractiveness Report, 2019

Africa FDI 2014-2018 by source: 10 largest investors. /Graphic via EY Africa Attractiveness Report, 2019

The Chinese have faced some criticism for their role, but even a U.S. official has acknowledged that they have been more willing to bet on the future of the continent than the world's richest nations.

"For too long, when investors have knocked on the door, and the Africans opened the door, the only person standing there was the Chinese," Tibor Nagy, the American assistant secretary of state for African Affairs, told the BBC in an Aug. 1 story.

However, the U.S., along with France, recorded the largest number of projects.

The Chinese, for their part, don't carry the colonial or language baggage of the other major investor nations. For example, a lot of the French cash goes to French-speaking countries and from the U.S. and Britain to nations where English is a state language.

One welcome development is the increasing investment from within Africa itself, with South Africa leading the way. For example, South African investors put a total of 375 million U.S. dollars in a record 10 projects in Nigeria in 2018.

'Improve debt management'

The external environment remains a drag on African economies but so too is the slow pace of domestic reforms, especially debt management and public sector institutions, according to the World Bank.

The bank says the proportion of African countries determined to be in debt distress or at high risk of external debt distress has doubled, but the pace of deterioration has slowed.

"Policymakers in the region must create fiscal space, improve debt management, and boost export performance to replenish international reserves," it says.

People dressed in traditional attire sing and chant in Durban, South Africa, in a street festival celebrating Africa Month on May 26, 2018. /VCG picture

People dressed in traditional attire sing and chant in Durban, South Africa, in a street festival celebrating Africa Month on May 26, 2018. /VCG picture

In a news release accompanying the release of Africa's Pulse, Albert Zeufack, chief economist for Africa at the bank, adds that "efficient and transparent institutions should be on the priority list for African policymakers and citizens."

Nigeria, South Africa and Angola, which make up about 60 percent of sub-Saharan Africa's annual economic output, are all facing various impediments, the bank says, but outside of the big three, growth is expected to remain "robust."

Looking further ahead, the Washington-based institution forecasts that growth in the region will rise to 3.1 percent in 2020 and 3.2 percent in 2021, reflecting the general international uncertainty.

EY sees some hope for the region in the African Continental Free Trade Agreement (AfCFTA) trade pact which was ratified in May 2019.

"Whilst many issues remain to be resolved, the pact could just provide the means to facilitating efficient, cheaper trade, thus providing a stimulus to the continent's growth," it says.

In effect, a lot of the factors that could drive faster growth are in Africa's hands, but it will surely need some external help along the way.

(Cover Photo: A Senegalese football fan wearing a wig and face paint showing her country's flag looks on prior to the start of the Africa Cup of Nations football match between Uganda and Senegal at the Cairo International Stadium, Egypt on July 5 , 2019.)