01:52

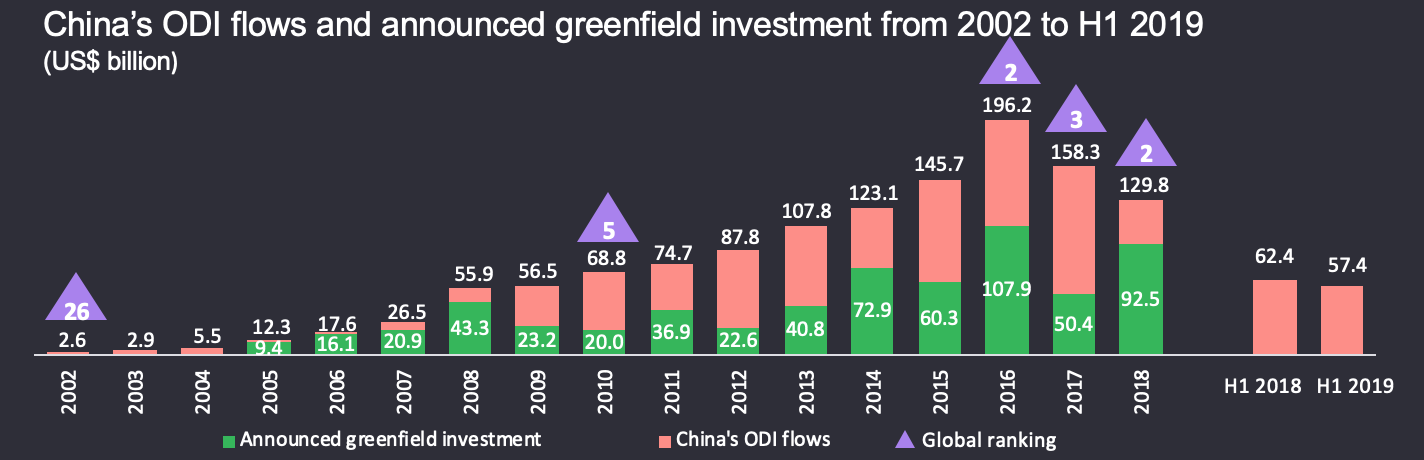

China's outward direct investment (ODI) continued to rise in global rankings and maintained an optimized structure and orderly development, according to EY's latest "China Go Abroad" report.

According to the United Nations Conference on Trade and Development, China ranked second worldwide in ODI flows in 2018 after Japan, and third globally in ODI stock after the U.S. and the Netherlands, accounting for 6.3 percent of the total stock worldwide.

China's ODI maintained an optimized structure and orderly development, and ODI in manufacturing and information transmission and IT service sectors increased by 7.3 percent year on year and 31.7 percent year on year, respectively, said the report.

Meanwhile, greenfield investment rebounded in 2018, up 84 percent year on year, becoming increasingly favored among Chinese companies.

China's ODI flows and announced greenfield investments from 2002 to H1 2019. /Source: EY

China's ODI flows and announced greenfield investments from 2002 to H1 2019. /Source: EY

The Belt and Road Initiative (BRI) promises fruitful results and great prospects. BRI is highly aligned with the development strategies of many developing countries. Meanwhile, the "third-party market cooperation" model also involves developed countries. BRI has a positive effect on guarding against the risks of deglobalization and trade frictions.

Total value of newly-signed overseas engineering, procurement and construction (EPC) contracts reached 63.6 billion U.S. dollars in H1 2019, growing by 33.2 percent year on year.

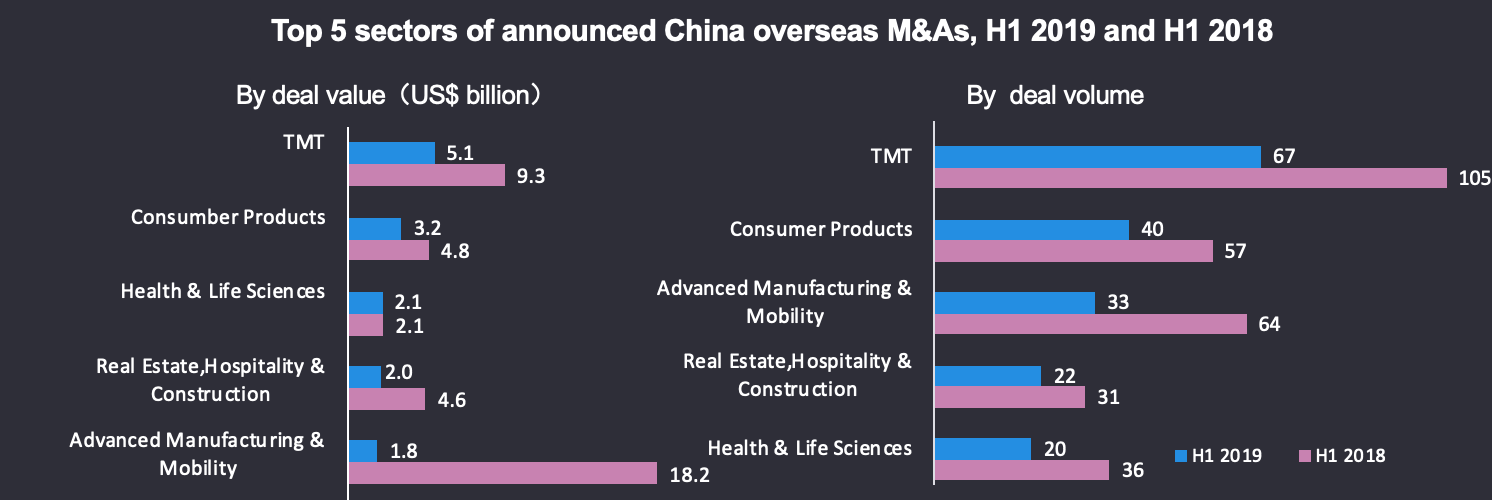

In H1 2019, the announced value of China overseas M&As reached its lowest level in the past seven years - 20 billion U.S. dollars - down 60 percent year on year, while the number of announced M&As dropped nearly 40 percent year on year to 257.

China overseas M&As in H1 2019. /Source: EY

China overseas M&As in H1 2019. /Source: EY

Moreover, high-tech and high value-added emerging sectors, high-end service industries and the consumer products sector will continue to be the focus of overseas M&A activities.

Chinese companies may face bigger challenges in investing overseas due to increasingly stringent regulations and restrictions imposed by developed countries on foreign investment, according to the report.

The report suggests that Chinese enterprises should seize investment opportunities with a well-prepared strategy and deep understanding of the market, actively seek new opportunities in industries, supply chains and investments, and effectively prevent and control geopolitical risks given the backdrop of rising protectionism in developed countries.

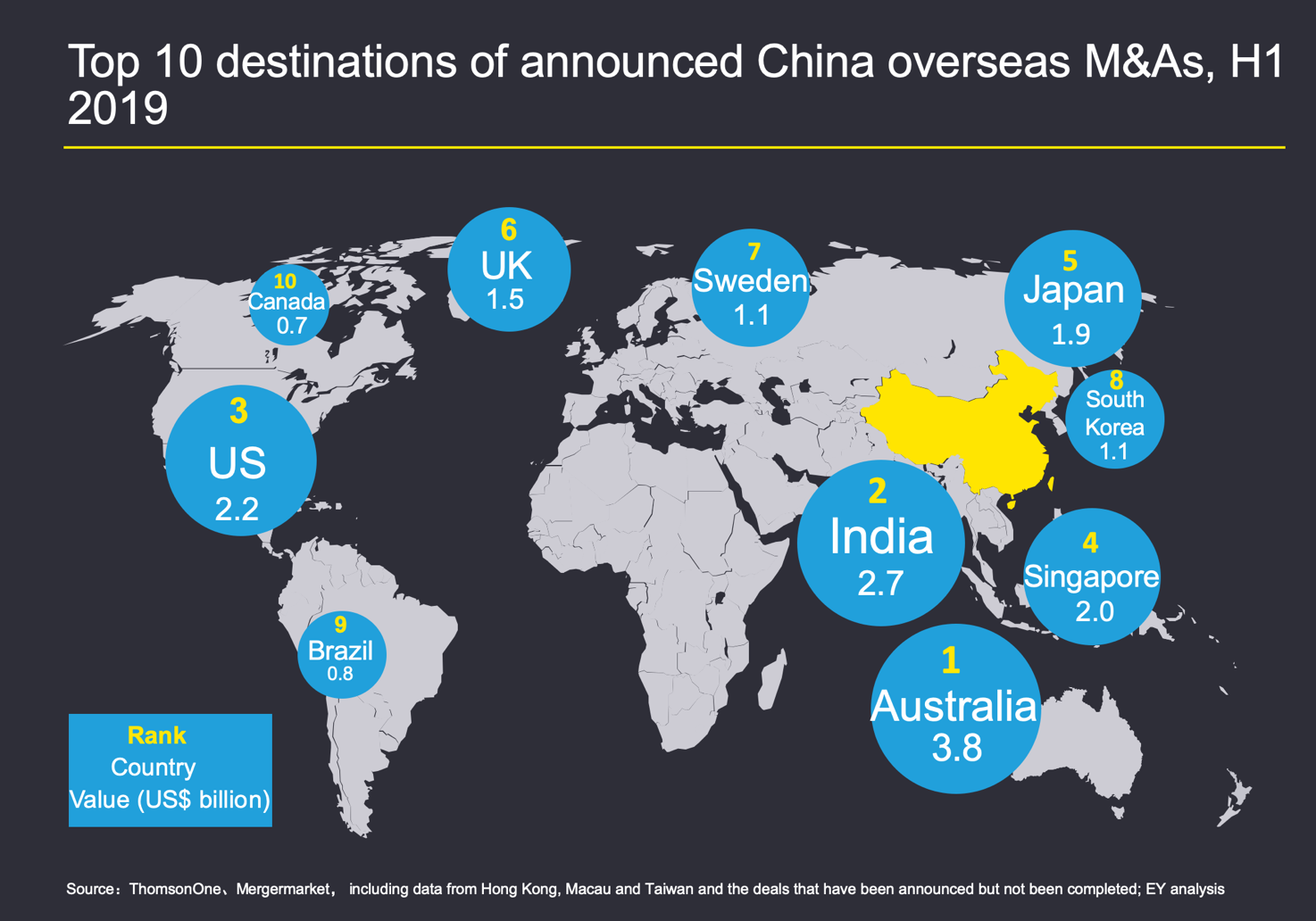

Top 10 destinations of announced China overseas M&As, H1 2019. /Source: EY

Top 10 destinations of announced China overseas M&As, H1 2019. /Source: EY

In addition, the report warns about the impact of trade frictions. "China-U.S. trade war impacts not only trade but also investment, capital, markets and technology. But still the U.S. is a good choice of investment in manufacturing sectors and technologies, especially those not so sensitive ones," said Loletta Chow, global leader of EY China Overseas Investment Network. "China has been cooperating with third-party countries in areas such as clean tech and infrastructure, and recently social infrastructure like digital economy, including e-commerce and e-payments, which are quite attractive from Chinese investment perspective."

China's ODI holds great potential because developing countries will accelerate their involvement in the BRI to protect themselves against the risks of deglobalization and trade frictions. Also, Chinese companies will vigorously improve their quality of overseas investment and increase competitive edge in international cooperation to achieve mid- to high-end position in the global value chain, said the report.