China's new energy vehicle (NEV) market is likely to see a sales rebound next year as automakers roll out more new products to lure buyers, auto executives said at the Guangzhou Autoshow last week.

"For next year, we foresee the NEV market will continue to grow, maybe not as dramatic as it was in the past," Stephan Woellenstein, Volkswagen Group's chief in China said.

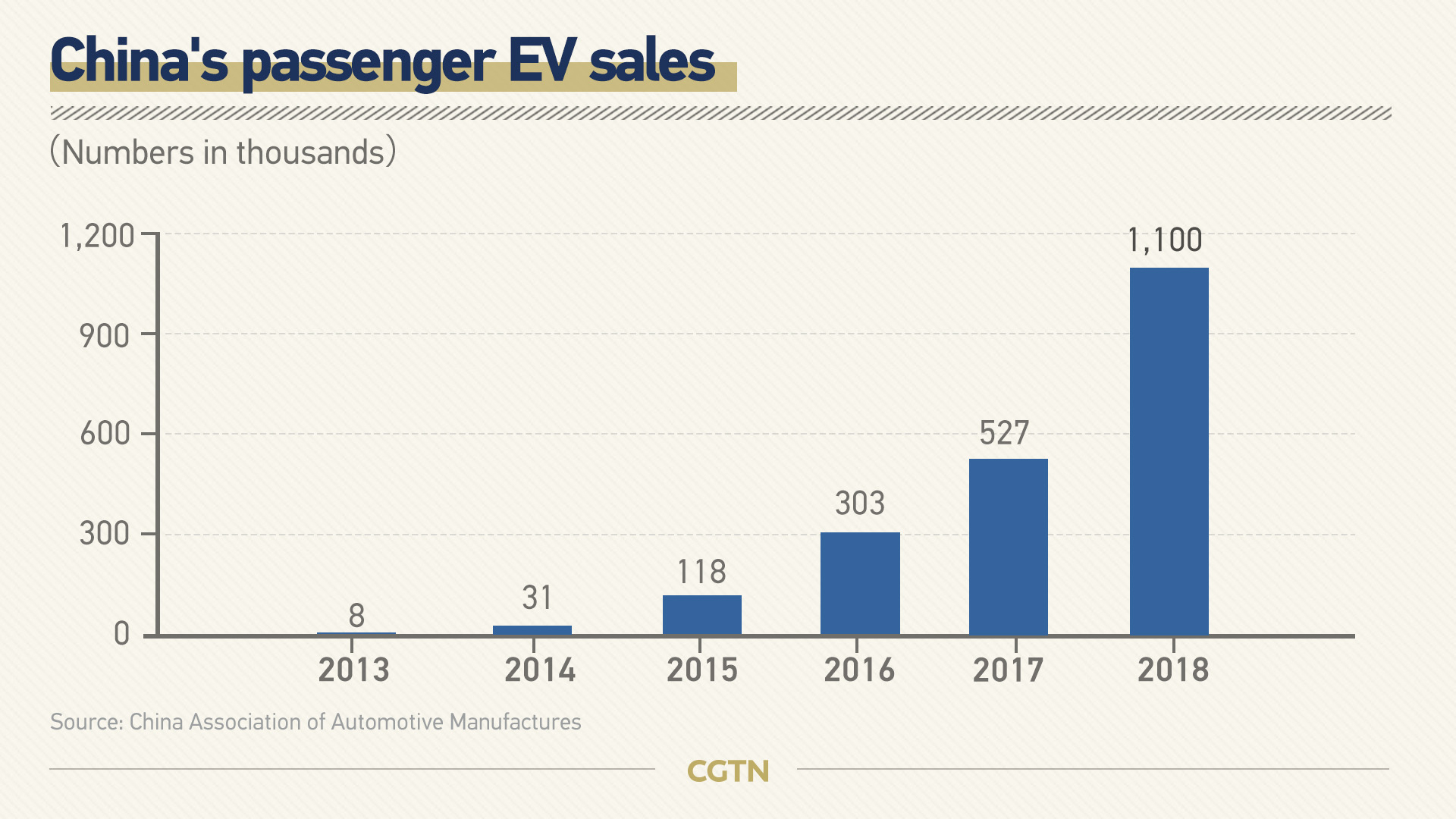

China is already the world's largest market for electric vehicles, with sales surging to more than 1.1 million units by the end of 2018. The annual growth rate registered at 118 percent between 2011 and 2018.

Carmakers such as Volkswagen, Toyota's Lexus, Daimler's Mercedes Benz and Tesla have come out in force at the Guangzhou Autoshow to showcase newly launched electric vehicles with fresh designs.

Toyota aims to launch 10 new electric models by 2025. It plans to ramp up production of EVs in China, expanding capacity at a Chinese plant run with its joint-venture partner Guangzhou Automobile Group to as much as 400,000 vehicles a year by 2022.

Woellenstein said that big automakers launching NEV models normally makes a difference and will also change consumer perception and drive the market, as they help NEVs become more mainstream.

Brian Gu, president of the Guangzhou-based electric vehicle start-up XPeng which just raised 400 million U.S. dollars from Xiaomi and other investors, said he believed that improvements to the country's charging infrastructure would help NEV sales to recover in 2020.

Read more: China builds world's largest network of charging stations for electric vehicles

Another positive is the falling prices of NEV as more automakers started producing vehicles, he added.

"In about two years-time, from my perspective, electric vehicles will be significantly cheaper than ICEs (internal combustion engine cars), as battery costs come down very rapidly and volumes will drag down cost."

China has been a keen supporter of NEVs – which include plug-in hybrids, battery-only electric vehicles and those powered by hydrogen fuel cells. However, it has been cutting subsidies for the EV sector since 2017, with all support expected to be completely scrapped by 2020. The move has add pressure on domestic producers.

Ma Fanglie, general manager of BAIC Group's electric vehicle unit BAIC BluePark, said the industry is "feeling a lot of pressure" and that more supportive policies were needed.

(With input from Reuters)