People walk past the Lockheed Martin stand during the Defense Systems and Equipment International (DSEi) exhibition, London, UK, September 11, 2007. The U.S. firm has maintained its position as the world's largest arms manufacturer since 2009. /VCG Photo

People walk past the Lockheed Martin stand during the Defense Systems and Equipment International (DSEi) exhibition, London, UK, September 11, 2007. The U.S. firm has maintained its position as the world's largest arms manufacturer since 2009. /VCG Photo

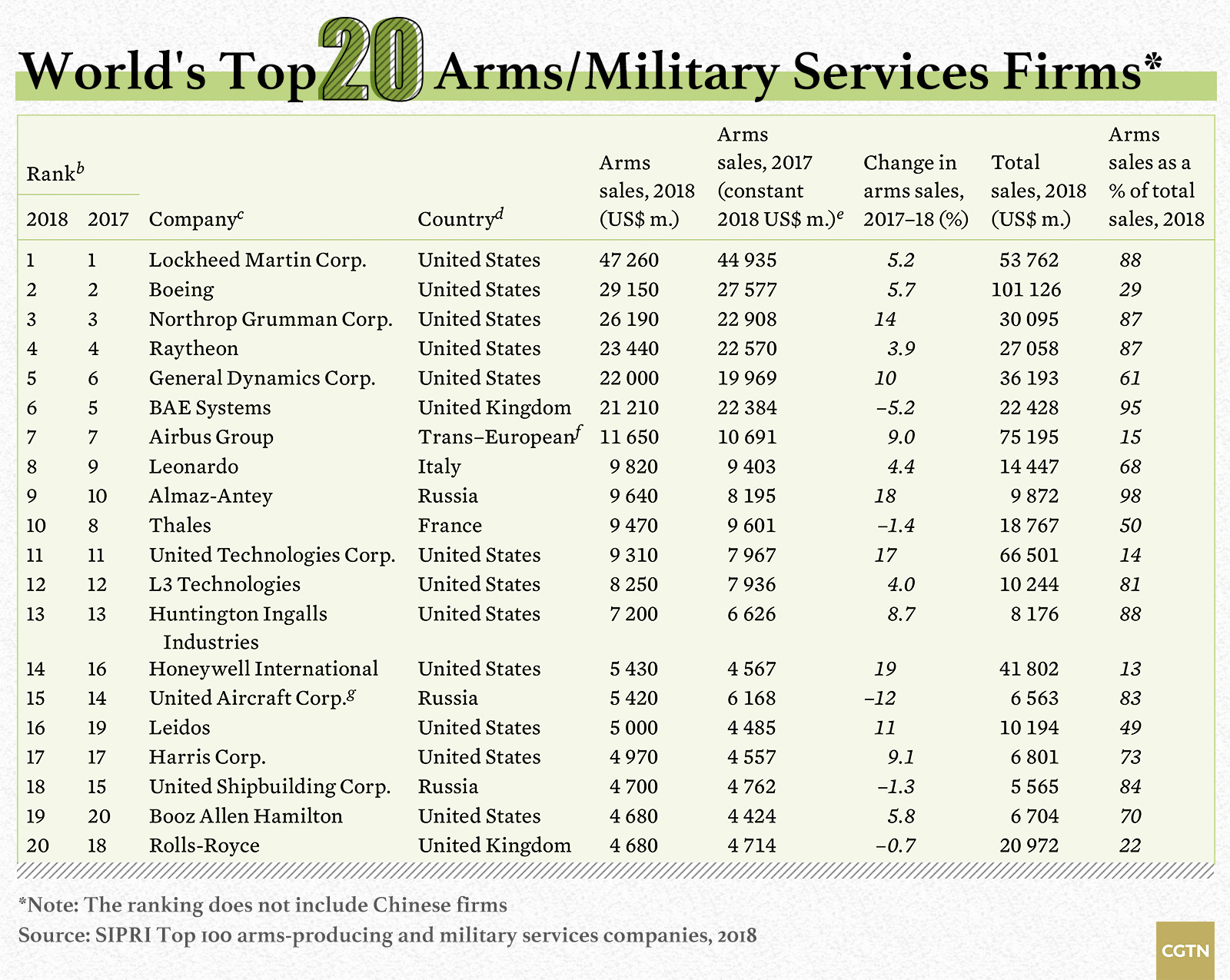

Sales of arms and military services witnessed an increase of nearly five percent worldwide in 2018, mainly led by a strong showing by U.S. firms, according to Stockholm International Peace Research Institute's (SIPRI) latest report on global arms industry rankings published Monday.

The report titled "SIPRI Top 100 arms-producing and military services companies, 2018" put the combined turnover of the world's biggest arms manufacturers (excluding Chinese firms) at 420 billion U.S. dollars last year, an annual increase of 4.6 percent.

The new data from SIPRI's Arms Industry Database showed that sales of arms and military services by the top 100 firms went up by 47 percent since 2002, the year from which comparable data is first available.

The latest study did not include China due to "insufficient data" but SIPRI's research estimated that at least seven Chinese companies would make it to the top 100 including three in the top 10 rankings of arms manufacturers.

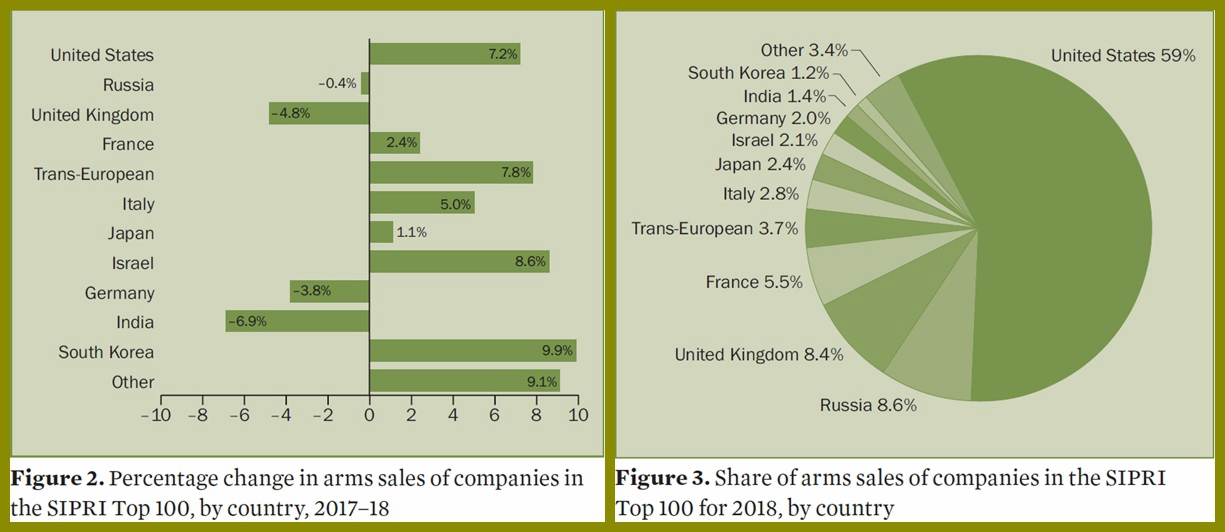

U.S. firms, meanwhile, dominated the SIPRI Top 100 list accounting for 59 percent of the global market, or a turnover of 246 billion U.S. dollars, up 7.2 percent from the previous year.

"For the first time since 2002, the top five spots in the ranking are held exclusively by arms companies based in the United States: Lockheed Martin, Boeing, Northrop Grumman, Raytheon and General Dynamics. These five companies alone accounted for 148 billion U.S. dollars and 35 per cent of total Top 100 arms sales in 2018," the report noted.

A key development in the U.S. arms industry in 2018 was the growing trend in consolidations among some of the largest arms producers. For example, two of the top five, Northrop Grumman and General Dynamics, made multibillion-dollar acquisitions in 2018.

The report cited U.S. President Donald Trump's push for modernization of military services as the Pentagon strengthened its position against Russia and China as the reason behind the robust performance of the U.S. arms manufacturers.

"U.S. companies are preparing for the new arms modernization program that was announced in 2017 by President Trump," reasoned Aude Fleurant, Director of SIPRI's Arms and Military Expenditure Program. "Large U.S. companies are merging to be able to produce the new generation of weapon systems and therefore be in a better position to win contracts from the U.S. Government," she added.

The SIPRI report also revealed that 80 of the world's 100 top arms producers were based in the U.S., Russia and Europe. Of the remaining 20, six were based in in Japan, three each in Israel, India and South Korea, respectively, two in Turkey and one each in Australia, Canada and Singapore.

Photo and data courtesy: SIPRI Top 100 arms-producing and military services companies, 2018

Photo and data courtesy: SIPRI Top 100 arms-producing and military services companies, 2018

Russia ranked second with 8.6 percent of the market share in global arms production, just ahead of the UK on 8.4 percent and France on 5.5 percent.

The combined arms sales of the 10 Russian companies in the 2018 ranking were 36.2 billion U.S. dollars – a marginal decrease of 0.4 percent on 2017. Their share of total top 100 arms sales fell from 9.7 percent in 2017 to 8.6 percent in 2018. This can be explained by the higher top 100 total in 2018 due to the substantial growth in the combined arms sales of US and European companies, the report stated.

Russia's largest arms producer, Almaz-Antey, was the country's only company ranked in the top 10 (at 9th position) and accounted for 27 percent of the total arms sales of Russian companies in the Top 100. Almaz-Antey's arms sales rose by 18 percent in 2018, to 9.6 billion U.S. dollars.

"This increase was due not only to strong domestic demand, but also to continued growth in sales to other countries, particularly of the S-400 air defense system," explained Alexandra Kuimova, a researcher for SIPRI's Arms and Military Expenditure Program.

The combined arms sales of the 27 European companies increased marginally in 2018, to 102 billion U.S. dollars, the study found. While arms sales by UK-based companies saw a decline of 4.8 percent, to 35.1 billion U.S. dollars, they still remained the highest in Europe. BAE Systems (6th), the world's largest arms producer outside of the U.S., saw its sales drop by 5.2 percent in 2018, to 21.2 billion U.S. dollars.

Meanwhile, the combined arms sales of French companies were the second highest in Europe, at 23.2 billion U.S. dollars. "The overall growth in arms sales of the six French companies in the SIPRI Top 100 was mainly the result of a 30 percent increase in sales by combat aircraft producer Dassault Aviation," noted Diego Lopes da Silva, Researcher for SIPRI's Arms and Military Expenditure Program.