Editor's Note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

The Fed's overnight statement shows that it may hold policy rates throughout 2020. Ceasing its firepower on monetary easing isn't a surprise to the market. However, visible declines in the dollar and Treasuries' yield may confuse many market participants, as they contradict a much less dovish Fed.

The Federal Open Market Committee (FOMC) decided to keep rates on hold. Most importantly, the Fed statement removed the language in earlier statements on "uncertainties"remaining about the economic outlook.

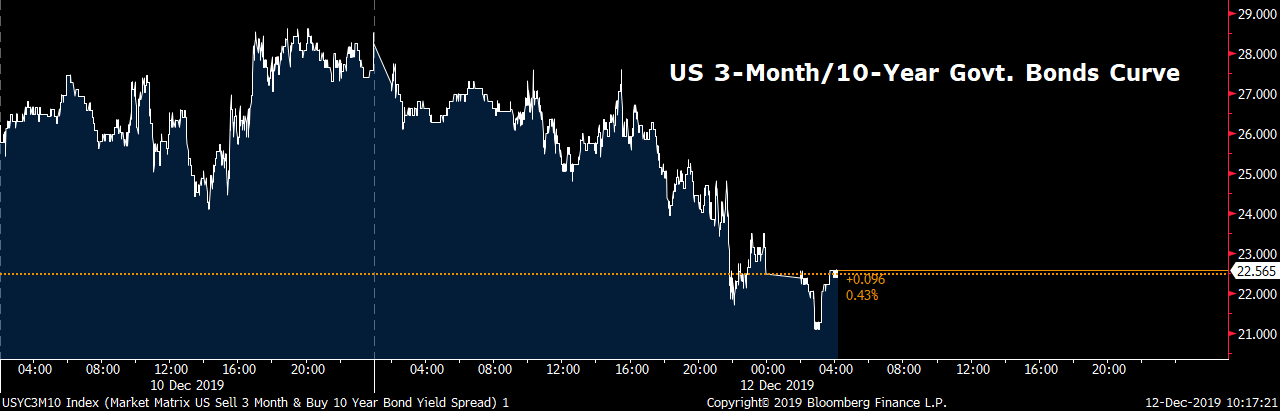

However, market reactions after the FOMC meeting don't match the Fed's statement. Dollar index dropped 0.3 percent to 97.12 overnight, heading to the biggest declines since December 2. Powell's upbeat statement on the U.S. economy also failed to convince the bond traders, as the 10-year government bond yield dipped 5bps overnight to 1.79 percent. Additionally, U.S. Treasuries' yield curve flattened after the FOMC meeting, a sign that reflects less momentum in its economic outlook.

The Fed's credibility is challenged

In the third quarter, the uncertainties Powell referred to were mainly recession fears, trade tensions, and a hard Brexit risk. Many of these risks remain at this moment.

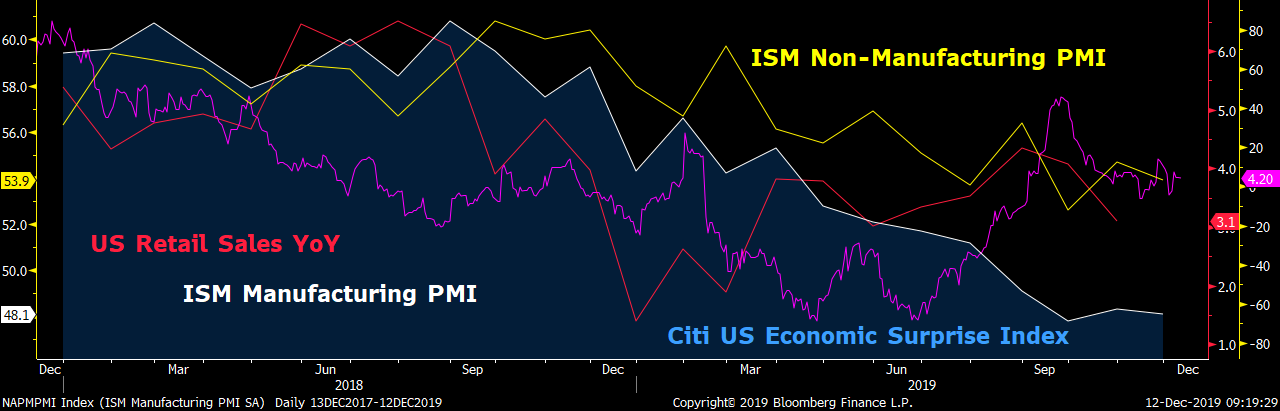

Risk of an economic slowdown leading into a recession remains on the table. U.S. economic data has broadly weakened in recent months except for the jobs report. Both ISM manufacturing and service PMI remain in a down trend and shows no sign of picking up at this stage. Retail sales only grew 3.1 percent in October from a year ago, significantly slower than a 4.1 percent growth rate for the month of September; Citi U.S. economic surprise index continued to decline in fourth quarter, suggesting the economic data have been largely missing the economists' forecasts.

Apart from the U.S. economic data, the outlook for solving the trade tension between the two largest economies remains unclear at this moment. As of December 12, there is still no official statement on whether the two sides would reach the "the phase one" deal any time soon. Low visibility in the trade outlook will continue to weigh on business confidence, pulling back investment activities in 2020.

The market is well aware of the Fed's misjudgment this time last year. FOMC provided an upbeat outlook on the U.S. economy on December 2018, by hiking the interest rate for a fourth time. However, the development in 2019 proved that the fourth rate increase last year failed to predict the upcoming macroeconomic condition. Thus, drops in the U.S. dollar and Treasuries yield hint that markets have not agreed with the Fed's prediction on the economic outlook. Gains in gold and Japanese yen, the typical safe-haven assets are another signs that Fed's upbeat outlook is not convincing.

The Fed's pause in rate cuts reduces the monetary room for many other global central banks

Global central banks have cut the benchmark policy rates more than 50 times this year, and many of these cuts happened in second half when Fed started its easing cycle. Many central banks' policy rates are pledged to Fed's rate, meaning the borrowing cost in those countries would only go lower when the Fed decides to cut.

For those central banks whose policy not pledging to Fed's, usually also tend to follow the Fed's move. Experience from 2014-2016 showed that any divergent monetary policies with the Fed would cause capital outflows from those economies. Having that said, those economies who were expected to further lower the rates, now have to pause the rate cut as well. JP Morgan emerging market currency index gained 0.5 percent overnight, biggest increases in almost a month. Gains in other currencies directly pushed the greenback higher.

On the other hand, traders become more pessimistic on the economy amid less global monetary easing. This explains substantial declines in U.S. Treasuries yield and flattening yield curve.

Fed's dot-plot actually shows a slower inflation outlook, easier monetary condition

The dot plot shows the median forecast for core personal consumption expenditures (core PCE) is lowered to 1.6 percent this year from earlier forecast at 1.8 percent. On the interest rates projection, federal funds rate at the end of this year was lowered to 1.6 percent, 30bps below the forecast figures in September. For 2021 and 2022, the forecast rates are now downgraded to 1.9 percent and 2.1 percent, 20 and 30bps below the earlier forecasts respectively.

Fed's upbeat statement didn't translate into its upcoming rates projection, which shows policymakers are still worried the prolonged below-target inflation and growth risks.