Editor's Note: Matteo Giovannini is a finance professional at ICBC in Beijing and a member of the China Task Force at the Italian Ministry of Economic Development. The article reflects the author's opinions, and not necessarily the views of CGTN.

This week the news that the Chinese government is planning to remove foreign technology, including hardware and software, from state companies and agencies has appeared on the Financial Times and it has been later reported worldwide by all major media.

According to the article, China plans to replace an estimate of 20-30 million computers and other tech hardware with domestic products over the next three years. The policy has been nicknamed "3-5-2" because the replacement of the foreign tech will happen at a pace of 30 percent in 2020, 50 percent in 2021, and 20 percent in 2022.

Starting from next year key industries such as finance, energy and telecom will start to use more domestic products shifting from Dell, HP, IBM and Oracle to a wider range of suppliers, and then eventually to fully made-in-China hardware.

It is reported that this does apply only to state-owned enterprises. The change could represent a challenge for government entities considering that even though a majority of them already use Lenovo PCs, these are powered by American components such as Intel for the hardware and Microsoft Windows for the software.

The most surprising aspect on this report is represented by the shocked reaction of Western media. This reported change is nothing new, since the Chinese government has been trying for years to replace foreign technologies, especially those from the United States. In 2014, China set a target of becoming independent from foreign technology by 2020 within sensitive working environments such as banks, military, government agencies and state-owned enterprises. In 2017, China's cyber security law mentioned the aim to reduce China's reliance on foreign-made tech in order to use secure and controllable technology.

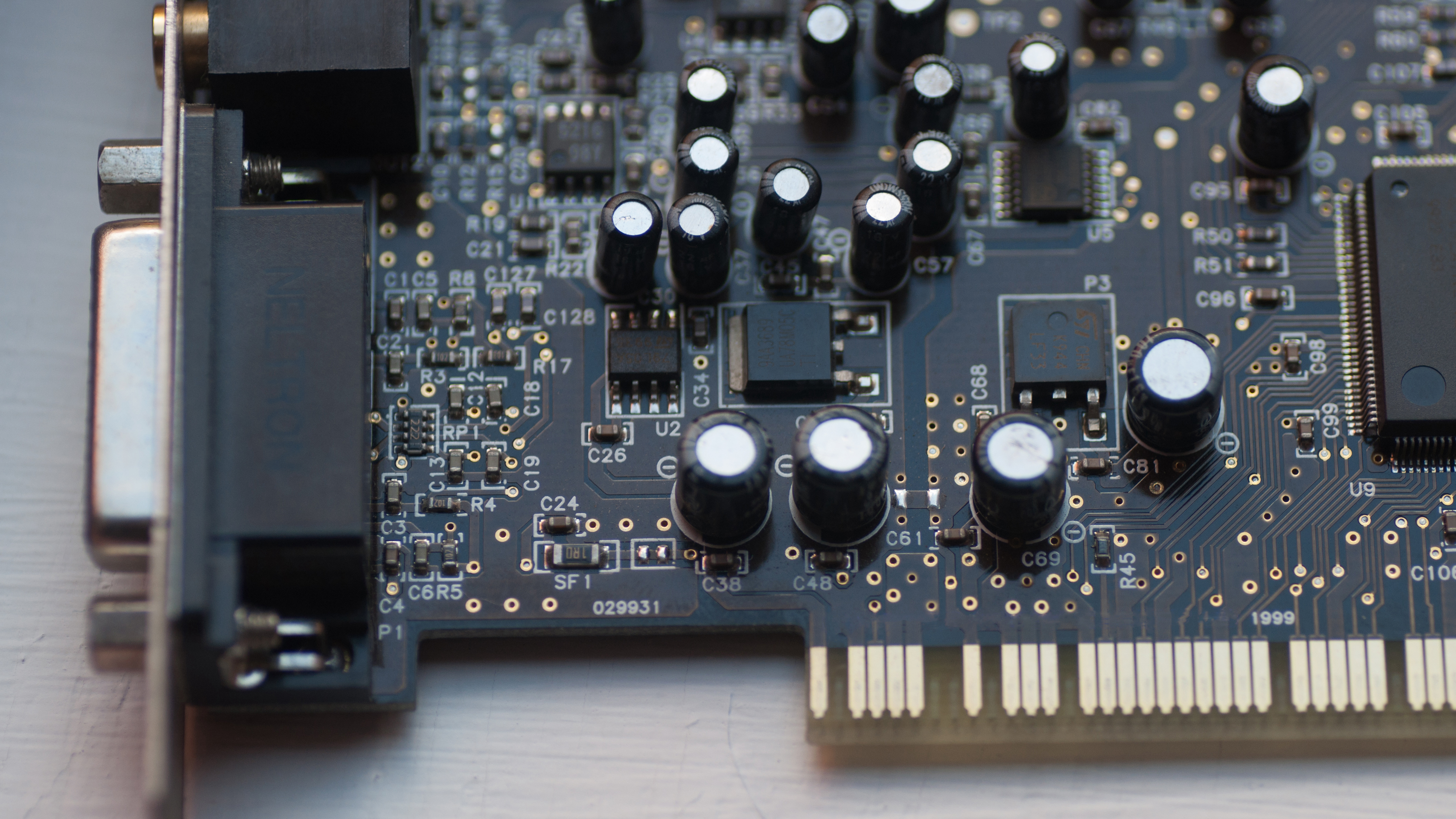

The idea of China tech independence could lead some Western tech companies to reevaluate their standings, as China is one of their biggest markets. /Photo via Reuters

The idea of China tech independence could lead some Western tech companies to reevaluate their standings, as China is one of their biggest markets. /Photo via Reuters

Certainly, the recent policies of the United States administration against China from stopping the issuance of visas to Chinese students related to STEM (Science, Technology, Engineering and Math) academic disciplines, to blacklisting Chinese tech companies entering the U.S. market, and to banning Huawei from accessing Google's Play app store for Android devices have fanned the flame on the idea of a Chinese independence from the United States' technology. However, this act cannot be simply viewed as a retaliation against the Trump administration's blockade on Huawei technology as the Western press has stated.

On the contrary, the report shows a clear sign of determination from China for more technological independence amid escalating tensions and the desire to mitigate the political risk generated by an unstable relationship and by an unpredictable U.S. administration.

Having learned Chinese language, I remember that the Chinese word for crisis is 危机- a combination of the characters 危险 (risk) and 机会 (opportunity). The China-U.S. trade war well represents a risk for China, given that a decoupling could deprive China of the access to the innovation of an important market player. But, it probably represents even more so as an opportunity for China to develop advanced home-made products. Becoming independent could mean striving to catch up in areas like semiconductors, where now China depends on Intel and Nvidia, and operating system, where it relies on Microsoft and Apple, and even taking the leadership position in strategic industries such as artificial intelligence and big data.

Moreover, technological independence from the United States could be a boost for the development of high-end components, such as chips and software, with the long-term broader intent to control each stage of the tech value chain.

Certainly this won't be welcomed by the United States corporate world. Especially for companies like Microsoft and IBM, whom are definitely going to be worried about this move and will have to review their estimates in terms of revenues in the lucrative Chinese market that's generating about 150 billion dollars each year for U.S. companies.

U.S. President Donald Trump's aggressive policies towards China, the banning of domestic companies from engaging business with Huawei and ZTE and the blacklisting of other Chinese firms could represent a boomerang for his administration that will lead him to face the discontent of the corporate world and ultimately of the common citizens frustrated by an self-centered policy labelled as America First.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)