04:10

Oil prices remained calm throughout 2019, cushioned by U.S. shale oil, despite two OPEC interventions and export disruptions caused by geopolitical tensions. But going into 2020, analysts note several key factors that could impact oil markets, including OPEC cuts, the U.S. presidential election and the overall state of the global economy.

Paul Michael Wihbey, executive director of Institute for the Geopolitics of Energy, said that 2019 was marked by the absence of any "significant volatility in the market over the 12 month period."

"The most important factor certainly was the massive increase in the U.S. shale production of crude oil and natural gas LNG," said Wihbey.

Research data shows that the U.S. became one of the world's top oil producers this year with an output of 13 million barrels a day. Wihbey said the production from the U.S. shale deposits cushioned the markets against one of the most significant events in 2019 – an attack that removed over half of all production in Saudi Arabia, the world's biggest crude oil exporter.

In 2020, Wihbey said he expects "lower prices" and for the next six to 10 months, with "prices probably in the range of 50 to 55 U.S. dollars per barrel for WTI (West Texas Intermediate), a little bit higher with Brent."

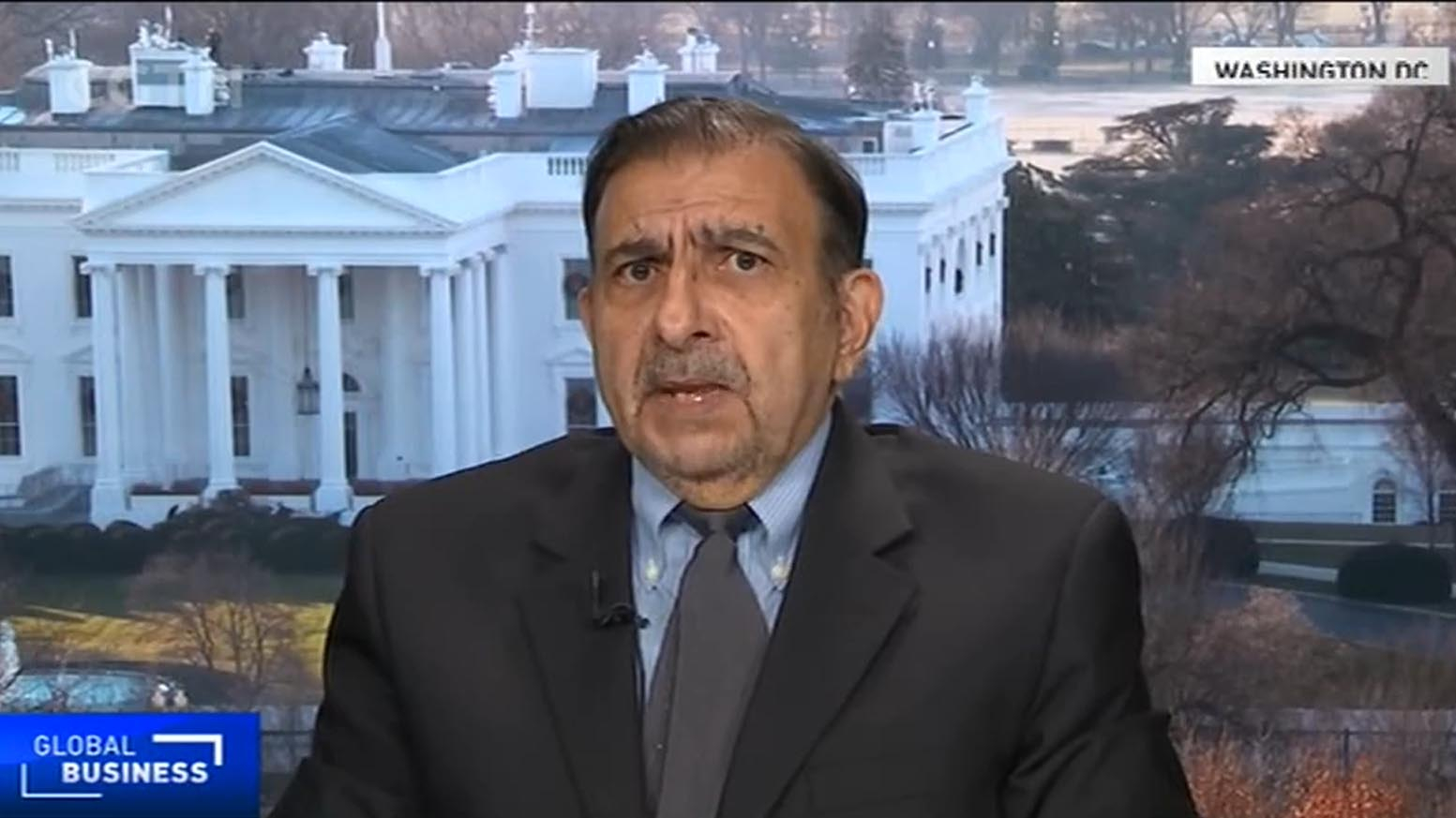

Institute for the Geopolitics of Energy Executive Director Paul Michael Wihbey expects WTI prices to range between 50 and 55 U.S. dollars. /CGTN Photo

Institute for the Geopolitics of Energy Executive Director Paul Michael Wihbey expects WTI prices to range between 50 and 55 U.S. dollars. /CGTN Photo

OPEC ability to control pricing to be limited

Wihbey also said that OPEC's ability to control pricing will become "very limited" with other non-OPEC producers, such as the U.S. and China, that can now "really set the price."

"We now have the U.S. and other countries, like China, actually setting the market in my opinion. It is no longer OPEC that sets the market. We will also see OPEC producers, like Nigeria, Iraq, Libya, and others break with their commitments to OPEC in order to have a greater amount of exports, generate more revenue and secure market share," he said.

While Saudi Arabia and the OPEC group are expected to further cut supply. Wihbey said non-OPEC producers, especially those with offshore deposits like Brazil and Norway, are expected to increase their exports.

Wihbey said that he predicts an agreement on oil between the U.S. and China as part of an overall deal on trade.

"As a consequence of that, China will have a better deal in terms of cost competitiveness in the marketplace and be able to purchase crude oil and LNG at discount prices that it cannot do at the moment," he said.

02:51

Meanwhile, analysts also said the U.S. election may well be the biggest wild card next year, even as Donald Trump was widely expected to survive the current impeachment trial. "It (U.S. elections) will have a big effect on sentiment on many things, including environmental policy, including Iran, China, trade and so on," said Qamar Energy CEO Robin Mills.

Analysts also said climate change was a factor that will shift the current dynamics. New rules to fight sea pollution will come into effect in January – over 90 countries have agreed to dramatically cut sulfur emissions from 3.5 percent to just 0.5 percent – a move that's also likely to increase the price of goods.

Star Fuels senior broker Matt Stanley said that a key period to watch was now till February. "It will be interesting to see what the price does between now and the middle of February. And that's really going to be relying on U.S. crude oil production, which again, has more or less nullified everything OPEC's tried to do."