Editor's Note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

The global capital market is in celebration mode now, which is definitely justified, but the big question remains unknown – what's next in the year of the Rat?

The stock market edged to another new-high before the year-end, while investors just worried about a potential recession a few months ago. But with less central banks' support being almost certain, global economies may diverge next year.

Asia is likely to outperform

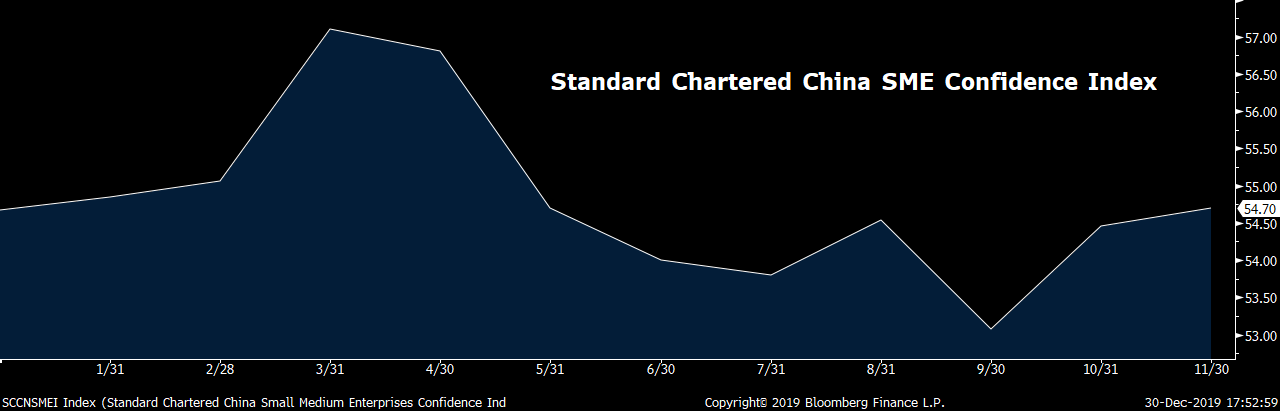

Indicators show that various China economic data is quickly improving. Its manufacturing PMI rose to 50.2 for November, the first time above 50 since April. Growth in retail sales and industrial production also accelerated last month. Small-medium enterprises' (SMEs) confidence in the economic outlook has been improving for a second month for November, according to Standard Chartered China SME confidence index.

Growth recovery in China carries higher quality in comparison to many other major economies. Recovery was quite broad-based from manufacturing to service sectors. Besides that, China's monetary policies have been staying prudent this year, meaning the room for the nation's monetary policies to counter any uncertainties will be much larger than many others.

Two main reasons are behind the Chinese economic recovery in 2019, which are likely to extend into 2020.

1) Despite the nation facing rising external challenges this year, as demand was weakening, policymakers implemented several reforms to boost domestic consumption. Moving into 2020, the share of the consumption to China's GDP is expected to further increase from the current level. The ratio was 61.4 percent in the third quarter, rising sharply from 55.3 percent in the second quarter.

2) Chinese exporters have been actively looking for new buyers from the ASEAN region when U.S. and Eurozone economies are slowing down. China exports to ASEAN increased by 11.4 percent this year on dollar term, much faster than the entire export growth. Looking ahead, the growth rate in those emerging Asia countries will continue to outperform those developed economies in the west, which are running out of the policy room in both monetary and fiscal sides.

Recent pork prices in China are showing signs of easing, which would be another fresh sign that room for both monetary and fiscal policies will be increasing next year.

The U.S. Federal Reserve (Fed).

The U.S. Federal Reserve (Fed).

Key risks in global economies remain in 2020

Risk of inversion in yield curve: Inversion in the U.S. yield curve was the trigger on the recession fears this year. In the past, curve inversion, meaning short-term rates are higher than the longer tenor rates, usually led to recessions, the notable one was the global financial crisis in 2008. The short-term rates represent the borrowing cost and the Fed's interest rate outlook, while the long-term rates reflect the investors' outlook on the economic outlook. Hence, inversion in yield curve can be elaborated as monetary policies failing to rescue the slowing economy.

The negative spread between the U.S. 10-year and 3-month bond yield widened to as many as 51 bps at the end of August, the widest since early 2007. The spread returned into positive territories, but it has been mainly due to falling short-end rates instead of rising long-end rates. Having that said, the recovery in the U.S. yield curve was driven by the Fed, after it responded to this "recession indicator" by cutting the policy rates three times in the second half of this year. However, investors' outlook on the U.S. economy hasn't really been improved as the U.S. 10-year bond yield remains below two percent.

Now, the Fed is reluctant to further lower the policy rates in 2020, according to various officials' speech in recent weeks. If the Fed holds such a stance, the yield curve will be largely driven by the economic outlook next year. Until today, there is no visible pickup in those U.S. economic data and corporate earnings, so the probability of traders looking into buying safer bonds remains high especially the current U.S. stock prices are relatively over-valued.

Thus, flattening or inversion in the yield curve could return in 2020. Now, the Fed's policy upper-bound rate stands at 1.75 percent. If the 10-year government bond yield falls below this number, traders may start to prepare another round of curve inversion, and such an environment won't be good news for the entire market sentiment.

Global manufacturing recession.

Global manufacturing recession.

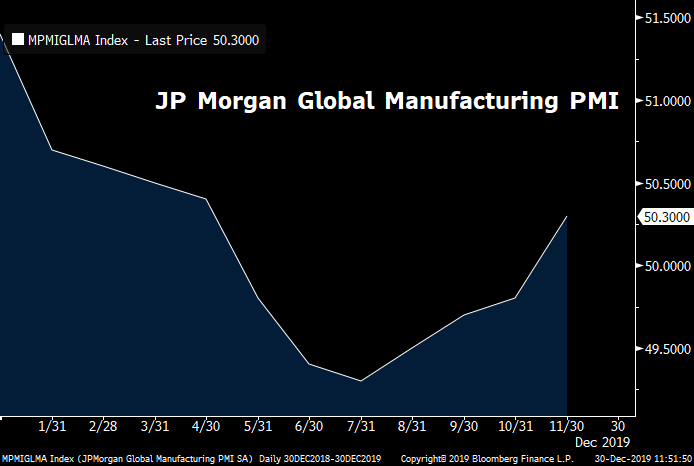

Global manufacturing slowdown: A manufacturing recession is one of the biggest themes in 2019. Worldwide factory activities moved into contraction territory in May according to JP Morgan global manufacturing PMI, after U.S. President Trump escalate the U.S.-China trade tension on that month. The index rebounded into above-50 territory again in November as the two largest economies started working on a partial agreement.

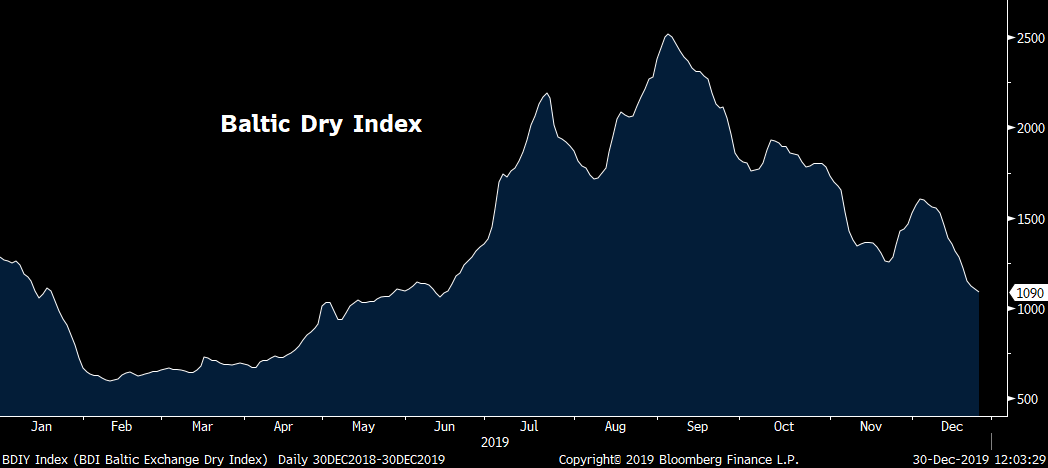

An early indicator shows that recovery in manufacturing activities could be fragile at this moment. Baltic Dry Index (BDI), an indicator that served as a proxy for a general shipping market bellwether has started falling since the beginning of September. The declines in the BDI index reflects subdued factory orders and falling demands on raw materials. The index experienced a sharp rally in the second quarter right after the escalation in trade tension, which could be explained as increasing front-loading trades to avoid the higher tariff. Having that said, export orders in the upcoming a few months are likely to stay soft, restricting the growth in the manufacturing activities.

Heading into 2020, manufacturing activities will be one of the key factors influencing the stock market. Both JP Morgan's global manufacturing PMI and MSCI world stocks index peaked in early 2018, and stocks resumed rallying only when PMI climbed above 50-level in the fourth quarter earlier. Thus, the sustainability of the current rallies in global stocks will largely depend on whether the global factory PMIs can remain staying in the above-50 territory. Once the manufacturing activities show signs of contraction, traders will quickly sell their stocks portfolio and buy U.S. Treasuries, such moves will be likely to flatten the yield curve again.

Less central banks' support: Global central banks' rate cuts dominated the capital markets in the second half. The scale of those monetary stimuli is the largest in the decade, bringing a huge amount of liquidities into stocks, bonds, and commodities. But many of those central banks' monetary stances are expected to be changed next year.

Many other central banks' monetary policies have to follow the Fed. When the Fed raised the borrowing cost from 2015 to 2018, central banks around the world were forced to tighten the monetary condition to mitigate the pressures on capital outflows. The Fed's rate cuts in the second half offered those central banks an opportunity to adjust their policy rates. Many central banks still have plenty of rooms to further reduce the policy rates, but they have to pause that if the Fed stays put.