The total value of yuan-denominated bonds held by overseas institutional investors reached 2.2 trillion yuan (318 billion U.S. dollars) as of December last year, data from a state-owned financial institution showed.

In 2019, overseas institutional investors bought bonds worth 3.2 trillion yuan (about 462 billion U.S. dollars), and sold bonds worth 2.1 trillion yuan, making a net purchase of Chinese bonds worth 1.1 trillion yuan in holdings, according to the China Foreign Exchange Trade System.

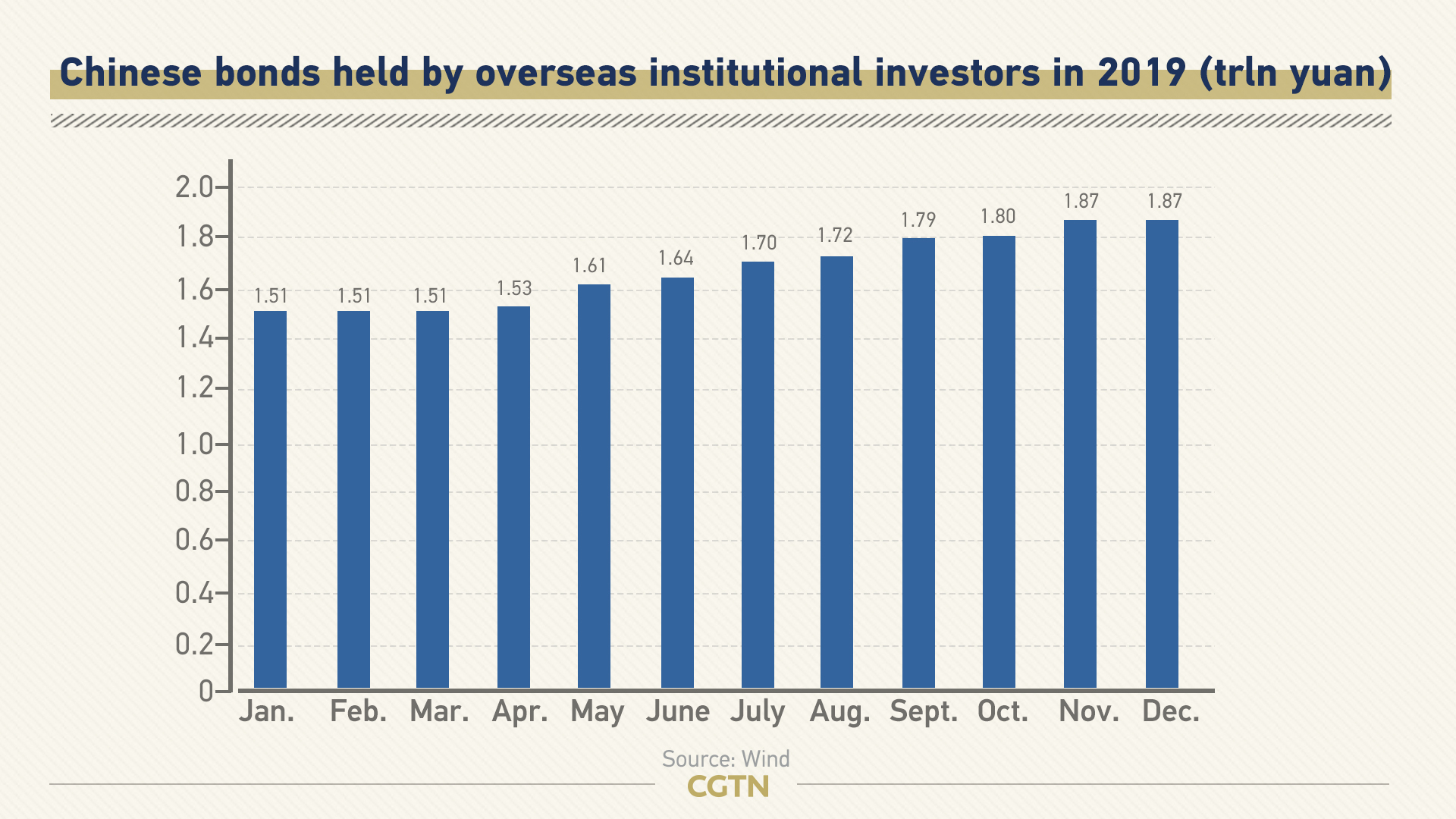

In December alone, Chinese bonds held by overseas institutional investors reached 1.87 trillion yuan, increasing for the 13th consecutive month, according to the financial data service provider Wind.

Government bonds are most favored by overseas institutional investors, with holdings reaching 1.31 trillion yuan as of December, accounting for 68.98 percent of the total foreign-funded Chinese bonds.

Opening up the financial sector

As the world's second largest bond market after the United States, China continues to open up its financial sectors with a slew of policies being rolled out.

China's financial stability and development authority in July 2019 unveiled 11 measures to facilitate business in the bond market. Foreign-funded institutions are allowed to conduct credit rating business with all kinds of bonds in China's interbank and exchange bond market. They can also obtain type-A underwriting licenses in the market.

The Ministry of Finance in January this year removed restrictions for foreign banks to participate in the underwriting of local government bonds, which would help expand the bond sales channel and boost yuan internationalization.

Overseas institutions are optimistic about the allocation value of China's bonds, and they would continue to increase their holdings once the time is right, according to a report by the China International Capital Corporation (CICC).

A majority of bond investors surveyed predicted that the allocation of Chinese bonds by overseas institutions will significantly increase in 2020, with the scale reaching 700 billion to even 1 trillion yuan, said the CICC report.