01:56

German insurer Allianz launched its wholly-owned insurance holding company in Shanghai on Thursday, which is also the first wholly foreign-funded insurance holding company in China, symbolizing a major step of China's capital market liberalization.

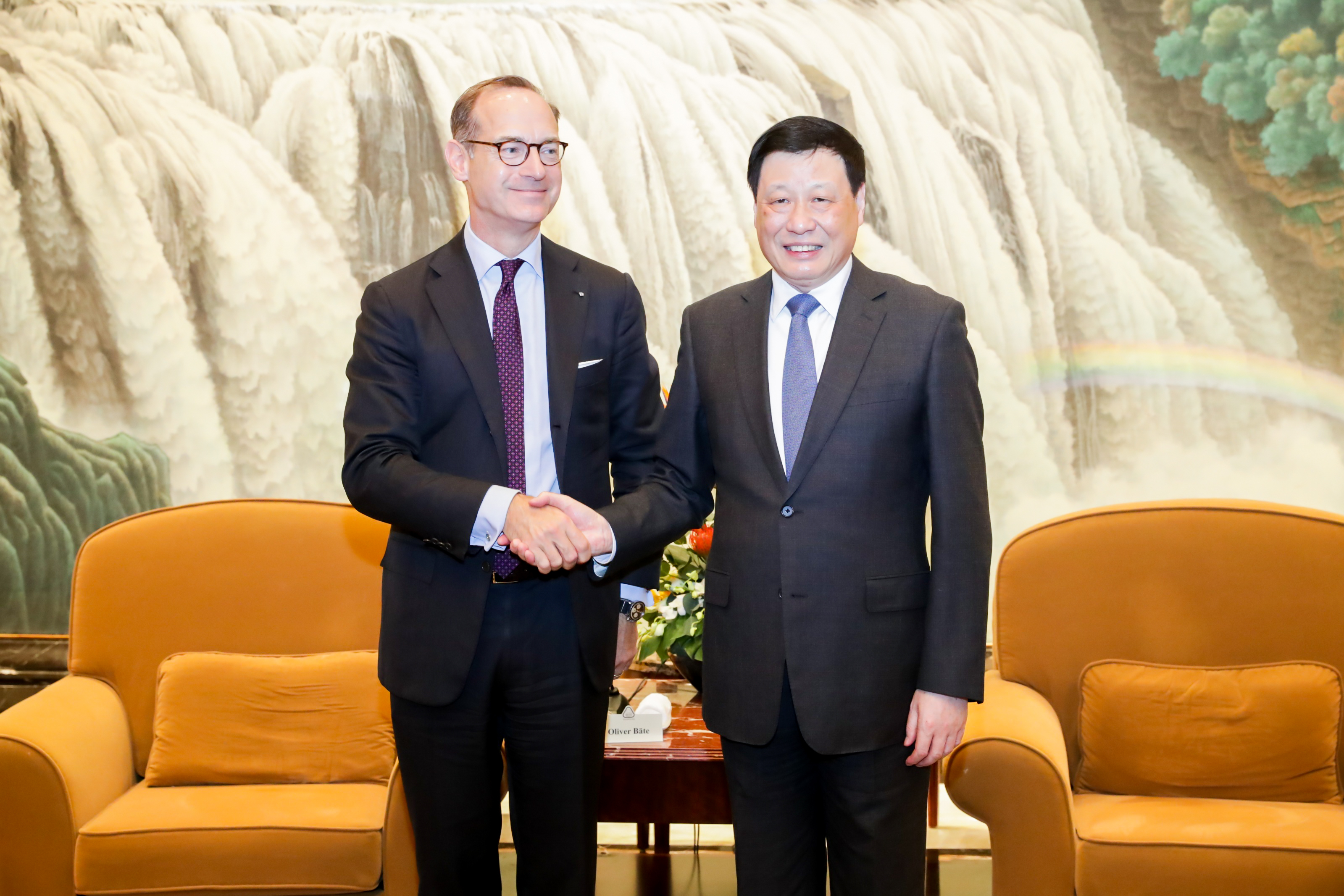

"We have been in China's presence for 100 years. We have been waiting for the opening of the market for a long time. And we are very happy that now is the time that we can actually spread our wings." Oliver Bäte, Chairman and CEO of Allianz Group, said.

According to the Swiss Re Institute, China's strong economic growth, high government spending, increased consumer awareness, and technological innovations will transform it into the world's largest insurance market by the mid-2030s.

"We also know that it is a complex market because you see a strong polarization. I think it is the most polarised market, five, six major companies make 60-70 percent of the market. Therefore, it is also very important for whoever is playing here to have a clear view [of] how and which role we have to play," Sergio Balbinot, Chairman of Allianz (China) Insurance Holding Company, said.

There used to be a cap on foreign ownership at insurance companies. In late 2019, Chinese regulators gave Allianz the green light to set up a wholly-owned insurance holding company in China, which came sooner than the market expected. Chinese authorities hope the accelerated opening up of its banking and insurance sectors will stimulate the health, growth, and competition of the industry.

"For wholly-owned foreign insurance entities, we expect them will bring more coordination among its different entities, that is under the same foreign parent company. So we will see ecosystems developed by those holding companies on their own, which will be used to compete with local peers," Michelle Hu, Managing Director and Partner of BCG, said.

Experts say foreign insurers will bring different perspectives and practices to develop a more sustainable and differentiated value proposition that Chinese customers need.