The keynote speech U.S. President Donald Trump delivered in Davos largely eulogized his foreign trade policy and achievements in past years. It revealed his intention of bringing his policy and tactics further into 2020. After he signed a phase one trade deal with China, locking one with Europe is very likely to be his upcoming agenda.

Trump claimed that the United States-Mexico-Canada Agreement and phase one trade deal with China were two of the biggest ever. "Those trade deals are starting to kick in already, and saw tremendous potential for the future. We have not even started, because the numbers we're talking about are massive," he said.

These claims he made in Davos clearly demonstrate that Trump took his trade deals with other countries as his key political achievements and would probably continue aiming to strike more accords with other trading partners in 2020. Through his speech, he seems satisfied on what has been achieved in phase one deal with China. Though he mentioned that phase two deal negotiations will begin shortly, his tone didn't show his urgency to accomplish that for now.

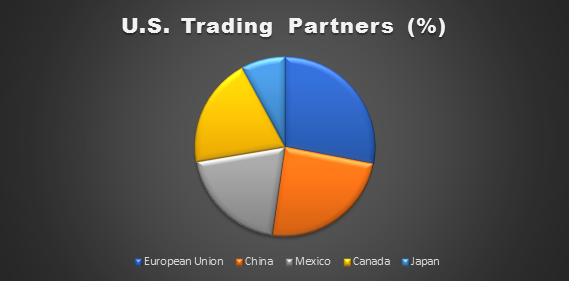

If Trump aims to achieve "massive inflows" from trade, he might just mainly target those who are the U.S.'s largest trading partners, as he wouldn't have much time to negotiate many trade deals this year due to presidential election. A chart below illustrates major trading partners of the U.S. European Union accounts for 19 percent. Until today, U.S. has reached trade pacts with China, Mexico, Canada and Japan, but no major agreement with European Union yet.

Trump's comments on "tremendous potential for the future" may spur speculations that whether the U.S.-EU trade deal would be the top agenda for Trump administration's top foreign policies. As of November 2019, the U.S. ran a trade deficit of around 13 billion U.S. dollars with EU, which accounts for 30 percent of the U.S.'s total trade deficits. Thus, Trump has the incentive to implement measures for narrowing the trade deficits.

According to his patterns in past years, his strategy was always to impose tariffs on the U.S.'s trading partners before the negotiations were arranged. At this moment, capital markets have already anticipated that the auto industry in EU would become the next target of Trump's administration for negotiating a broader trade deal. Since the U.S. and China were expected to sign a partial deal in December 2019, chart below shows that MSCI Europe Index and MSCI Europe Auto Index have started moving in opposite directions.

And market seems to be right. Trump said in Davos on Tuesday that "they know that I'm going to put tariffs on them (EU) if they don't make a deal that's a fair deal." He also said he is serious about imposing tariffs on European cars. The threatened tariff flags the trading relationship between Europe and U.S. is getting to deteriorate, and the negative sentiment in business may be spread into broader sectors, as seen in U.S.-China trade tension in past two years.

IMF may have been over-optimistic on euro zone's growth rate

IMF forecast the growth in the euro area to pick up from 1.2 percent in 2019 to 1.3 percent in 2020, and 1.4 percent in 2021. The base on its projected improvements is based on external demand. However, IMF may not put the potential trade tension between the U.S. and Europe into its forecast, if the U.S. starts to impose higher tariff on Europe's car industry.

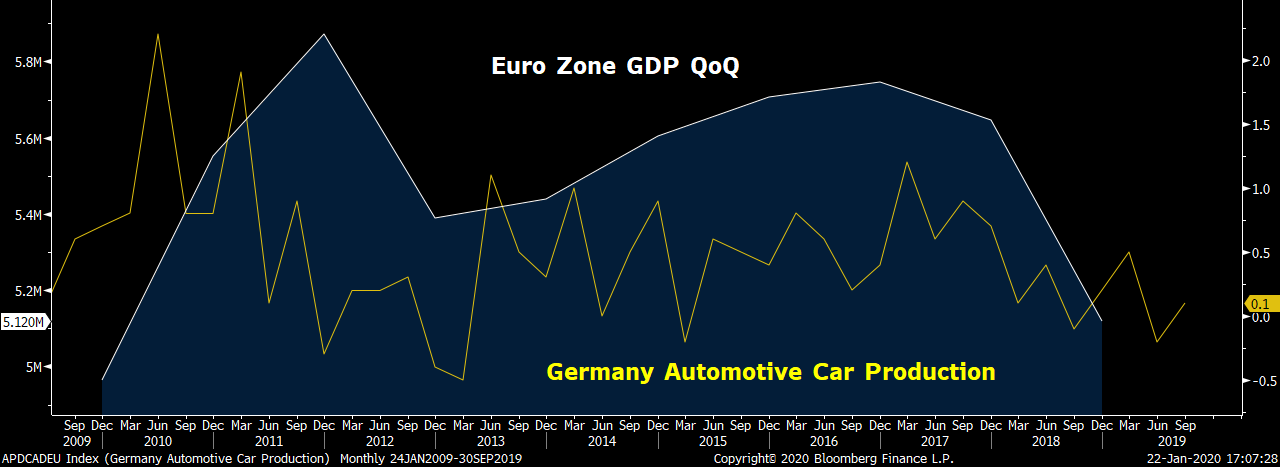

Auto sector is one of the pillar industries in Europe. It's largest economy is Germany, which narrowly avoided a recession in 2019 due to its car production rapidly slowing down. If Trump's administration imposes hefty tariffs on the European automobile sector, growth in Europe would become more challenging in 2020. The chart below shows that euro zone GDP growth rate and Germany automotive car production has been nearly on the same pace as it was in the last decade.

It's also worth highlighting that Trump criticized the Federal Reserve's rate decisions and negative rates in Europe in Davos. Trump renewed his ongoing complaints with the Federal Reserve, saying the central bank hiked too quickly and is now lowering rates too slowly. Not only he thinks that euro zone is playing an unfair "game," but he may also pressure the Fed to lower the rates again this year as what he did in 2019.

Many economists believe that the real reason behind Trump's preference of lower rates last year was to offset some of the negative impact from rising U.S.-China trade tensions in this period. Having said that, Trump's sudden criticism of the Fed reveals the intention to initiate a new trade tension when no one really expects the Fed to do anything in near term.

In short, trade tension could be still the main obstacle to global growth, and de-escalation in U.S.-China trade tensions may mean possible escalation in the U.S.-EU trade tensions.