Editor's Note: Jimmy Zhu is chief strategist at Singapore-based Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

China factory activities substantially contracted in February due to the coronavirus' impact on production. The reading may suggest that volatility in capital market could continue next week. However, yuan's trading volume picking up since middle of the month is an important signal that Chinese manufacturing activities are gradually moving towards their normal levels amid fewer new infection cases in recent days.

China manufacturing PMI for the month of February dropped to 35.7, the lowest level in history, versus 50.0 in the prior month. The reading is also below the median forecast at 45.0 compiled by Bloomberg. Before the release of the data, the lowest level in manufacturing PMI was at 38.8 in November 2008. Meanwhile, service PMI for the same month suffered a larger scale of declines, the reading dropped to 29.6, first time below the key 50-level threshold, from 54.1 in January.

Masks are seen on a production line manufacturing masks at a factory in Shanghai, China January 31, 2020. /Reuters

Masks are seen on a production line manufacturing masks at a factory in Shanghai, China January 31, 2020. /Reuters

Looking into the sub-indices, new orders PMI dropped to 29.3 and the new export orders PMI declines to 28.7. These two sub-indices are usually taken as leading indicators to gauge the domestic and external demand. However this time is an exceptional case. The larger-than-expected declines are mainly due to many business operations' shutting down as the efforts to minimize the virus spread, rather than reflecting the underlying trend of the fundamental economic outlook.

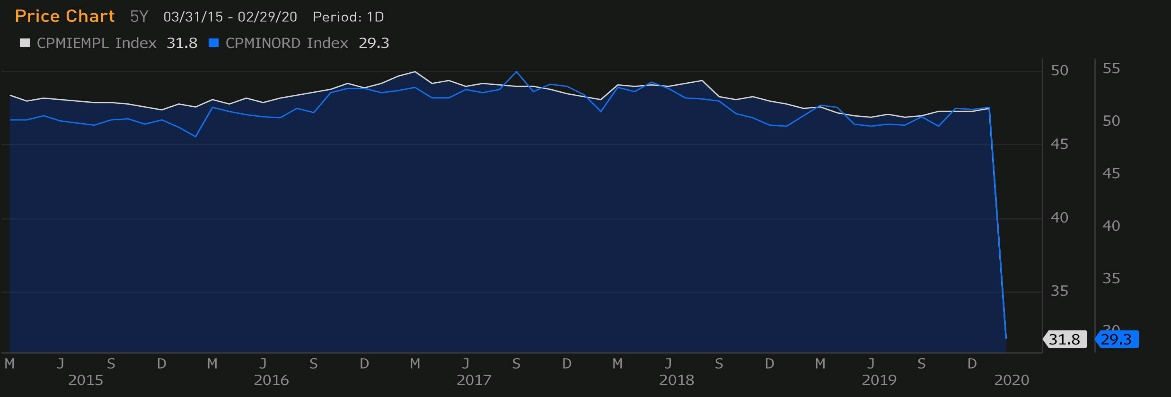

Still, the employment sub-indices may be worrisome if the pace recovery is slow. For the month of February, manufacturing employment PMI dropped by 15.7 percentage points to 31.8, while the service employment index declined by 10.7 percentage points to 37.9. Less decline in service sectors' employment was due to many people in this category can work from home in the quarantine period. The substantial declines in employment indices suggest many business owners currently halt the manpower expansion or even lay off some headcounts.

There are nearly 400 million, around 30 percent of the population in China, that is considered middle-class household, according to China's statistics agency. Huge numbers of citizens in this category are currently expected to pay mortgage loans. If employment PMI readings stay at a low range for a sustainable period of time, risk of increasing defaults and then the stability in financial system shouldn't be ignored. Chart below shows that employment condition has been highly correlated with the new business orders.

China manufacturing employment PMI (white) vs. China manufacturing new orders PMI (blue)

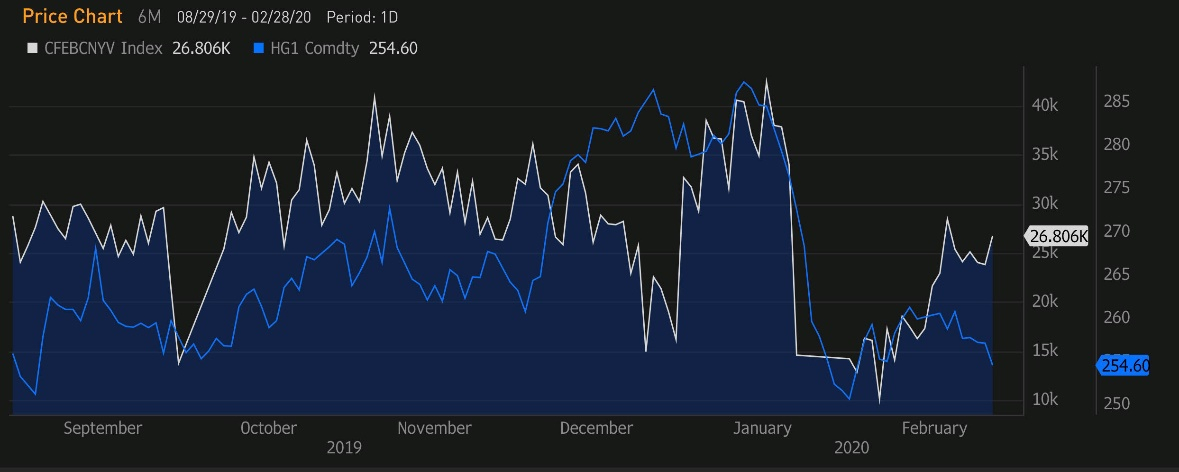

The positive news is that there is sign that more Chinese businesses have started returning into operations, which is the onshore yuan trading volume. When manufacturers import raw materials and export products, such activities usually involve foreign-exchange trading. Another chart below shows that onshore yuan daily trading volume in CFETS (China Foreign Exchange Trade System), the only platform to trade the onshore yuan, has been picking up since middle of February, suggesting business in manufacturing sectors are recovering. Moves between the yuan daily trading volume and copper price, one of the most widely used raw material in the industrial sectors are in the similar pace over the past six months.

CFETS onshore yuan daily trading volume (white) vs. Copper price (blue)

Based on our calculation, the onshore yuan trading volume in February is only around 50 percent of its long-term average levels. Thus, the production levels in February could be only reach half of the normal capacity. If the yuan daily trading volume starts to cross above 30 billion U.S. dollars per day in March, we may see a rapid recovery in the manufacturing PMI and its sub-indices.

Rely more on domestic demand

As of February 29, new infection cases on the Chinese mainland excluding Hubei Province has been kept within single-digit for a second consecutive day after falling from hundreds of daily cases in the past month. It shows virus spreading are likely to further ease in China. However, the situation is becoming more severe overseas, especially in those key manufacturing countries such as Korea, Japan, Italy. Even the U.S. CDC has issued a warning earlier of the week on potential outbreak in the country. These countries are all China's top exports destination. Thus, without the slowdown in virus spreading in those nations, China new export orders may find it difficult to recover.

Before the U.S. stocks market closed, Fed's chairman Powell issued a statement that the central bank is closely monitoring developments and will act as appropriate to support the economy. The statement opens doors for the Fed to cut rates as early as in March. However, investors don't really expect the Fed's easing to be able to buffer the negative impact from the coronavirus. Dow Jones stocks index remained trading at 1.4 percent lower at Friday's close, marking the worst week since the global financial crisis in 2008.

On the other hand, yuan's value versus a basket of currencies may continue to rise as the spread of the coronavirus in China has been contained at a much lower rate than many other countries. CFETS RMB Index, a gauge to value the Chinese yuan with a basket of currencies used by its major trading partners, has risen to 93.10, the highest level since August last year. Yuan's appreciation more or less may reduce the completeness of the Chinese exporters if all other conditions stay the same.

CFETS RMB Index

Against such a backdrop, Chinese policymakers are expected to accelerate the policy support to boost the domestic demand, especially the production levels are gradually recovered now. We expect The People's Bank of China (PBOC) to cut the one-year LPR (Loan Prime Rate) by another 10bps in March. At the same time, the PBOC may further release liquidities into smaller-sized companies through targeted-based RRR (Reserved required ratio) cut as early as in March.

PMI data shows that small-sized companies have most suffered from the virus outbreak, with the manufacturing PMI in this group dropping to 34.1, well below the large companies' reading at 36.3. There are many private firms falling to categories as small-medium companies, and around 80 percent of the employment in China is from the private sector.