U.S. billionaire environmentalist Tom Steyer, a fierce critic of President Donald Trump who had pushed early for his impeachment, abandoned his bid for the 2020 Democratic presidential nomination on Saturday after trailing in third place in the South Carolina primary, Reuters reported, citing a campaign source.

Steyer, who poured hundreds of millions of dollars of his own money into his quest, dropped out of the race on the day of his strongest showing yet in a 2020 Democratic nominating contest. Even so, he finished far behind winner Joe Biden and second-place finisher Bernie Sanders.

"Honestly, I can't see a path where I can win the presidency," Steyer told supporters in South Carolina.

Steyer in January poured 64.7 million U.S. dollars of his own wealth into his bid for the Democratic nomination, which brought his total campaign spending to 267 million U.S. dollars.

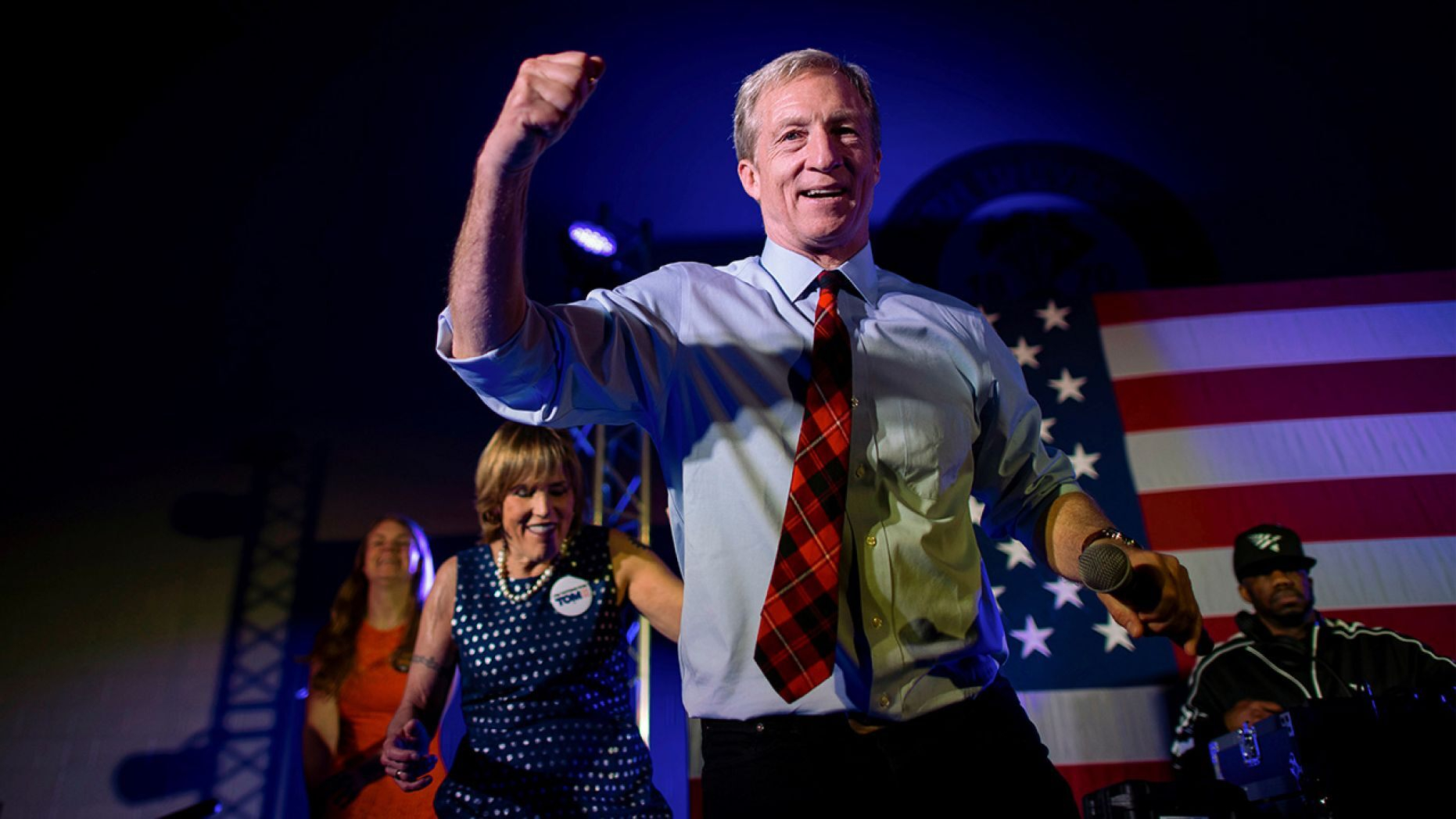

Tom Steyer dances onstage with rapper Juvenile during his Get Out the Vote rally in Columbia, South Carolina, U.S., on February 28, 2020. /Reuters

Tom Steyer dances onstage with rapper Juvenile during his Get Out the Vote rally in Columbia, South Carolina, U.S., on February 28, 2020. /Reuters

"This has been a great experience, I have zero regrets. Meeting you and the people of America has been a highlight of my life," he said.

The 62-year-old former hedge fund manager from San Francisco portrayed himself as a political outsider and blasted corporate money in U.S. politics in July, when he joined a field of two dozen Democrats seeking to deny Trump, a Republican, a second term.

Like fellow billionaire Michael Bloomberg, Steyer drew criticism from other Democrats as trying to buy his way to the nomination. Spending tens of millions of dollars, however, did not win the level of support from voters needed.

Steyer said he would support the eventual Democratic nominee.

Steyer amassed a fortune, estimated by Forbes magazine at 1.6 billion U.S. dollars, after founding investment firm Farallon Capital Management in the mid-1980s and serving as a partner at San Francisco private equity firm Hellman & Friedman.

(With input from Reuters)