A trader works on the floor at the New York Stock Exchange (NYSE) in New York City, March 5, 2020. /Reuters

A trader works on the floor at the New York Stock Exchange (NYSE) in New York City, March 5, 2020. /Reuters

The S&P 500 fell by seven percent upon opening on Monday, triggering an automatic 15-minute pause in trading for the first time since the 2008 financial crisis.

The benchmark recovered some ground soon after trading resumed, but was still down about 6 percent.

Near 1340 GMT, the broad-based index was down more than 200 points at 2,764.21. The Dow Jones Industrial Average sank 7.3 percent to settle at 23,979.90, while the tech-rich Nasdaq Composite Index fell 6.9 percent to 7,987.44.

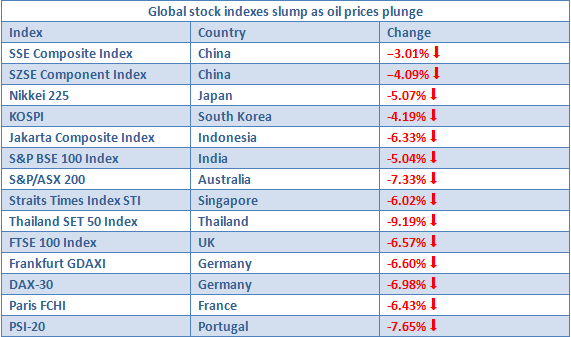

Compiled by CGTN as of the time of writing.

Compiled by CGTN as of the time of writing.

The 10-year U.S. Treasury yield tumbled down through 0.5 percent to a record low, about half the level of just a week ago.

Worldwide stock markets took a pounding on Monday as oil plunged 30 percent after an all-out, aggressive price war erupted between two of the world's biggest producers, Saudi Arabia and Russia.

European markets suffered hefty losses in early trade with London FTSE dropping more than 8 percent, Frankfurt GDAXI falling more than 7 percent and Paris FCHI almost matching those losses, Reuters reported.

Russia's Finance Ministry proclaimed that the country can manage its revenue shortfall for the next six to 10 years if oil prices drop to a 25-30 U.S. dollars per barrel range thanks to its National Wealth Fund.

The continuing spread of coronavirus outside of China also dents the waning market sentiment.