Packed pork in a supermarket in Shanghai, February 12, 2020. /VCG

Packed pork in a supermarket in Shanghai, February 12, 2020. /VCG

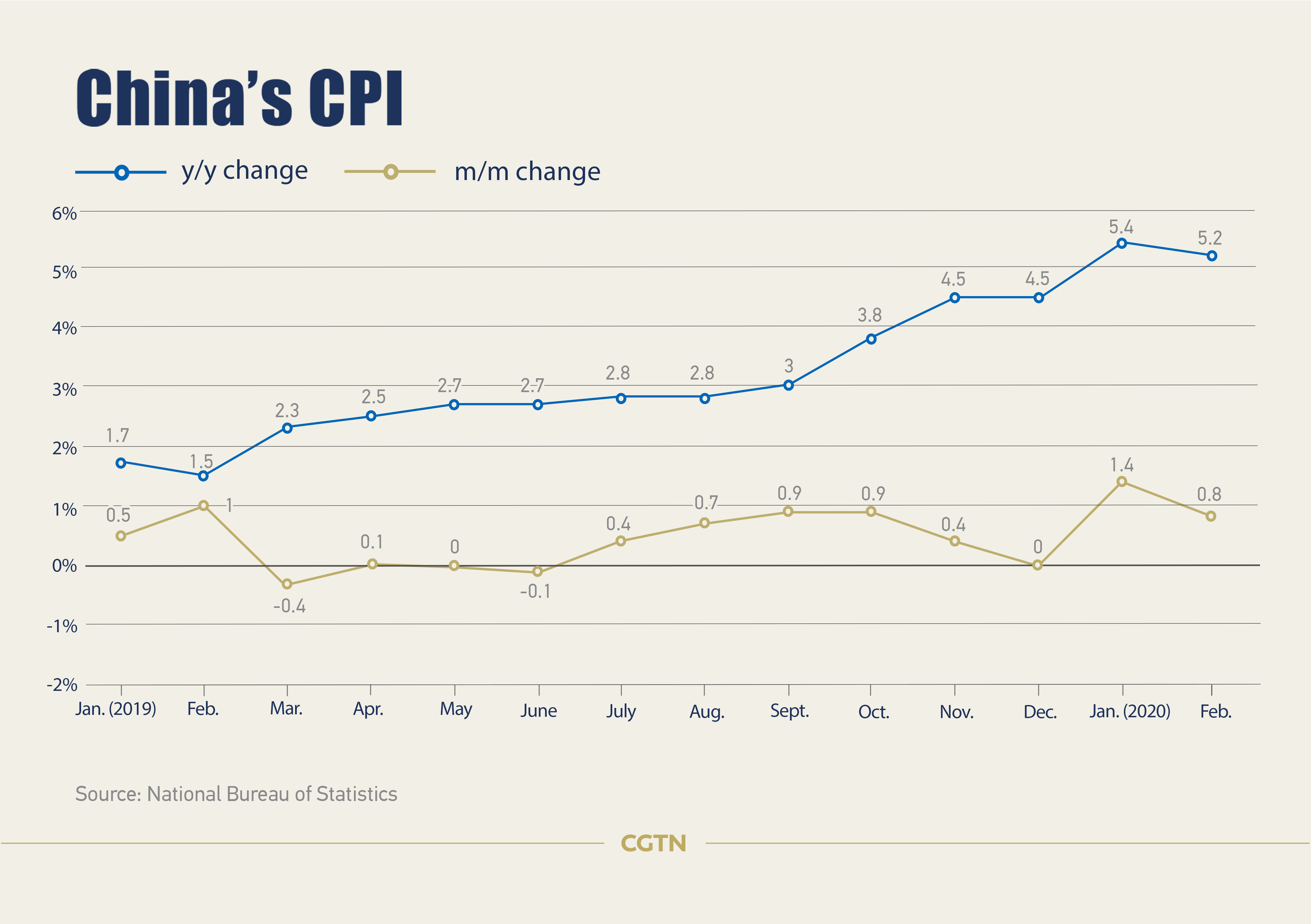

China's consumer inflation continued to rise in February as logistics was disrupted by the COVID-19 outbreak but the growth rate declined, while producer prices fell due to the temporary halt of the coronavirus-hit production activity, the country's statistics authority said on Tuesday.

The country's consumer price index (CPI) registered 5.2 percent in February year on year, edging down from the 5.4-percent surge in January, the same as a Reuters poll by economists.

Meat prices surged by 87.6 percent last month, contributing to a 3.85-percentage-point increase of the CPI, said the National Bureau of Statistics (NBS). Pork prices surged by 135.2 percent in February, much higher than the 116-percent-increase in January, resulting a 3.19-percentage-point increase of the CPI.

Food prices rose by 21.9 percent year on year last month, while non-food prices increased by 0.4 percent, data showed.

The impact of the new price increase is relatively high, accounting for about 40 percent, said Zhao Maohong, director of the Urban Department of the NBS. Among the 5.2 percent year-on-year increase, the carryover effect of last year was about 2.9 percentage points, and the impact of new price increases this year was about 2.3 percentage points, he said.

The year-on-year peak of the CPI is expected to stay in January, which is 5.4 percent, given the positive results seen in the epidemic control, the resumption of transportation and a high base of pork prices, said Huang Wenjing, an analyst with Everbright Securities. For the whole year, the CPI would be 3.7 percent.

A worker from China Railway 14th Bureau Group Co., Ltd. works at the construction site of the Heyan Road Yangtze River Express in Nanjing, east China's Jiangsu Province, March 9, 2020. /Xinhua

A worker from China Railway 14th Bureau Group Co., Ltd. works at the construction site of the Heyan Road Yangtze River Express in Nanjing, east China's Jiangsu Province, March 9, 2020. /Xinhua

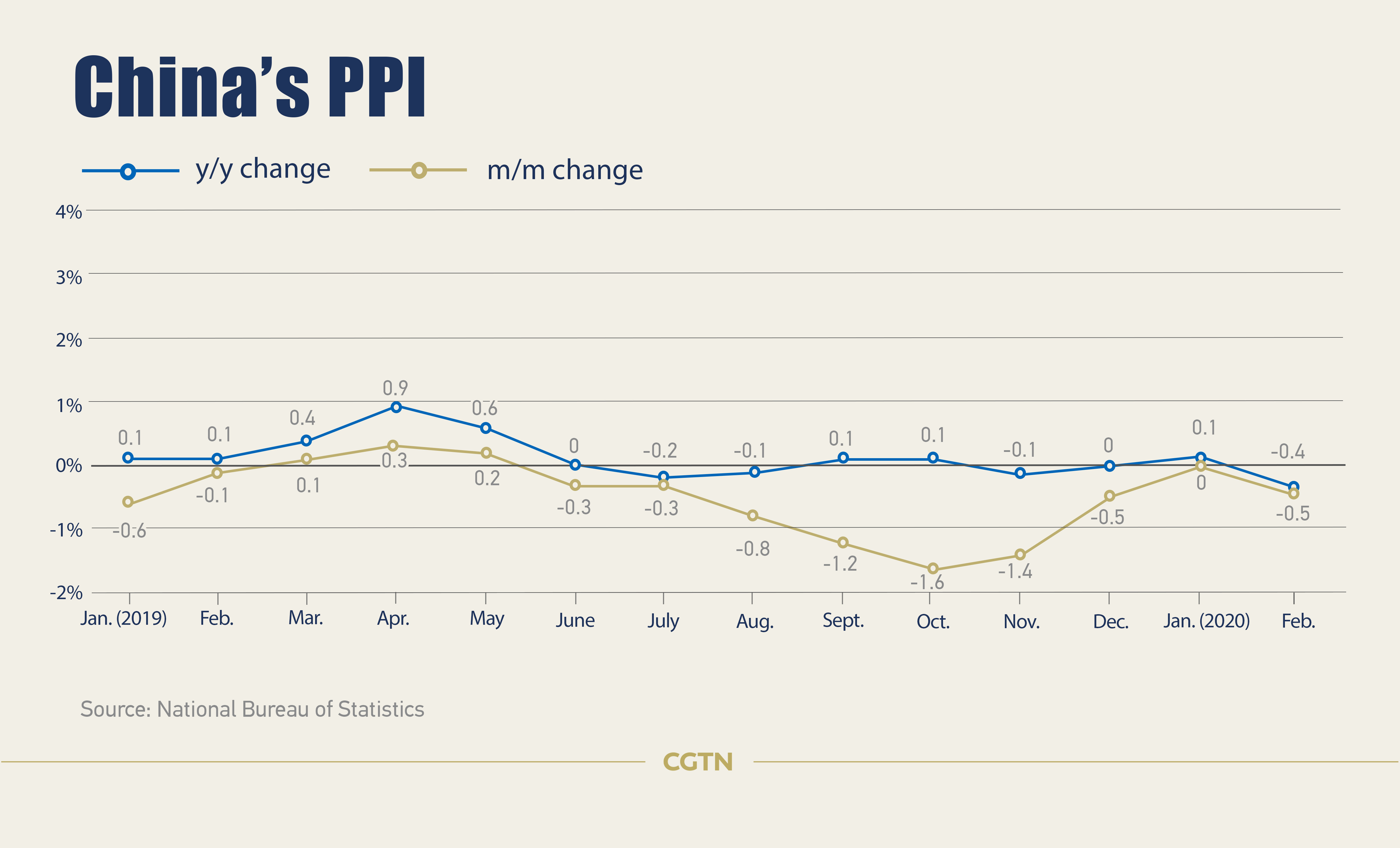

PPI back to downward trajectory

The country's producer price index (PPI) in February fell by 0.4 percent from a year earlier, reversing the 0.1-percent rise in January. Analysts earlier expected the PPI to fall 0.3 percent year on year.

The temporary shutdown of some industrial enterprises affected by the epidemic led to weak demand, causing producer prices to drop. On a monthly basis, the PPI fell by 0.5 percent last month, said Zhao.

The trajectory of the PPI would be in a "V" trend year on year. The PPI is expected to be in a negative range in the second quarter of the year given the high base of the same period last year. But it is expected to turn positive in the third quarter with the acceleration of work and production, and the whole year may be around zero percent, said Huang.

However, emerging risks in overseas markets cannot be underestimated as the fundamentals of the European market is not strong, the financial market in the United States is currently faced with risks and the oil-price plunge may depress inflation, said Huang.

In February, the international crude oil market was severely impacted with a sharp price fall, which affected prices of domestic oil and related industries. Prices of oil and gas extraction industry dropped 11 percent from a 4.3-percent increase in January. Prices of oil, coal and other fuel processing industry fell by 4.4 percent from 1.8 percent in January.

Prices of coal, steel and non-ferrous metals fell last month but in a steady pace. In February, the supply and demand of coal was basically balanced, and the coal price remained flat with the previous month. Affected by the increase in steel stocks, the prices of ferrous metal smelting and rolling processing industry fell by 1.4 percent month-on-month, expanding by 0.8 percentage points from January. Due to the price fall of copper in the international market, the price of copper smelting fell by 3.6 percent last month, data showed.

In addition, the price of the pharmaceutical manufacturing rose slightly. Affected by factors such as rising raw material prices and logistics costs during the epidemic prevention and control, the price of pharmaceutical manufacturing rose by 0.3 percent in February. Among them, the price of disinfection products increased by 14.8 percent, and the price of sanitary materials increased by 1.5 percent.

'CPI and PPI continue to differentiate'

The CPI and PPI are expected to continue their differentiation in the first half of the year under the influence of falling oil prices and rising pig prices, according to the CEBM, a think tank of Caixin.

The prominent driving factor of rising food prices is still pig prices. The epidemic has affected logistics and poultry supply, which has magnified the shortage of pork supply, according to the CEBM.

As work and production continue to resume, pork demand may expand significantly, and pig prices may reach a new high in the second quarter. It is expected that the impact of pig prices on CPI will be significantly weakened in the third quarter, said the CEBM.

The oil prices drop caused by supply factors has driven domestic PPI lower, but it will not bring a direct and overall negative impact on the profits of industrial enterprises, said the CEBM.

At present, structural easing is still the focus of monetary policy, which includes re-lending, re-discount and deposit reserve rates. In the future, the pace of interest rate cuts and reserve requirement ratio cuts will mainly follow the domestic economic performance, especially after companies gradually resume work and production, said the CEBM.