Factories in China are gradually accelerating the work resumption process. /Xinhua

Factories in China are gradually accelerating the work resumption process. /Xinhua

Editor's note: Chen Jiahe is the chief investment officer at Novem Arcae Technologies. The article reflects the author's views and not necessarily those of CGTN.

The National Bureau of Statistics of China on Friday published its latest report on the operational status of China's industrial enterprises.

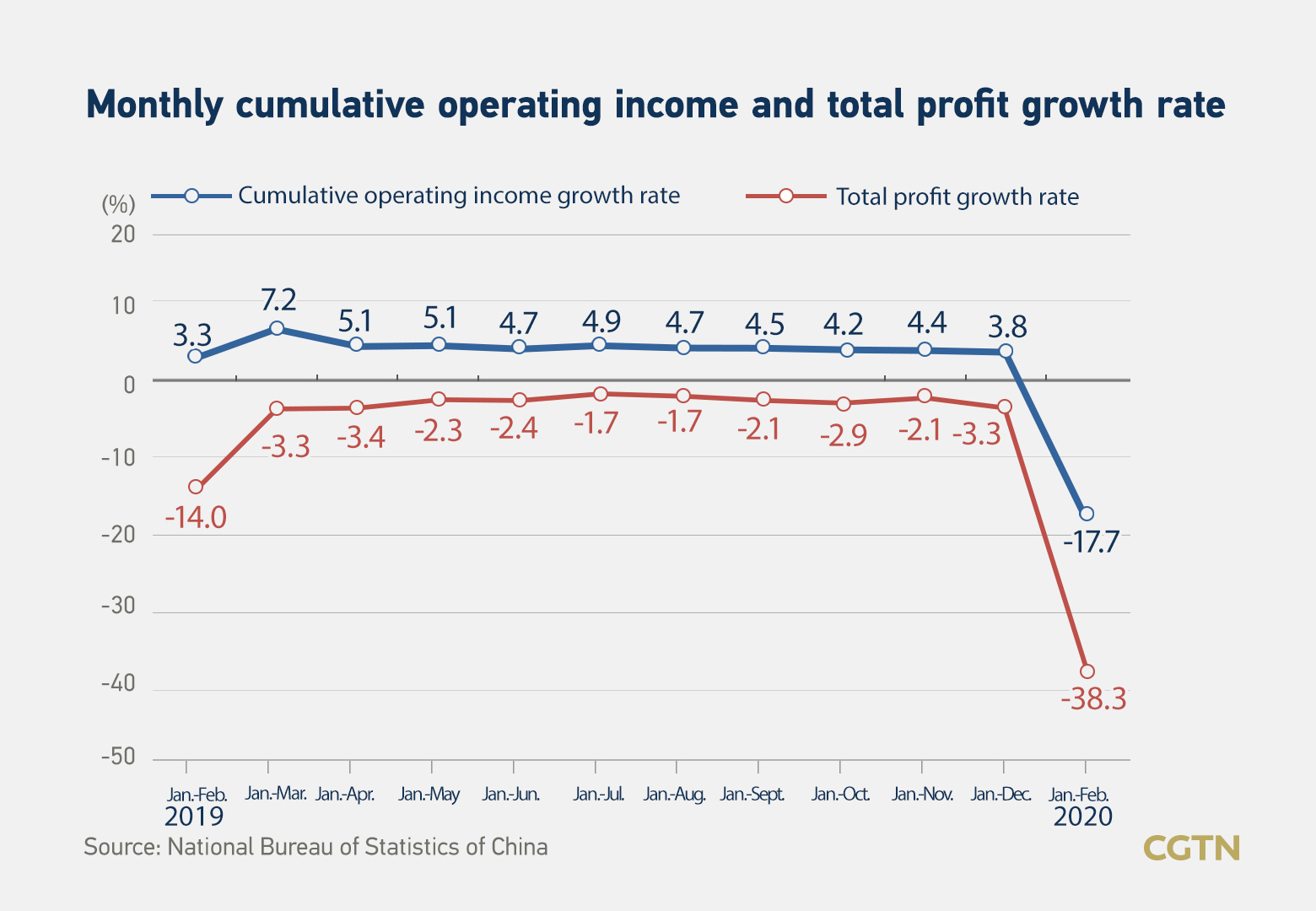

In the first two months of 2020, the total profit of surveyed industrial enterprises was 410.7 billion yuan, down 38.3 percent year-on-year. State-owned enterprises made a total profit of 146.5 billion yuan, a decrease of 32.9 percent compared with the same period in 2019. Joint-stock enterprises scored profits valued at 315.8 billion yuan, an annual slump of 33.6 percent. Meanwhile, the international industrial enterprises recorded profits to the tune of 79.6 billion yuan, 53.6 percent lower than a year ago. Profits of private enterprises were down 36.6 percent to 120.8 billion yuan.

The slump in profits of international companies is much larger than that of their domestic counterparts. This is interesting because in January and February, the coronavirus had not spread widely globally, especially in regions with heavy economic weight such as Western Europe and North America.

This large decline cannot be due to discontinued demand from international economies. The possible explanation is that it is due to disruption to the international supply chains.

As domestic companies are closely linked with local markets, the manufacturing of their products rely less on supply chains or their supply chains are usually less sophisticated. However, international companies usually rely heavily on an international supply chain and their businesses can be comparatively more sophisticated. This means a slight disruption to the overall supply chain can bring more damage to these companies, compared with domestic companies.

What caused the drop in the profits of industrial enterprises is obvious: the spread of the coronavirus in China in the first two months of the year. Investors will remember that. However, the impact is only temporary.

China has now successfully contained the virus within its boarder and is also taking very strict and effective measures against imported cases.

While economic data only reveals what happened in the past, investors don't presume it represents the current status of the Chinese economy. Instead, with the recovery of economic activities and the revival of industrial production activities, we might be able to expect more positive economic data in the next few months.

A detailed look at the industries also reveals the different situations for each industry. When the outbreak caused a temporary paralysis of the economy, some industries still saw their profits grow, such as tobacco, non-ferrous metals, oil and gas refining, agricultural products and food, among others. These industries revolve around compulsory consumption items or raw materials that require little labor.

The hardest-hit industries, on the other hand, include industries such as computer and communications-related equipment, as well as automobiles. The common feature of these industries is that they are consumer discretionary, which means they are items whose purchase is out of choice, not need.

It's important to remember that China has brought the outbreak under control and other countries are taking measures to contain the epidemic. The economic data will be brighter when the spread of coronavirus is curbed as economic activities return to normal.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)