07:04

China's foreign trade volume in the first quarter of this year reached 6.57 trillion yuan (about 930 billion U.S. dollars), declining by 6.4 percent year on year. Compared to the big decline in the first two months of 2020, China's trade activities are seeing a strong rebound in March.

J.P. Morgan's Global shipping index showed that China improved a lot in March compared with first two months. However, the concerning news is seeing the Shipping Index start to decline dramatically again.

Zhu Haibin, JP Morgan's Chief China Economist said the recession is not related to factory shutdowns, but mainly reflecting the economic growth is slowing down because of social distancing.

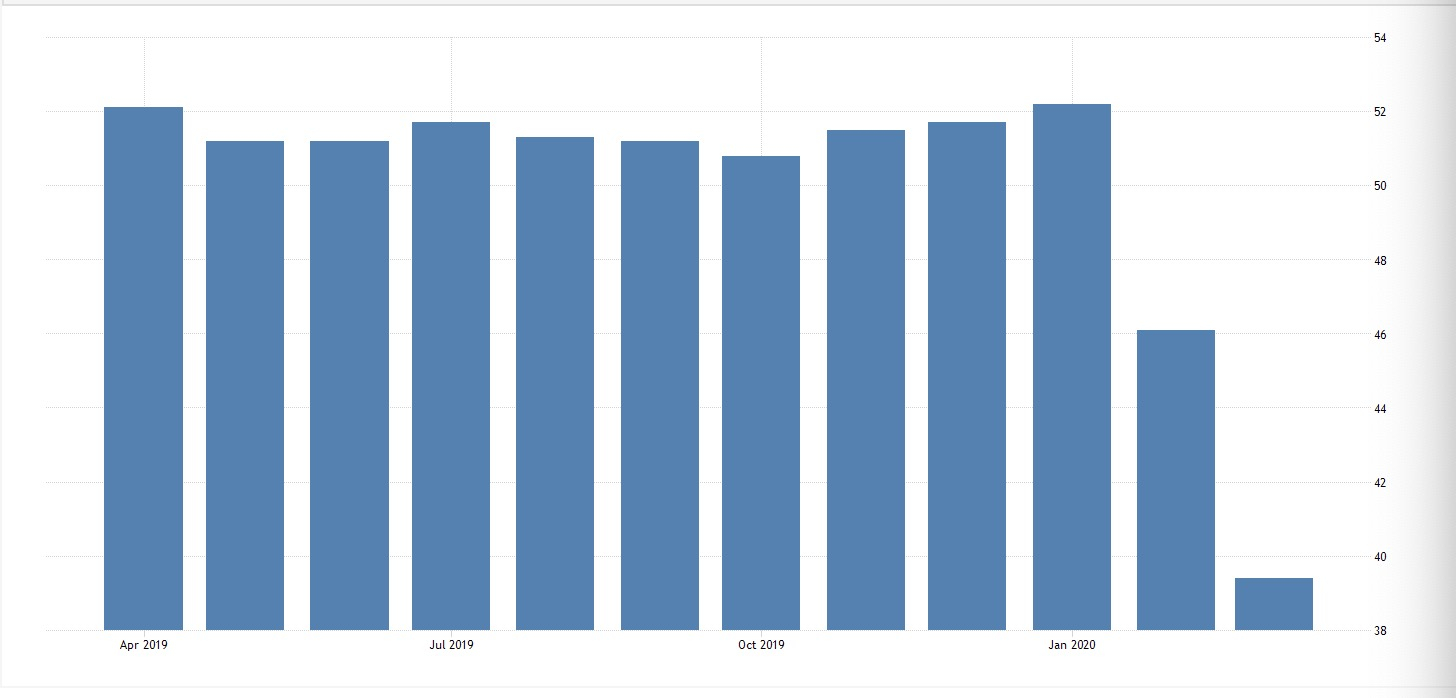

JP Morgan global Composite PMI from April 2019-March 2020. /Trading Economics

JP Morgan global Composite PMI from April 2019-March 2020. /Trading Economics

A snapshot of what's in store for global trade – JP Morgan's Global Composite PMI shows its output index contracting at its sharpest rate in over 11 years with employment falling the most since July of 2009.

"A lot of the resilience for China's trade activity, but I think the other dark sky is still ahead. We should pay attention," Zhu told to CGTN.

In terms of the COVID-19 pandemic, Zhu forecasted that the world will see the deepest recession, particular in advanced economy. And then we will see a major impact on global demand, which will also disrupt the global supply chain. The trade protection will increase," Zhu said, "China's export sector is still facing a challenge time.”

Zhu said the priority in trying to stabilize the situation is the normalization of production and consumption activity.

The "Chinese government should further step up policy support goes on fiscal side to support the export-oriented companies particularly SMEs, because they are the most important hiring sectors that accounting for the majority of the employment in China,"Zhu noted.

Some measures have already been announced in the last two months in China. For example, the waiver of the social security contribution and also tax reduction, to release the SMEs' pressure under the tough time."

"But more need to come actually going forward," Zhu said, "move further increase the fiscal stimulus both within the budget and also the special government bonds can use to further support the affected corporate sectors."

One key debate of the question is that how long this the current deep recession will last, Zhu said the more important than fiscal policy is that the companies try hard to survive through the next several months. He believed that the virus impact will become smaller and the global economy will start on track of the recovery in the second half from third quarter.