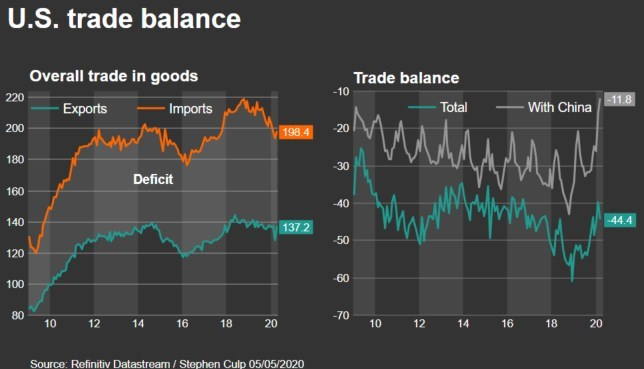

The U.S. trade deficit soared 11.6 percent to 44.4 billion U.S. dollars in March due to the coronavirus pandemic – the largest rise since December 2018, data from the Commerce Department showed Tuesday.

A Reuters poll forecast the trade deficit to increase to 44.0 billion U.S. dollars in March, while Bloomberg estimated a gap of 46.1 billion U.S. dollars.

"Trade between locked-down countries all over the globe will continue to falter in what looks like a second Great Depression and it could be years before the globalization trend reasserts itself as the world grows more cautious during this unprecedented health crisis," said Chris Rupkey, chief economist at MUFG in New York.

In March, exports lost 9.6 percent, or 187.7 billion U.S. dollars, the lowest since November 2016. Imports fell 6.2 percent, the most in 11 years, to 232.2 billion U.S. dollars.

Exports of motor vehicles and parts dropped 2.5 billion U.S. dollars to 11.3 billion U.S. dollars in March, the weakest since November 2011. Shipments of consumer goods hit a seven-year low in March. Exports of services tumbled 10.8 billion U.S. dollars to 59.6 billion U.S. dollars, the lowest level since November 2013, hurt by travel restrictions because of COVID-19.

The goods trade deficit with China decreased 4.2 billion U.S. dollars to 11.8 billion U.S. dollars in March, a 16-year low.

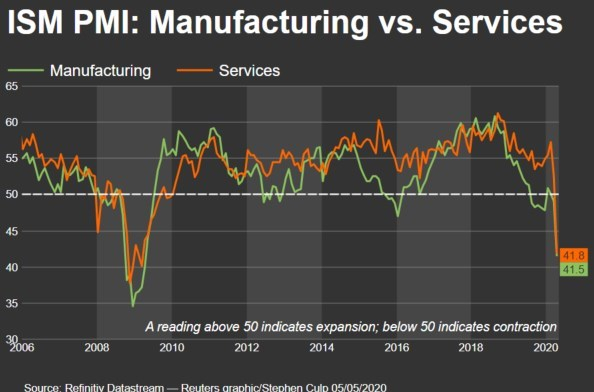

Other data on Tuesday showed tough measures to slow the spread of COVID-19, the respiratory illness caused by the coronavirus, pushed the nation's vast services sector into contraction in April for the first time in nearly 10.5 years.

The U.S. business activity hit record lows in April with the manufacturing PMI sliding to 41.8 in April, down from 52.5 in March, according to the Institute of Supply Management (ISM).

A reading below 50 indicates contraction in the services sector, which accounts for more than two-thirds of U.S. economic activity. The ISM survey's measure of new orders for the services industry dropped to a record low in April.

The country's GDP contracted 4.8 percent in the first quarter of 2020, marking the worst dive since the fourth quarter of 2008. The fall was mainly dragged by consumer spending, nonresidential fixed investment, exports and inventories amid the coronavirus outbreak.

"We continue to expect that the apex of the impact of COVID-19 on the U.S. economy occurs this quarter, with GDP falling around 30 percent at an annualized rate," said Ryan Sweet, a senior economist at Moody's Analytics in West Chester, Pennsylvania.

Stocks on Wall Street were trading higher as investors ignored the data, focusing instead on recovering oil prices and an easing of travel restrictions in several countries. The dollar rose against a basket of currencies. U.S. Treasury prices were mostly lower.

(With input from Reuters)