China's economy showed signs of significant improvement in April from its COVID-19 lockdown as the coronavirus pandemic ebbs in the country, with industrial output growing in the positive territory, according to data provided by the National Bureau of Statistics (NBS) on Friday.

Industrial output bounced back into positive territory in April as an overwhelming majority of factories across China started humming again amid nationwide efforts to resume production, with the total value added of major industrial firms climbing by 3.9 percent year on year.

The reading overshot the 1.5 percent estimate in both Bloomberg and Reuters polls. It came after a small downturn by 1.1 percent in March and a 13.5 percent collapse in January and February, which marked the first contraction in three decades.

"The industrial output data showed that the resumption of work and production in China has been successful," Chen Fengying, a research fellow with the China Institutes of Contemporary International Relations told CGTN.

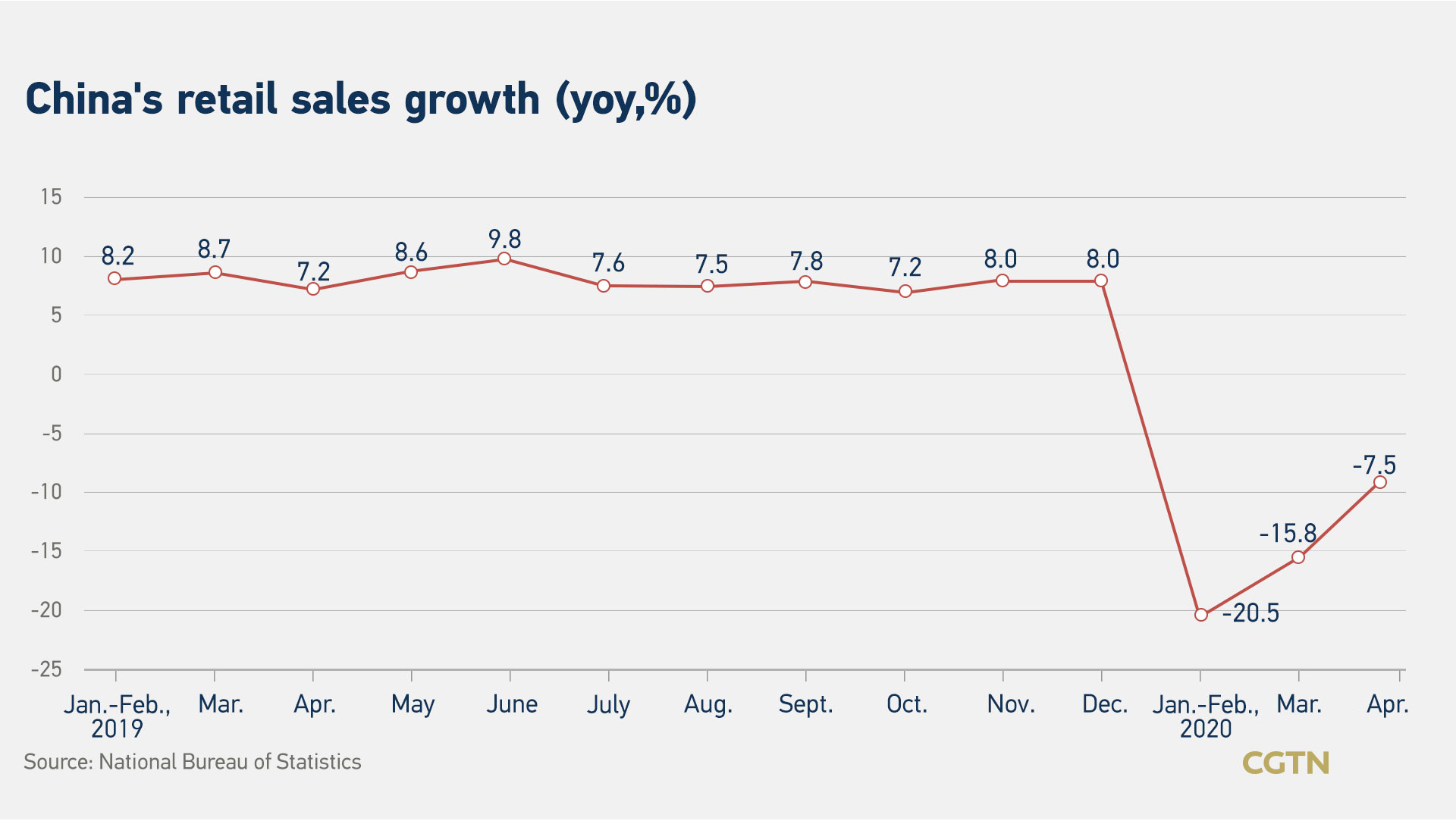

Consumption remained the overriding growth engine fueling the country's economy, with retail sales, a major indicator of consumption growth, edging down 7.5 percent in April compared to the same period last year and narrower from a 15.8 percent tumble in March, boosted by local voucher issuance programs that have helped release pent-up demand, NBS data showed.

"Consumption will come back in the second quarter, and I advocate companies and platforms instead of the government to issue consumer vouchers," Chen said.

From January through April, the nationwide online retail sales amounted to expanded 1.7 percent to 3.07 trillion yuan, versus a decrease of 0.8 percent from the January-March period. Among them, the online sales of physical goods increased by 8.6 percent, 2.7 percentage points higher than that of the first three months and accounting for 24.1 percent of total retail sales.

"Online retail sales played an important role in stabilizing market supplies, protecting people's livelihood, and helping employment in service industry during the coronavirus outbreak. It also played a vital role in narrowing the decline in the service output," Bai Ming, deputy director of the international market research institute of the Chinese Academy of International Trade and Economic Cooperation told CGTN.

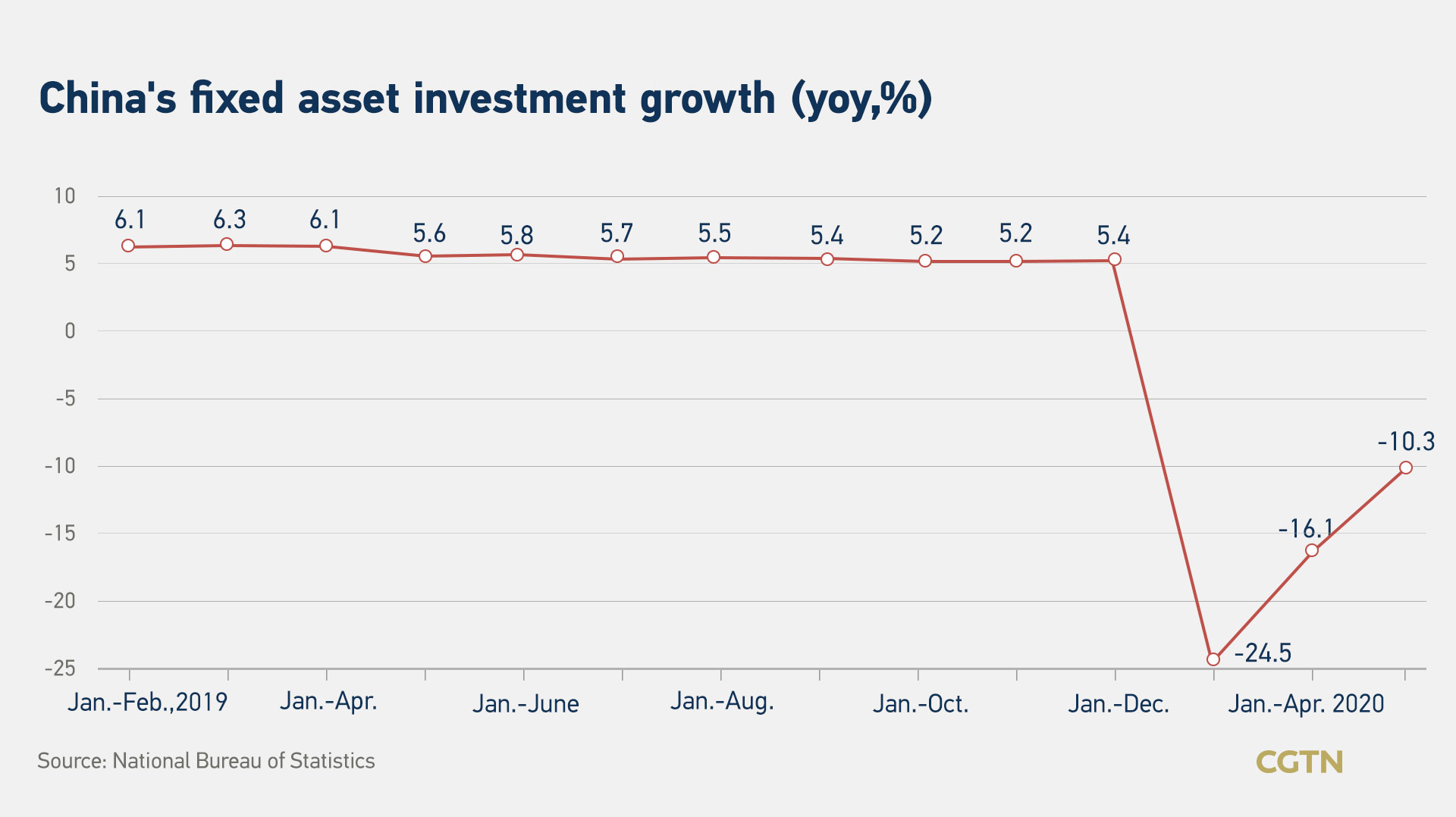

Weighed on by the flare-up of infections and uncertainties clouding overseas outbreaks, China's fixed-asset investment during the January-April period contracted by 10.3 percent, but it still pared a year-on-year decline of 16.1 percent in the first quarter of 2020.

The economic data released on Friday also showed foreign direct investment (FDI) into the Chinese mainland rebounding in April. Such a rise could attribute to the policy-added efforts nationwide to shore up the stability of foreign investment, with a FDI inflow, up 8.6 percent year on year to settle at 10.14 billion U.S. dollars.

During the January-April period this year, the FDI moved downward 6.1 percent from a year earlier to the tune of 286.55 billion yuan (41.3 billion U.S. dollars), dragged down on the quarantine and social distancing measures targeting the coronavirus pandemic.

The FDI inflow to information services, e-commerce services and professional technical services skyrocketed last month by 46.9 percent, 73.8 percent, and 99.6 percent respectively compared to the same period a year earlier.

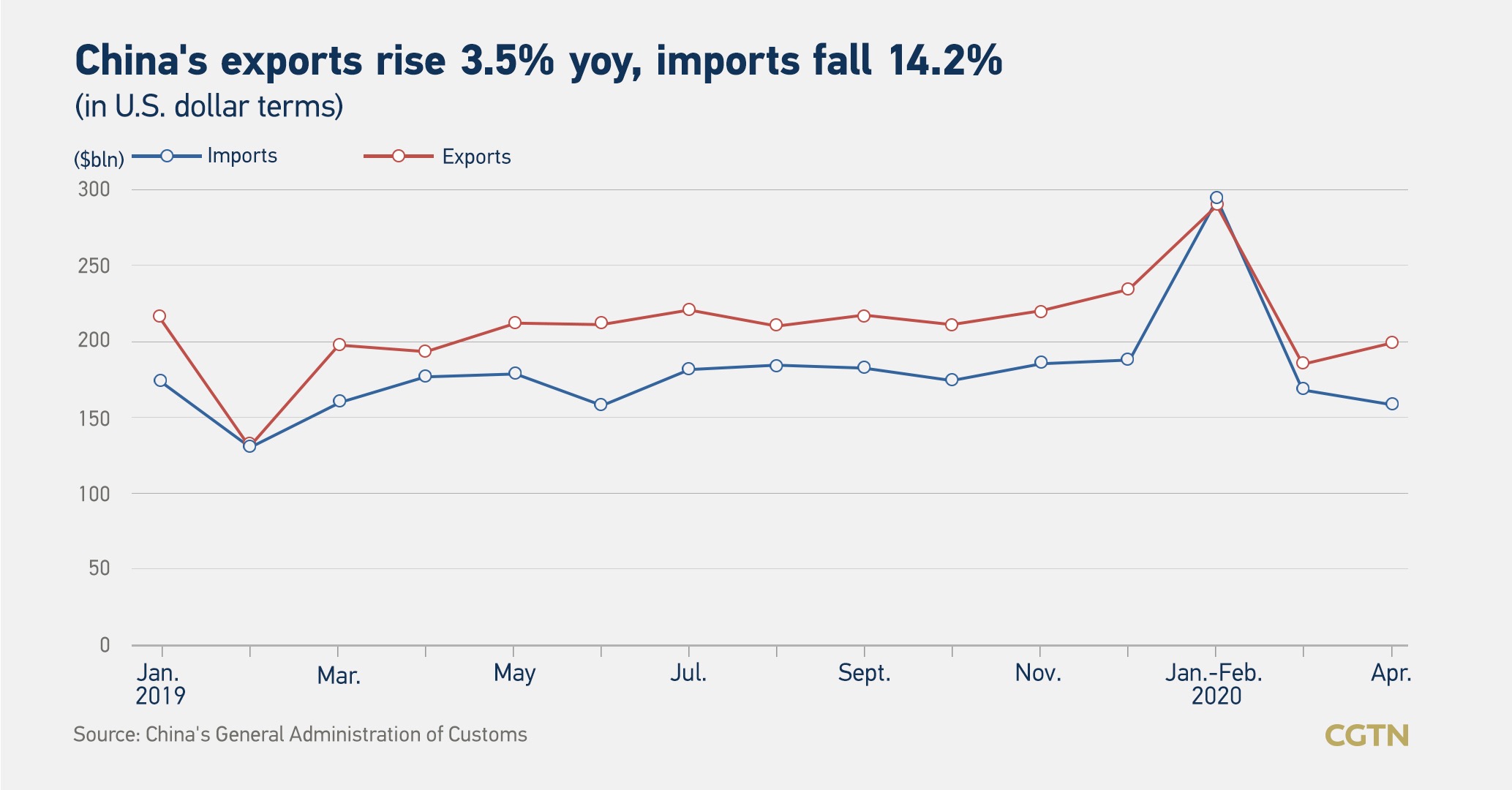

The country's exports notched up an unexpected gain of 3.5 percent in U.S. dollar terms for the month of April as factories and restaurants got back on track in the wake of eased restriction measures and social distancing, coupled with a 14.2 percent retracement in imports.

That is a far cry from a Reuters poll, which projected April imports and exports would suffer double-digit setbacks of 11.2 percent and 15.7 percent, respectively, following tentative tweaks in March, while Bloomberg forecast that the contraction in China's foreign trade is set to continue through the second quarter.

China's inflation further sailed into the slowdown territory in April, with its main gauge of the consumer price index (CPI) registering a year-on-year rise of 3.3 percent which is 0.9 percent narrower than in March, buoyed by a swift and violent sink of oil prices and pork prices.

"The current pace of recovery is neither disappointing nor encouraging. We believe hopes of a quick recovery are dimming, as China still faces two big challenges: collapsing external demand due to the pandemic, and remnants of the virus inside China," economists from Nomura said.

"The recovery is underway whether we call it a 'V' or not, but headwinds are still there, and the economy is yet to return to normal yet," the economists added.

Food prices remained the locomotive of consumer inflation last month though its increment speed bounced back from March's 18.3 percent to the current 14.8 percent, due in large part to pork price inflation descending to 96.9 percent as compared to 116.4 percent in the previous month.

China's job market remained stable in April, with the surveyed unemployment rate in urban areas standing at 6 percent, 0.1 percentage points higher than in March. A total of 3.54 million jobs were created in the first four months this year.

What's next?

Liu Aihua, NBS spokesman, said that the national economic performance in April continued the recovery momentum gained in March, but the improvement of these indicators has a nature of compensatory recovery; some major indexes are still in the downtrend range.

Asked when China will step out of the negative growth zone, Liu noted this depends not only on the resumption speed of domestic production but also on the epidemic situation overseas and economic changes. The trend of economic development still needs to be observed, but China is confident that the momentum of recovery and improvement will be maintained.

"China is still accelerating its transformation and upgrading. Consumer prices are relatively stable. It is still need to stimulate investment, especially investment in construction of infrastructure," the research fellow Chen Fengying commented on the economic performance.

"The real estate market will continue to be regulated, but needs for improved housing and other reasonable needs will be guaranteed," she added and was echoed by Bai.

"Industrial output has basically stabilized, but it will take time for fixed-asset investment to recover. Investment is more of a long-term expectation, and should consider factors both at home and abroad. I expect the investment will be stabilized in Q3 and rebound in Q4," Bai told CGTN.

"The recovery of industries related to optional consumption overseas will be under great pressure, such as computers, mobile phones, high-end clothing," Chen Jiahe, the chief investment officer at Novem Arcae Technologies told CGTN.

"Catering is slowly recovering. Tourism, especially distant trips, still face difficulties in recovery," Chen added.

"The central bank will fine-tune monetary policy in Q3 and Q4, which will be slightly looser than it is now. More infrastructure projects will be launched," noted Bai.

However, Chen Jiahe disagreed with Bai. "The Chinese economy has passed its worst stage, and the monetary policy should not be looser than it is now," Chen told CGTN.

"Affected by macroeconomic policies adopted by foreign countries, the monetary and fiscal policies will ease," Chen Fengying agreed with Bai. "But it's better to advocate direct financing through stock markets and bond markets," she added.

"We expect Beijing to ramp up its stimulus measures by setting a higher fiscal deficit target at around 3.5 percent, issuing central government special bonds to replenish banks' capital, increasing the quota of local government special bonds to support infrastructure spending, and encouraging state-owned enterprises and local government financing vehicles to take on more debt," economists from Nomura said.

"Foreign trade also supported the economic performance in April. But this improvement is technical, because the orders completed in April had been actually signed in February before the epidemic affected overseas markets. New orders signed after March have declined, and will be reflected in May and June data. It does not rule out a certain degree of decline in the future. Meanwhile, whether global trade protectionism will rise again is uncertain," Bai explained.

Chen Jiahe also had a different opinion. "The export growth in April is unlikely to be technical, but is because of the surge in foreign demand for anti-epidemic supplies," Chen told CGTN.

"Sustainability in export growth is questionable, because delayed orders will be completed and overseas demand for anti-epidemic supplies will come down. Zero growth, even negative two percent growth are acceptable for the whole year," Chen Fengying shared her opinion.

"The economy in Q2 is likely to reverse the decline, and is predicted to between a small negative and a small positive, probably zero growth. The restrictions are mainly external, one is the interruption of the global industrial chain, which affects our imports and exports. The other is the large inputs of epidemic cases, which would result in lockdowns again," added Bai.

Chen Jiahe, the chief investment officer believed the economic performance in Q2 will definitely be better than in Q1, though slightly weaker than expected under normal conditions. China's future economic performance depends on the speed of recovery of the overseas epidemic. Europe has seen the dawn of victory, but the situation in the U.S. remains tricky.

"We expect export growth to plunge to around 22 percent in May and June and maintain our real GDP growth forecast at negative 0.5 percent year on year in Q2 despite a jump from -6.8 percent in Q1," economists from Nomura said.

(Cover image: An employee works at a production line manufacturing optical fiber cables at a factory of the Zhejiang Headway Communication Equipment Co. in Huzhou City, Zhejiang Province, China, May 15, 2019. /Reuters)