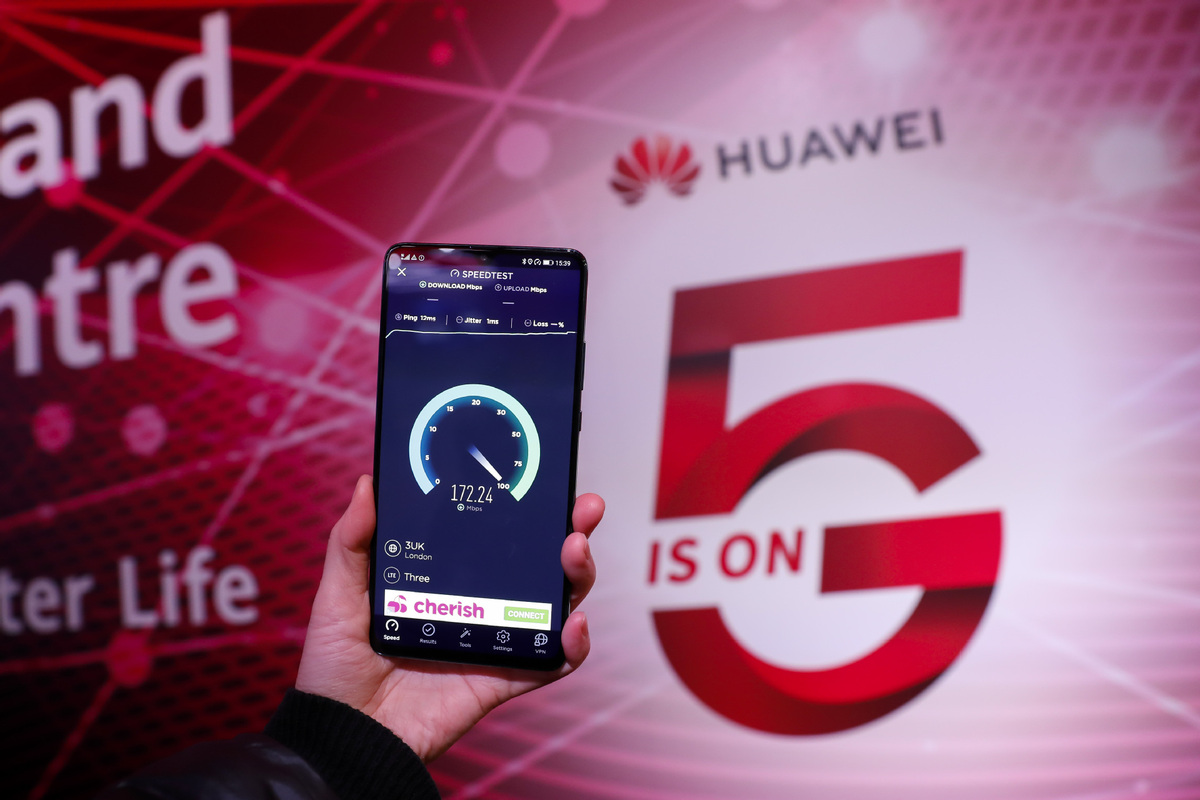

The logo of China's tech giant Huawei. /Xinhua

The logo of China's tech giant Huawei. /Xinhua

Editor's Note: Iram Khan is a Pakistan-based commentator on international and commercial affairs. The article reflects the author's opinions, and not necessarily the views of CGTN.

The latest restrictions by the U.S. Department of Commerce on telecom manufacturer Huawei's acquisition of semiconductors were aimed at countering the competition from China's growing tech prowess. The ill-advised move, however, is about to trigger a series of problems for businesses in the U.S.

Fair competition between contenders in any industry optimizes the use of resources by providing a level playing field. It engenders an evolution that ultimately benefits the entire industry. This step by the U.S. government is going to cause exactly the opposite effect.

The free trade regime that the international community had strived hard to foster during the major part of the last century will suffer the greatest repercussions – especially at a time when the world is trying to restart the economic engine in the face of the COVID-19 pandemic.

But the shocks in the semiconductor industry that will follow this decision are going to seep into all high-tech sectors and risk a setback to the recovery process.

Huawei is one of the biggest customers of semiconductors. Putting up roadblocks in its lawful right to produce telecommunication devices will result in lost outputs, shrunk jobs and slackening of research and development in the U.S. and beyond. Impediments in this crucial industry will, in effect, have ramifications across the computing world.

No single country can claim hegemony on technology in today's open global economy. But anyone banking on innovation will have an edge. Huawei became a household name around the world by following this doctrine being encouraged in China.

In the U.S., meanwhile, the episode is going to further stem innovation in chip-making because curbing peaceful and constructive technology is like curbing knowledge. Without serious competition, U.S. vendors will have a lesser incentive to make improvements in their chips. While American chip makers will certainly stagnate, the path for their Chinese counterparts is all upward from here.

China's tech giant Huawei. /Xinhua

China's tech giant Huawei. /Xinhua

On maturing, China's domestic semiconductor industry will present an alternative to international consumers and allow the market to avoid getting hostage to the U.S. government's whims. China has no shortage of chip designers as well as the rare earth metals needed for manufacturing semiconductors. This very abundance gives it an upper hand in the supply chain.

The curbs are based on a perceived security threat from Huawei. But the striking point here is that the Trump administration is not willing to share even a shred of evidence. This is why these concerns are not shared by its transatlantic partners. The leaders of Germany, France and the Netherlands said a day after the announcement of restrictions that they have no plans of following President Donald Trump's lead.

Under Trump's China-centric re-election bid, his country is sliding fast into a chasm of isolation, getting out of which would be more difficult if he gains the second term. The blessings it has been bestowing on Taiwan are, therefore, short-lived.

The Taiwan Semiconductor Manufacturing Company (TSMC) is already feeling the heat of the prohibition. Fourteen percent of its 2019 sales came from Huawei's Hisilicon division. After effectively disallowing it to sell to Huawei, the U.S. has provided the company no fallback to sustain its profits. Its stock price went down a solid 2.5 percent on the announcement of the restrictions.

Back in the U.S., American companies have long-lost the cost advantage to Chinese companies. And neither is it feasible for most to manufacture products outside China. Now with the rise of competitors like Huawei, they are losing on the qualitative advantage as well. This offers a clue to the reasons behind the action initiated by the U.S. Department of Commerce.

Creating problems for Huawei is, in fact, creating greater problems for U.S. businesses who are reeling with COVID-19 induced losses. Their expansion plans are on hold as the buying power of American customers has tanked. Last year, the initial round of sanctions imposed on Huawei prompted U.S. suppliers to complain to Washington about the lost potential deals estimated at billions of dollars. Huawei, on the other hand, emerged with a 19 percent increase in its total sales in 2019.

The Chinese government has firmly opposed the "abuse of export controls" by the U.S. It has called it a violation of market principles and a disregard for basic international economic and trade rules. Spokesperson of the Ministry of Commerce went on to say that China will take any necessary measures to defend the legitimate interests of Chinese firms.

The disdain shown by the Trump administration against multilateralism is impacting not just China. Last year's tariff war proved inimical to many European and Asian companies who are now looking for means to balance out their dependence on U.S. technologies. Moves like the one against Huawei are accelerating the advancement of Chinese technology, whereas, for multinational firms, they are turning the option of "America First" to "America Last."

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)