Editor's note: Daryl Guppy is an international financial technical analysis expert. He has provided weekly Shanghai Index analysis for Chinese mainland media for more than a decade. Guppy appears regularly on CNBC Asia and is known as "The Chart Man." He is a national board member of the Australia China Business Council. The article reflects the author's opinion, and not necessarily the views of CGTN.

The most important features in the Two Sessions work report from Chinese Premier Li Keqiang were not the missing physical infrastructure build that some Western suppliers were eagerly anticipating. Those expecting a boost in Chinese imports of iron ore as happened following the global financial crisis were disappointed.

Recovery from the COVID-19 crisis calls for a different approach to that used in the global financial crisis (GFC). The GFC was a liquidity and credit crisis. Banks stopped lending to each other and then stopped lending to customers. Many western countries, with their foreshadowed COVID-19 recovery infrastructure stimulus seem to miss the difference.

The COVID-19 crisis is about fiscal support rather than demand stimulation so it's no surprise that economic growth targets have not been set. Economic survival and protection of economic gains is the priority. Premier Li's work report acknowledges this and so provides a more sophisticated and targeted response.

Premier Li identified domestic consumption as the main driver of growth and COVID-19 recovery. The wide-spread use of coupons to direct spending avoids the diversion of recovery expenditure into personal savings. Domestic consumption is boosted by credit support for start-ups and the growth of innovation by cutting taxes and fees reduces operating costs.

These fiscal measures are particularly important for small-medium enterprises (SMEs) and micro-businesses. These are essential drivers of the economy and in aggregate, the largest employers. Targeting support in these sectors is smart thinking and avoids the problems seen in the U.S. where fiscal support was gobbled up by large corporations rather than by the SMEs who needed it most.

Infrastructure stimulus remains an important focus, but much of this is soft infrastructure. It's not infrastructure you can pick up and put on truck. It's the infrastructure of an advanced digital economy that creates the next-generation information networks. This is a soft-infrastructure concept not yet fully grasped, let alone implemented, in many western environments, so there is a tendency to dismiss its importance. They look for infrastructure made of steel, not of bytes. The work report understands that building a bridge of bytes is more important than building a bridge of steel.

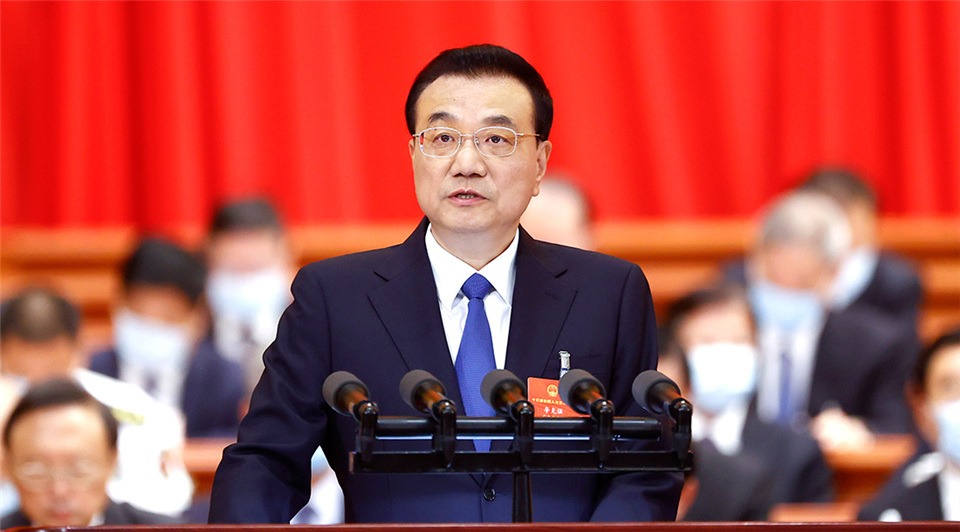

Premier Li Keqiang delivers a government work report at the opening meeting of the third session of the 13th National People's Congress at the Great Hall of the People in Beijing, May 22, 2020. /Xinhua

Premier Li Keqiang delivers a government work report at the opening meeting of the third session of the 13th National People's Congress at the Great Hall of the People in Beijing, May 22, 2020. /Xinhua

China survived the COVID-19 lockdown in part because of a well-developed and sophisticated e-commerce structure based on advanced 5G and internet services. The shift to an almost fully digital economy was smooth as it only required a small bridging step because WePay and Alipay were already ubiquitous. The successful tracking and continued containment of COVID-19 relies on existing advanced information networks, 5G capacity and AI developments.

The further development of this soft infrastructure is a priority objective because it provides competitive strength in a digital economy in everything from payment options to cross-border trade transactions.

The objective is to be able to operate within a global environment while retaining essential sovereignty. While the Chinese yuan is tied to the U.S. dollar, the economy is also tied to the (mis)fortunes of the U.S. economy and fiscal decisions. This soft infrastructure development helps to stabilize the environment for foreign trade and investment. It is a foundation for growth.

Increasingly essential to this sovereign independence is the development and deployment of a sovereign digital currency, first within China and then within a broader trade settlement framework. A sovereign digital currency provides a functional alternative to the dollar settlement system, blunting the impact of any sanctions and facilitates integration into globally traded currency markets as a foil to political disruption.

The priorities highlighted in the work report improve the implementation of Belt and Road Initiatives with liberalized trade facilitation and by making it easier for foreign investment.

Whilst President Trump seems keen to discourage American investment in China, there are many other countries, both within and outside the BRI framework, looking to develop Chinese investment opportunities. Premier Li's focus on this soft infrastructure is an important enabling factor and much more significant than the lack of GFC-style hard infrastructure stimulus or a GDP target.

All the features in this work report were directed at one fundamental objective: the continued alleviation of poverty and the general lifting of living standards for all of society, both financially and in terms of life quality with safe drinking water and a better environment.

Outside commentators who were looking at the work report in terms of what was in it for them were disappointed because the focus is on an effective economic recovery that is China-orientated.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)