Hong Kong-listed chip-maker Semiconductor Manufacturing International Corp (SMIC) aims to raise about 20 billion yuan (2.8 billion U.S. dollars) selling shares publicly in Shanghai, the company said in a prospectus on Monday.

The announcement comes as the Shanghai-headquartered company fattens its funding war chest amid broader tech-related tensions between the United States and China.

SMIC said the proceeds from the Chinese share sale will be used to fund projects and replenish operating capital.

Last month the company announced it received 2.2 billion U.S. dollars in investments from Chinese state investors that will go to one of its plants.

Established in 2000, SMIC is the Chinese mainland's top semiconductor foundry and the rival to Taiwan-based Taiwan Semiconductor Manufacturing Company (TSMC).

The latter company produces best-in-class chips for a range of companies that include Apple, Qualcomm, and Huawei.

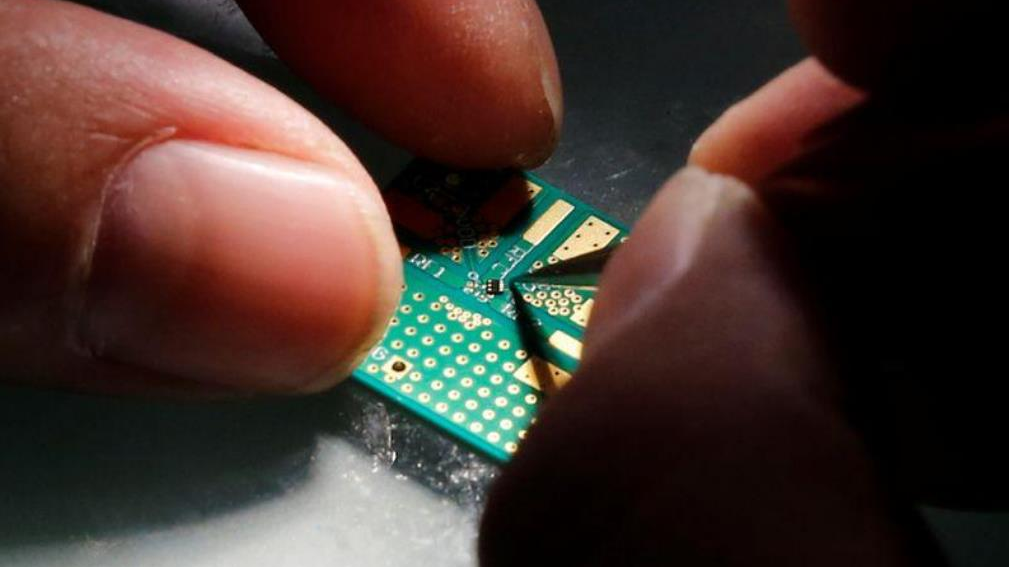

A researcher plants a semiconductor on an interface board during a research work to design and develop a semiconductor product at Tsinghua Unigroup research center in Beijing, China, February 29, 2016. /Reuters

A researcher plants a semiconductor on an interface board during a research work to design and develop a semiconductor product at Tsinghua Unigroup research center in Beijing, China, February 29, 2016. /Reuters

SMIC, meanwhile, remains less advanced than TSMC in its production capabilities.

Both TSMC and SMIC have found themselves caught in the U.S. Department of Commerce's actions against Shenzhen-based smartphone maker Huawei Technologies.

Last month, the department expanded a restriction known as the Foreign Direct Product Rule to cover makers of semiconductor manufacturing equipment produced by U.S. companies. Experts say the move will likely affect both TSMC and SMIC's ability to provide chips to Huawei.

In its prospectus, SMIC referenced the Foreign Direct Product rule as a potential risk.

With the rule in place, "Certain semiconductor equipment and technologies imported from the United States may not be used to manufacture products for a number of customers before obtaining administrative approval from the United States Department of Commerce," it said in the prospectus.

(With input from Reuters)