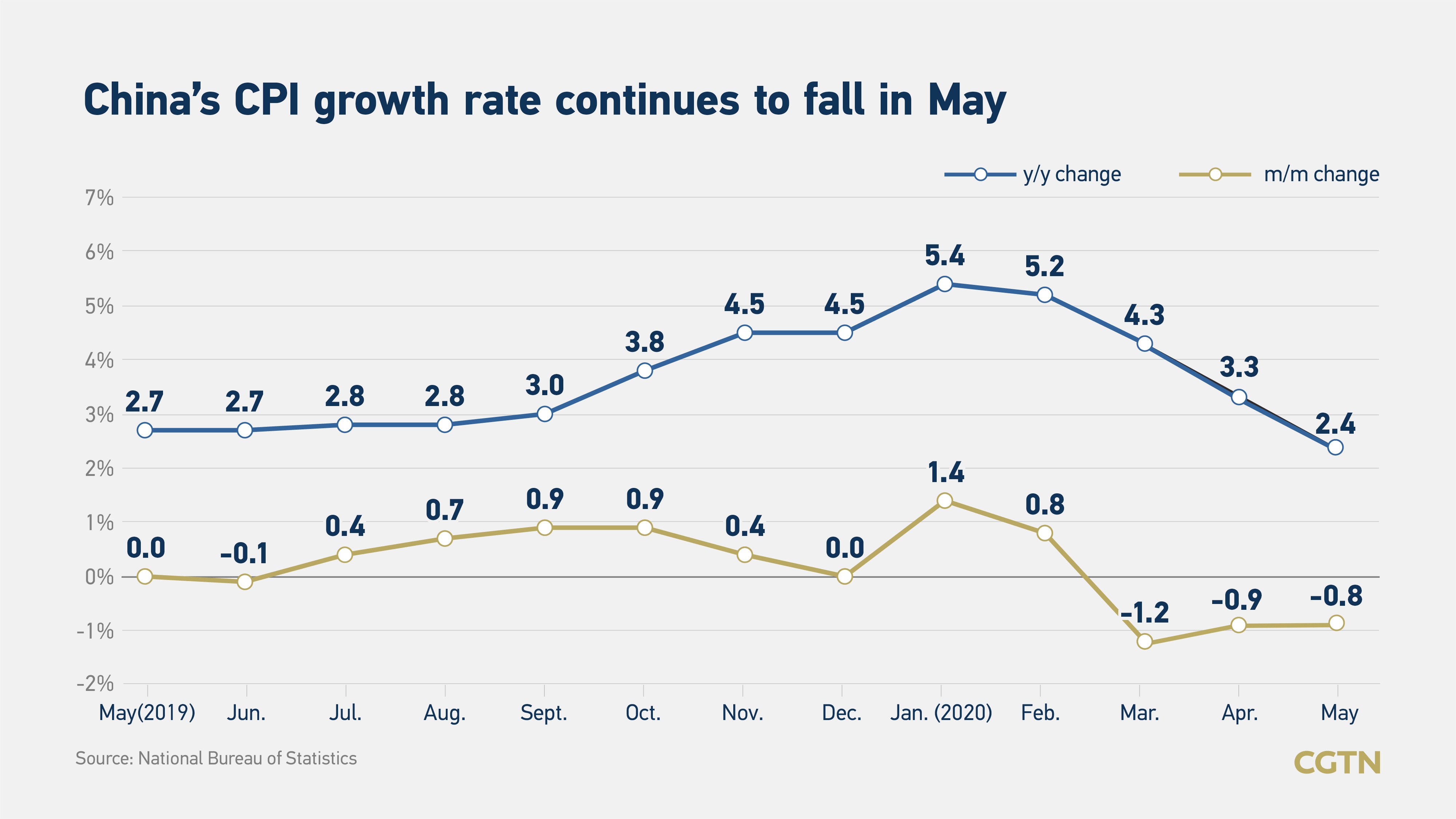

Due to a drop in food prices, China's consumer price index (CPI), a main gauge of inflation, fell back for the fourth consecutive month, registering a year-on-year rise of 2.4 percent in May, 0.8 percent lower than in April, the National Bureau of Statistics said Wednesday.

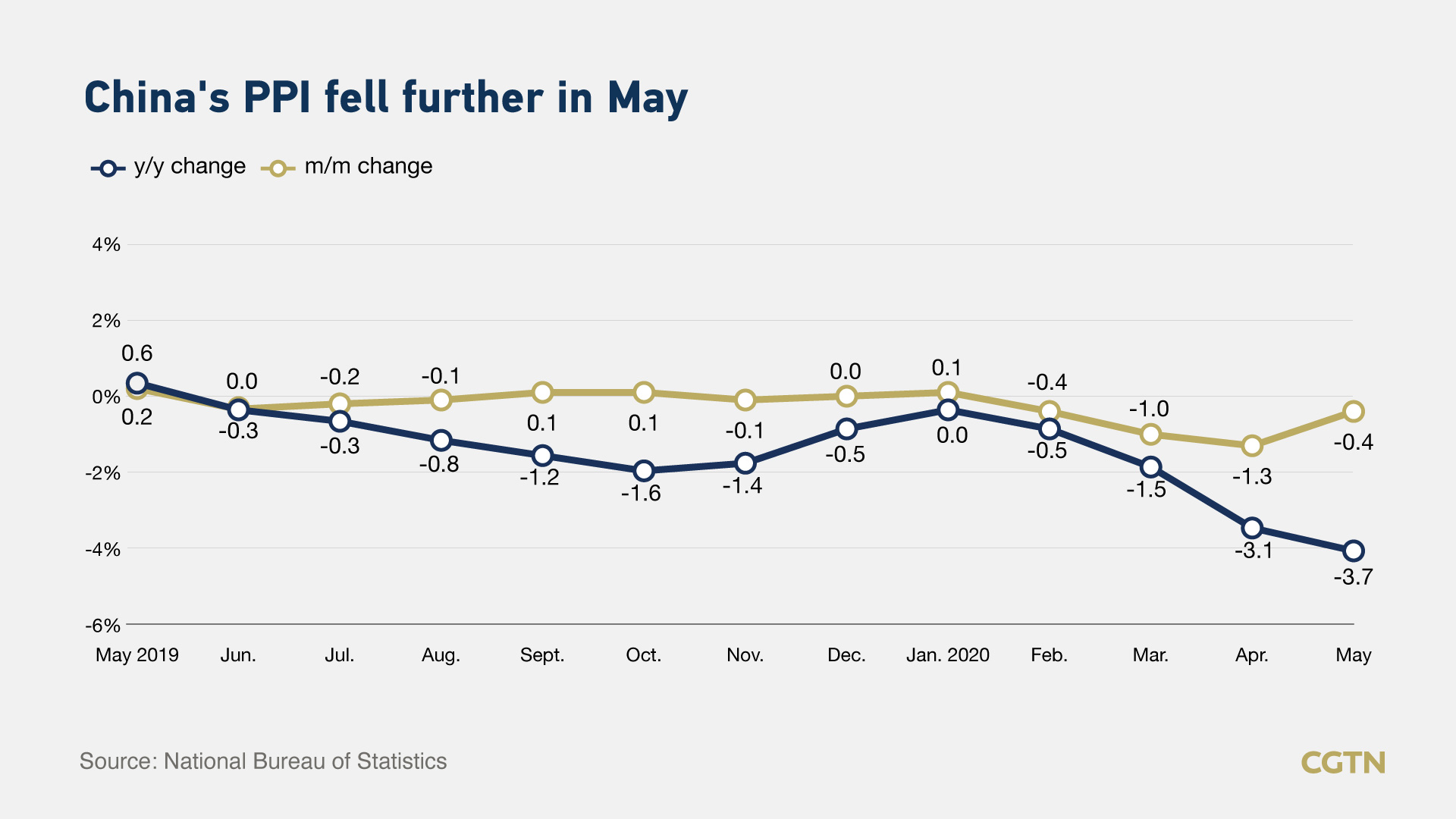

The percentage was lower than the 2.7 percent increase estimated by economists in a Reuters poll. Meanwhile, China's producer price index (PPI), which measures costs for goods at the factory gate, dropped 3.7 percent year on year in May, a larger decline than the 3.3 percent fall expected by analysts in the same poll.

"The data reflects that with the accelerating resumption of production in China, the supply is increasing, resulting in a decline in prices, while from the perspective of demand, consumer demand is still relatively weak," said Liu Chunsheng, an associate professor at China's Central University of Finance and Economics, adding that with the accelerating pace of resumption in the future, demand will improve.

The CPI continued to decline by 0.8 percent in May, narrowing by 0.1 percentage point from the decline in April. Food prices, which account for nearly one-third of the weighting in China's CPI, fell 3.5 percent, an increase of 0.5 percentage points from the previous month, causing a drop of about 0.78 percentage points in the CPI.

In breakdown, vegetable prices fell 12.5 percent from April over rising supplies.

Meanwhile, non-food prices remained flat compared to the previous month; consumer goods prices fell by 1.2 percent, and service prices remained flat.

Compared with the same period last year, food prices remained the main driver of consumer inflation in May, while its growth rate tapered from April to 10.6 percent, mainly led by pork price inflation declining to 81.7 percent in May from 96.9 percent in April.

"The pork price is an important factor affecting CPI," Liu told CGTN. "The production capacity of hogs has been further restored and warm weather dampened consumption, resulting in pork prices in May dropping 8.1 percent from a month earlier, which has contributed to the decline in the CPI from a month earlier as well as a slow rise in the year-on-year growth of CPI."

In the first five months of this year, CPI went up 4.1 percent year on year on average.

PPI declines further

The country's PPI, which measures costs for goods at the factory gate, dropped 3.7 percent year on year in May, with the decline increasing by 0.6 percentage points, the lowest since April 2016.

The price of means of production fell by 5.1 percent, a further drop by 0.6 percentage points from a month earlier, dragging the PPI's decrease by around 3.79 percent. Oil and natural gas extraction sectors widened the drop in prices from April to 57.6 percent, a further decrease of 6.2 percentage points on a monthly basis.

Compared with the previous month, PPI edged down 0.4 percent, narrowing by 0.9 percentage point from the decline in April.

"From the perspective of supply, the price of raw materials is declining, especially the decline of oil prices, resulting in a relatively weak PPI," Liu said.

Also, the demand for production materials is still being suppressed. In the future, it will be necessary to combine other data, such as international market conditions and resumption conditions in China to observe the recovery of demand, he added.

"Based on the data of the past few months, the pressure of deflation is now relatively large and the data performance in the future will mainly depend on the prevention and control of the epidemic," Liu said.

He noted that economic resumption in European and American countries is underway even though the epidemic has not been completely prevented and controlled, so there are certain risks.

"If the epidemic does not spread more widely under the condition of resuming production, namely the second wave of the lockdown will not come, I believe that the CPI and PPI may increase during the year," Liu said.

Allowing for the mild bounce gained in pork prices and floods raging in south China, Nomura Securities reckoned CPI inflation will cease to fall and settle near 2.4 percent year on year in June. But the slide in year-on-year CPI inflation might flare up again in H2, potentially to just 0.4 percent at year-end.

The financial service firm, nevertheless, projected PPI inflation could move upward slightly to -3.5 percent from a year earlier in June, in part due to the recent recovery in global oil prices and a low base of comparison in June 2019.

"We believe falling CPI inflation and continued PPI deflation will provide Beijing with more space to implement policy stimulus to offset the impact of COVID-19 on the economy," Nomura Securities denoted in the latest research report.

The larger-than-expected inflation tumble could also soothe some fears incurred by the bond markets and prop up waning investor sentiment, it further elaborated.

(Cover via VCG)

(Graphics by Qu Bo)