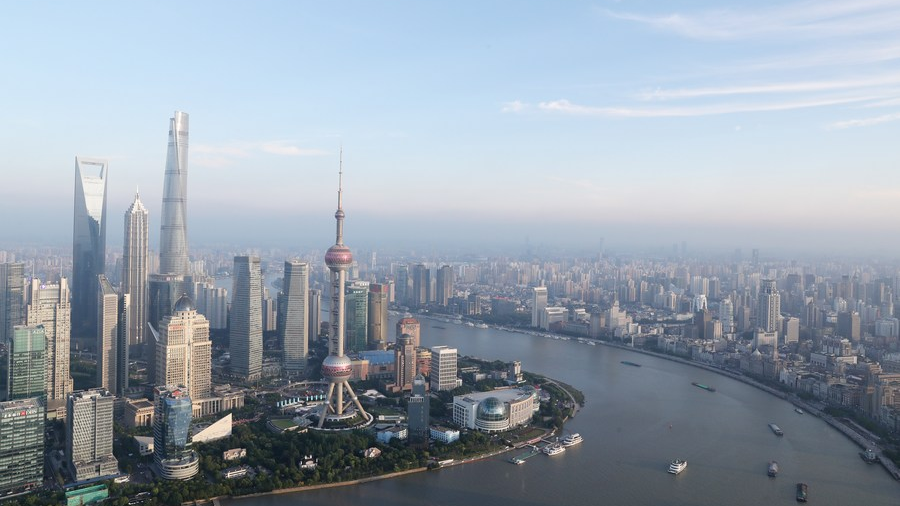

A view of the Lujiazui area in Shanghai, east China, June 21, 2018. /Xinhua

A view of the Lujiazui area in Shanghai, east China, June 21, 2018. /Xinhua

Editor's note: Matteo Giovannini is a finance professional at ICBC in Beijing and a member of the China Task Force at the Italian Ministry of Economic Development. The article reflects the author's opinions and not necessarily the views of CGTN.

The 12th edition of the Lujiazui Forum, an event created with the intent of fostering discussions among high-level government officials, world financial leaders and scholars on China's financial reforms and market opening up, came to a conclusion on June 19 after two days of debates on the theme of "Shanghai International Financial Center 2020: News Starting Point, New Mission, New Vision."

This year's event was flagged by the People's Bank of China's announcement of the launch of a new fintech subsidiary in Shanghai, China's financial capital, that follows last January's announcement of an action plan to turn Shanghai into a globally competitive fintech hub in five years' time by increasing investment in R&D for technologies such as blockchain and 5G and by introducing a series of incentives to attract hi-tech companies and talents.

The Lujiazui Forum's announcement is also important because it represents a supplement of the PBOC's policy released in August 2019 for the development of the whole Chinese fintech sector during a three-year plan aiming at integrating coordinated development of finance and technology by placing China and Shanghai at the international forefront of this field by 2021.

It has to be stressed that the financial policies adopted by the Chinese central bank during the last six years have all converged into a clear strategy of elevating Shanghai's chances to become a world-class international financial center that could one day compete with leading cities such as New York and London.

To realize this ambitious prospect, Chinese authorities have gone through a step-by-step approach starting with the release of policies that served to boost the role of the city, which is already one of the world's largest seaports and a major industrial and commercial center of China, as a global traditional financial hub.

To accomplish this challenging goal, the integration of the domestic market has become a necessity to create a single Chinese stock market ranked as one of the biggest in the world by market capitalization and by daily trading turnover.

Chinese Vice Premier Hu Chunhua (2nd R, front) and then-British Chancellor of the Exchequer Philip Hammond (3rd R, front) attend the launch ceremony of Shanghai-London Stock Connect in London, Britain, June 17, 2019. /Xinhua

Chinese Vice Premier Hu Chunhua (2nd R, front) and then-British Chancellor of the Exchequer Philip Hammond (3rd R, front) attend the launch ceremony of Shanghai-London Stock Connect in London, Britain, June 17, 2019. /Xinhua

The launch of domestic Stock Connect programs with Hong Kong and Shenzhen and international Stock Connect programs with the most prominent financial hubs of the European Union, London and Frankfurt, have enabled Shanghai to become the real playmaker of the Chinese financial market.

All these policies have started to pay off successfully when the professional services firm Ernst & Young recently disclosed that Shanghai had topped the global league table of initial public offering (IPO) in the first quarter of 2020 overcoming Hong Kong and New York.

At the same time China has built its unrivalled fintech dominance by leveraging a combination of factors such as a rapid urbanization, an underbanked population, a favorable and supportive regulatory environment, a booming online industry and an extremely high mobile penetration giving the country a unique series of conditions for the expansion of online finance that no other country in the world can count on.

This phenomenon has meant that the center of financial technology has quickly started to migrate from the Silicon Valley and London to the Far East and specifically to China with cities such as Shanghai, Hangzhou, Beijing and Shenzhen leading this trend.

The PBOC's decision to bet on Shanghai instead of Hangzhou, whose local government has released a plan last year to convert the city into an international fintech center by 2030, can be explained with the intent to use the city of London, a financial center that has also been able to become the fintech capital of the world, as a benchmark.

London's success can be explained by the presence of the right mix of a large amount of capital, a vibrant start-up ecosystem that attracts the best talents and a cosmopolitan environment.

In this regard, Shanghai doesn't need to envy London and the consequence of Brexit from one side and China's growing influence on global financial markets on the other side mean that is just a matter of time before the overtaking is accomplished.

In addition, the outbreak of COVID-19 has accelerated an already ongoing digital transformation, not just for financial services, but broadly for all industries. Shanghai has been widely celebrated as a model in China for the implementation of technologies and for the response to the epidemic.

The Chinese central bank's resolution to set up a subsidiary in support of the transformation of Shanghai into a leading fintech center is therefore not an overnight decision, but the result of a well-planned strategy that looks at the long term and that will eventually drive the further opening up of the Chinese finance sector while elevating the city's stature on the global stage.

The mobilization of substantial resources, a supportive regulatory market, a tech-savvy population and the ability to turn an epidemic into an opportunity of acceleration of technological progress are all factors that, in addition to the critical role that fintech is going to play in the future of the international financial system, are leading to achieve the ultimate goal of turning Shanghai into the world's top financial center.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)