02:56

Asian shares scaled four-month peaks on Monday with stocks in the Chinese mainland leading gains regionally, as investors counted on super-cheap liquidity and fiscal stimulus to sustain the global economic recovery.

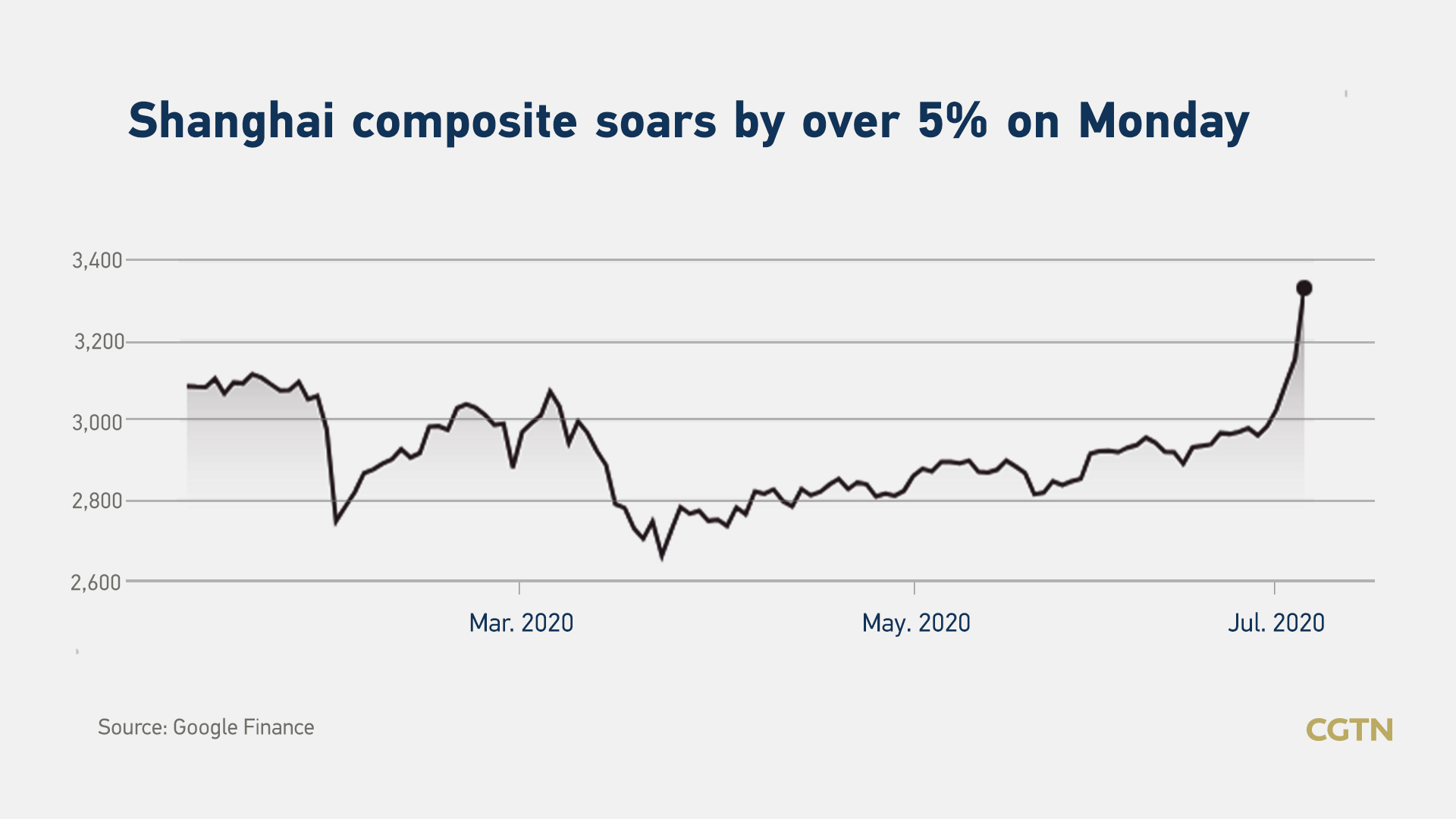

The benchmark Shanghai Composite Index closed at 3,332.88, up 5.71 percent. The Shenzhen Component Index picked up by 4.09 percent, closing at 12,941.72.And the ChiNext Index, China's NASDAQ-style board of growth enterprises, rose by 2.72 percent to 2,529.49 points.

MSCI's broadest index of Asia-Pacific shares outside Japan climbed by one percent to its highest since February. On the Chinese mainland, the Shanghai composite soared by over five percent and the Shenzhen composite surged by over four percent. Hong Kong's Hang Seng Index also increased by over four percent.

Eyes were on Chinese blue chips, which jumped by more than two percent, on top of a seven-percent gain last week, to their loftiest level in five years. Even Japan's Nikkei, which has lagged with a soft domestic economy, managed a rise of 1.3 percent.

"We think there is a case for raising tactical allocation on Asian equities in the context of global equity portfolios," wrote analysts at Nomura in a note.

Chinese A shares' turnover exceeded 1.42 trillion yuan (202 billion U.S. dollars) on Monday, the highest in five years, and brought the market value to over 10 trillion U.S. dollars. The turnover has exceeded one trillion yuan for three consecutive trading days, notifying investors of a "bull market."

Financial sector outperformed, investors encouraged

Sector-wise, banks like Postal Savings Bank of China, Industrial Bank and China Merchants Bank were all up around 10 percent. Insurance companies like China Life Insurance and New China Life Insurance were both up by 10 percent, while the higher priced Ping An Insurance gained almost 8 percent. That's before even start talking about the security firms, nearly all of them up by 10 percent today, not only feeding those gains, but also feeding the more buoyant market and business outlook for these brokerages.

Many analysts shared a common opinion that the gains stem from a combination of low interest rates and pretty ample liquidity. That's not just pushing the retail investors towards stocks, but also some of the institutional players.

There's also some pressure coming from unusual activity in the bond market that's been amplified over the last couple of trading sessions last month. The yield on the benchmark 10-year treasury rising the most since 2016 on Monday. The selloff is also spilling over to the credit market, where companies are shelving plans to sell debt as borrowing costs surge.

"Seeing the start of a bit of a route that hit Chinese bond market also delivered a blow to the wealth management products owned by many Chinese retail investors. Savers with some cash on hand are looking to the stock market instead of delivering gains that they were hoping for," Li Shaojun, chief strategy analyst at Guotai Junan Securities, wrote in a research note.

And many analysts seem to be pretty reassured that this won't be the start of a repeat of the 2015 bubble, as the authority and central bank have been keeping a pretty firm grip on their monetary policy tools.

An electric screen showing Japan's Nikkei and Shanghai Stock Exchange markets' indices outside a brokerage in Tokyo, Japan, July 1, 2019. /Reuters

An electric screen showing Japan's Nikkei and Shanghai Stock Exchange markets' indices outside a brokerage in Tokyo, Japan, July 1, 2019. /Reuters

Too soon to define a technical rally or long term bull market

Over the last couple days, there's a lot of talk about whether it's the start of a bull market run for A-shares, while an expert told CGTN though it's too soon to reach a conclusion, it's still a pretty good sign to begin with.

"However it is hard to say whether this is a technical rally or a long time one, since long term growth actually starts from technical rally," said Chen Jiahe, the CIO of Novem Arcae Technologies.

Chen listed the example of the U.S. stock market back in the early 1980s, as when it started long-term rally that lasted for two decades and just started from a very huge jump for 10 months.

"After the August of 1982, the S&P 500 index rose by around 70 percent, that's the 70 percent of increase in just 10 months and that was followed by a bull market of two decades. So it is really hard to tell the difference between a technical rally and a long term bull market, sometimes bull market just to start with the technical one. You never know that from the beginning," Chen further elaborated.

According to financial data provider Wind, last week there were over 4 billion dollars in northbound inflows from Hong Kong into the Chinese mainland markets, which is around four times the normal weekly average. Talking about how sustainable are these flows, Chen are not among those ones who regard North Bound capital as decisive factor for the stock gain.

"The North Bound capital is a help to the recent rally, but it's actually not the major reason behind the rally as the scale is too small to influence the market. There has been around 1.5 trillion yuan traded in A share for today, which we add up to almost 10 trillion for a week. So four billion dollars U.S. of inflow in a week is too small to have a major impact on the stock market. But anyway, more capital influence is always a good thing," Chen illustrated.

STAR Market's biggest IPO to come

While investors are confident on market performance, they are also waiting for the Chinese STAR Market's (Sci-Tech innovation board) biggest IPO.

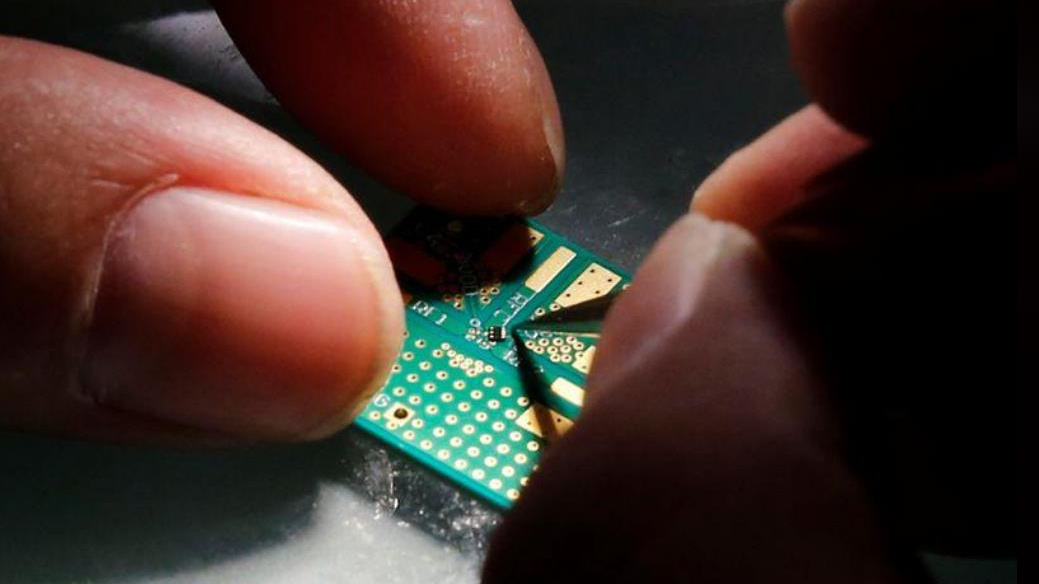

On Sunday, China's Semiconductor Manufacturing International Corp (SMIC) said in a filing it would raise 46.29 billion yuan in a Shanghai share sale, more than double its initial target, pricing its offering following a surge in its Hong Kong-listed stock. It could also become Chinese A shares' biggest IPO in the last 10 years.

The company, which is Chinese mainland's top semiconductor foundry and had originally sought to raise about 20 billion yuan, set the sale price of its shares to be traded in Shanghai at 27.46 yuan each.

Planting a semiconductor on an interface board during a research work to design and develop a semiconductor product at Tsinghua Unigroup research center in Beijing, China, February 29, 2016. /Reuters

Planting a semiconductor on an interface board during a research work to design and develop a semiconductor product at Tsinghua Unigroup research center in Beijing, China, February 29, 2016. /Reuters

The offering values the company at 109.25 times its 2019 earnings, based on the expanded share base, according to the filing. By comparison, rival Taiwan Semiconductor Manufacturing Co Ltd has a trailing price-earnings ratio of 21.315.

SMIC's Hong Kong-listed shares shot up more than 20 percent to 40.10 HK dollars at market close on Monday. The shares have skyrocketed by 230 percent so far this year.

SMIC's online subscription, mainly targeting individual investors, will start on Tuesday, it said.

(CGTN's Wu Zheyu also contributed to the story)

(With input from Reuters)