Smaller U.S. companies will bear the brunt of the economic downturn triggered by a prolonged coronavirus crisis as they struggle to cut costs as much as bigger multinational peers, analysts' estimates compiled by Reuters showed.

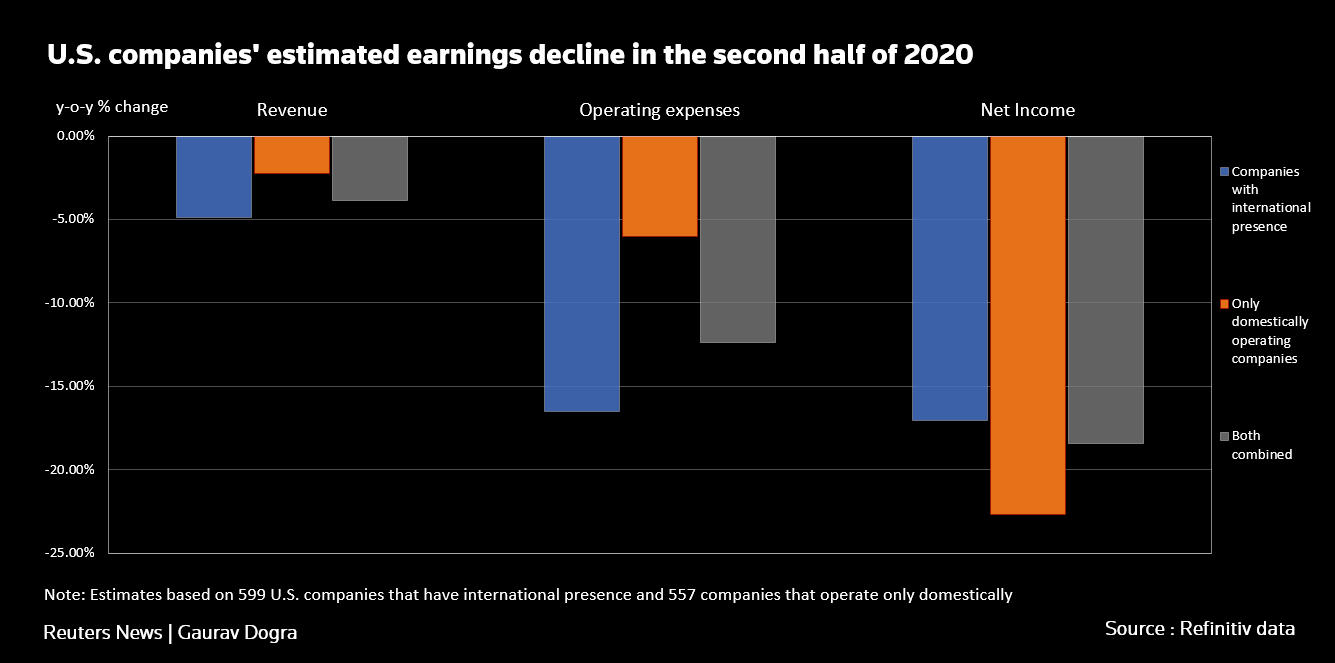

The data, which pooled over 1,000 U.S companies that have market capitalizations of least 1 billion U.S. dollars, showed that analysts expect U.S. firms to post an 18 percent drop in profit in the second half of 2020.

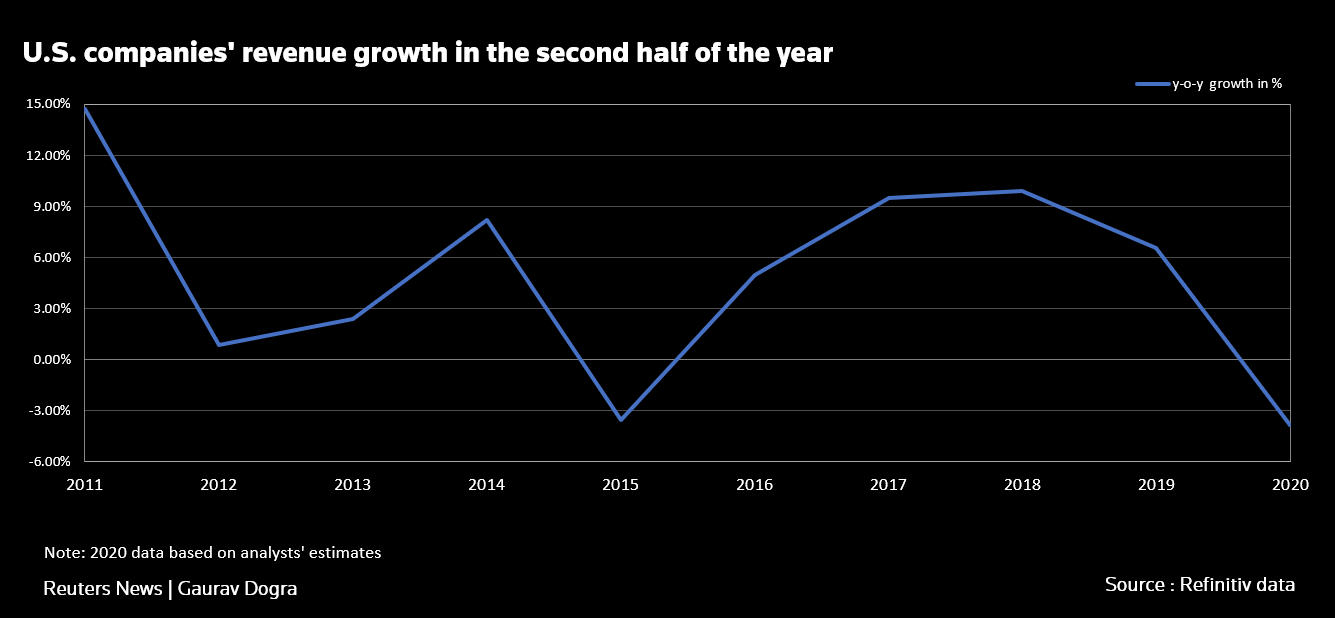

Revenue will be down 3.8 percent in the same period, marking the steepest fall in at least a decade, according to Refinitiv data.

The situation looks grim for most U.S. companies, with data showing that firms with large domestic operations are likely to post a 22.7 percent drop in profit, compared to the 17 percent fall expected at multinationals.

Companies with an international presence are expected to have revenue shrink at a higher rate, but their profits will fare better, helped by cuts in operating expenses that company plans show will average 16.5 percent versus 6 percent for U.S.-centric rivals.

Boeing Co, Royal Caribbean Cruises and General Electric to name a few have cut thousands of jobs this year to reduce costs.

"Domestic firms have already most likely scaled down to the bone their initial headcount in reaction to the economic downturn in the spring and are not in a position to continue to reduce the number of employees further," said Daniel Morgan, a senior portfolio manager at Synovus Trust Co.

The companies relying solely on domestic revenue streams, according to data, are on average about a third as big by market value compared with the multinationals included.

The energy sector will be the worst hit, the data showed, with profit expected to fall over 80 percent, as oil companies struggle to recover from a slump in global fuel demand and prices.

The health sector, on the other hand, will report the growth of about 2 percent as governments, charities and Big Pharma companies pour billions of dollars into developing a vaccine for the new coronavirus.

With U.S. companies starting to report their second-quarter results, analysts expect S&P 500 companies overall to report a 43.9 percent drop in earnings, the biggest fall since the financial crisis.

(Cover image: Signage of The Boeing Company in Seattle, Washington, U.S. June 29, 2020. /Reuters)

Source(s): Reuters