2020 is undoubtedly a chilly season for foreign trade as the COVID-19 pandemic has severely ravaged global trade by disrupting global economic activity leading to both supply and demand shocks.

In February, what worried most Chinese exporters most was when to resume production as they were desperate to ease foreign customers' concerns as they handled a heavy backlog of orders. As if the sluggish recovery of the supply chain wasn't enough to be worried about, the ominous news came a month later: no demand.

There were over 14.89 million confirmed COVID-19 cases globally as of Tuesday, with over 615,000 fatalities and nearly 8.4 million recoveries, according to the latest tally from Johns Hopkins University.

Data from the China General Administration of Customs revealed that in the first half of 2020, China's goods trade, in U.S. dollar terms, contracted by 6.6 percent year on year, with exports declining by 6.2 percent to 1.10 trillion U.S. dollars.

"When the coronavirus at first was spreading in China, foreign customers worried about the unclear outlook for the epidemic in China, coupled with exaggerated reports abroad, leading to a great impact on us," said Liu Shenghua, head of e-commerce department of Guangzhou Pinliu Industrial Co., LTD.

Based in the capital city of South China's Guangdong Province, Pinliu is a private enterprise founded in 2015, mainly providing Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) services for non-woven products, such as compressed facial masks, disposable washcloths, and heating products, like steam hot eye masks and warm uterus paste.

Employees wear masks while working in the factory of Pinliu, Guangzhou, South China's Guangdong Province, China. /Photo by Piuliu

Employees wear masks while working in the factory of Pinliu, Guangzhou, South China's Guangdong Province, China. /Photo by Piuliu

"Our products are mainly exported to Southeast Asia, Europe, and the Middle East, which used to account for 30-40 percent of the total before the pandemic outbreak, but now the proportion is only 20 percent," Liu said.

"Foreign customers delayed placing orders, the down payment was accordingly delayed. Thus, excess inventory does give a certain pressure on our cash flow," he said, stressing that in the past few months, quite a few small private firms that he knows have gone bankrupt due to the adverse impact of the epidemic.

"Now we depend more on domestic sales," Liu said, adding that they are working with partners like Watsons and Renhe Pharmacy Co, a China-based company principally engaged in the pharmaceutical industry.

Meanwhile, another private entrepreneur in Guangzhou, Li Li, can breathe a little easier.

Guangzhou Xumin Packaging Ltd. is a company specializing in the sale and customization of cosmetic packaging vessels founded by Li, who has been worked in this field for more than 10 years and started the export business three years ago.

"Because of the soared demand for hand sanitizer and disinfectant during the epidemic, our foreign trade performed better than when we first started the export business. After all, our major business is producing packaging bottles," Li told CGTN.

"However, domestic sales have inevitably declined due to the weak consumption of daily cosmetics caused by the pandemic," she said.

A sluggish recovery

Li said they have resumed production in February and are very grateful that the government allowed resumption, citing that "at that time, disinfectants were in great demand in domestic, which also drove the demand for packaging materials... Therefore, after we have fully prepared anti-epidemic measures and passed the assessment by the government, the production started without stopping. The entire process only took two or three days."

Li continued saying: "The foreign demand for packaging at present, however, is slowing down, and the epidemic has also caused customs clearance and other procedures to become troublesome."

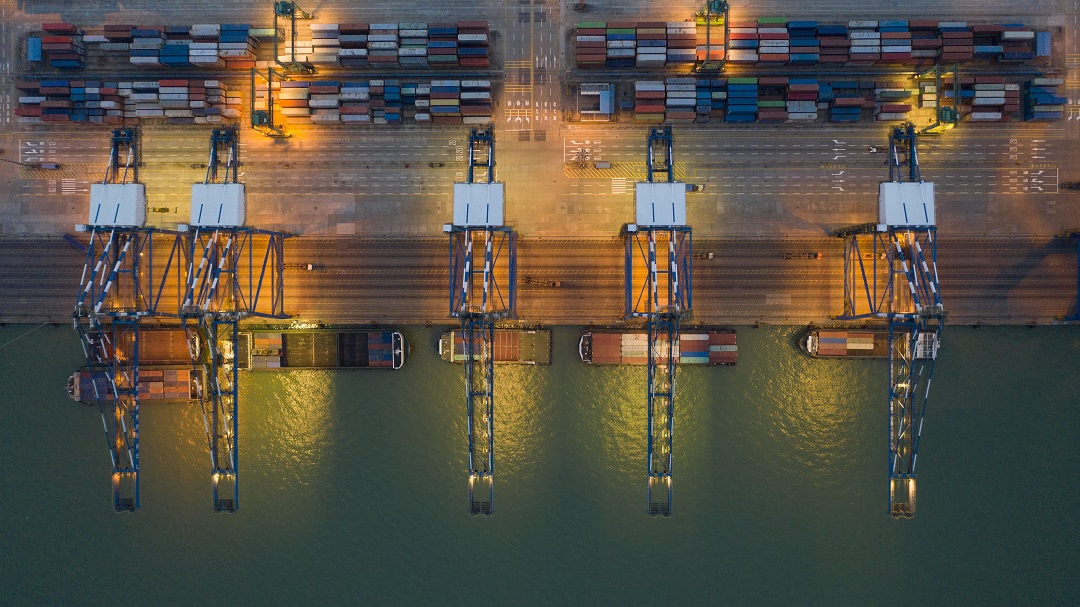

Nansha Port in Guangzhou gradually resumes normal operations, south China's Guangdong Province, on April 18, 2020. /VCG

Nansha Port in Guangzhou gradually resumes normal operations, south China's Guangdong Province, on April 18, 2020. /VCG

While Pinliu saw relatively faster growth of orders in May and June thanks to the domestic economy restoring, Liu said, "now the sales have slowed, and is mainly destocking."

Official data showed that China's export growth turned positive in June but saw only a slight recovery, rising by 0.5 percent to 213.6 billion U.S. dollars.

"The lack of exports is not because of no goods, like several months ago, but no orders, which at least presents that our production capacity has been restored," Bai Ming, deputy director of the Academy of International Trade and Economic Cooperation in Ministry of Commerce told CGTN.

E-commerce with high expectations

According to Li, in the past, getting export orders relied more on participation in exhibitions, such as the China Import and Export Fair, or the Canton Fair. Later, came e-commerce business-to-business (B2B) platforms like Alibaba.com, which is a relatively low-cost way for small and medium-sized enterprises (SMEs) like her workshop to get started quickly.

Both Li and Liu's export business is mainly carried out through Alibaba.com, the B2B online marketplace owned by Chinese e-commerce giant Alibaba Group.

"At present, only the sales of masks on Alibaba.com are not too bad," Liu said, noting that Pinliu just began to produce and export masks because of the epidemic.

Exports of textiles including masks increased by 32.4 percent in H1, data showed, and exports of medical materials and drugs, and medical devices increased by 23.6 percent and 46.4 percent respectively.

In May, Alibaba.com launched its first two-week global online trade show to help coronavirus-hit traditional trade businesses to reach customers after most physical exhibitions have been canceled amid the epidemic.

The e-commerce giant planned to hold 20 such online trade exhibitions this year, with the first introducing cross-border B2B live streaming, with more than 1,000 B2B live streaming sessions arranged during the exhibition in May.

"We have applied for the exhibition of Alibaba.com for the next month and are waiting for approval, where we can make live streaming by the time," said Li, delighted that her store's sales increased through the March Expo this year, an annual online promotion of Alibaba.com for buyers to discover new products and suppliers globally through online channels.

The anchor sells household goods via live streaming, Foshan, south China's Guangdong Province, on July 9, 2020. /VCG

The anchor sells household goods via live streaming, Foshan, south China's Guangdong Province, on July 9, 2020. /VCG

According to official data, the sales through March Expo this year increased by 167 percent year on year, and the number of new merchants settled on the platform increased by 194 percent from a month earlier.

"We haven't made a live broadcast yet. For B2B merchants like us, a live broadcast is definitely better than email contact, because it can foster the trust of customers and we are able to communicate timely through it.

Liu considered the effect of live streaming as not very significant after they followed the platform and made a factory live streaming. "The reason may be that the factory live streaming is different from the shopping one where viewers can directly place an order. The biggest role of the former is actually to show and attract."

Official data proved that the private sector turned the tide of China's foreign trade in H1. During the period, it contributed 45.1 percent to China's total trade, 4.9 percent up from a year earlier, and up by 3.5 percentage points from the same period last year, with the exports accounting for 53.7 percent of the total exports.

"We hope the government will organize activities to increase our exposure and broaden opportunities for us to attract and connect customers," Liu said.

To support exporters in expanding domestic sales channels, the country's commerce ministry has promised recently it will work to pool resources from both domestic and foreign trade sectors and make use of various online shopping festivals and platforms such as fairs and expos.

The State Council has also introduced a guideline accordingly, affirming that it would encourage financial institutions to offer those exporters more funds and strengthen credit support for their capital turnover. Meanwhile, it proposes to enhance direct loans to SME exporters through large E-commerce platforms.

When will the business return to its original level? Liu thought it's hard to say, "mainly because consumers have less money now."

Li, nonetheless, is relatively optimistic, saying: "We have accumulated a certain number of customers, which is definitely beneficial to the development in the future."

(Cover image: The factory of Pinliu, a private enterprise mainly providing Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) service for non-woven products and heating products /Photo by Piuliu)