The International Monetary Fund (IMF) logo is seen outside the headquarters building in Washington, the U.S., September 4, 2018. /Reuters

The International Monetary Fund (IMF) logo is seen outside the headquarters building in Washington, the U.S., September 4, 2018. /Reuters

The greenback's prevalence is unfavorable for emerging markets and developing economies (EMDEs) to recover, according to the International Monetary Fund (IMF), citing that Dominant Currency Pricing and Dominant Currency Financing hinder trade.

The COVID-19 pandemic has hit the world economy hard, and drastically collapsed global demand and commodity prices, capital outflows, and disrupted major supply chains and dwarfed global trade. Currencies have weakened sharply in the EMDEs but will they benefit from currencies' depreciation?

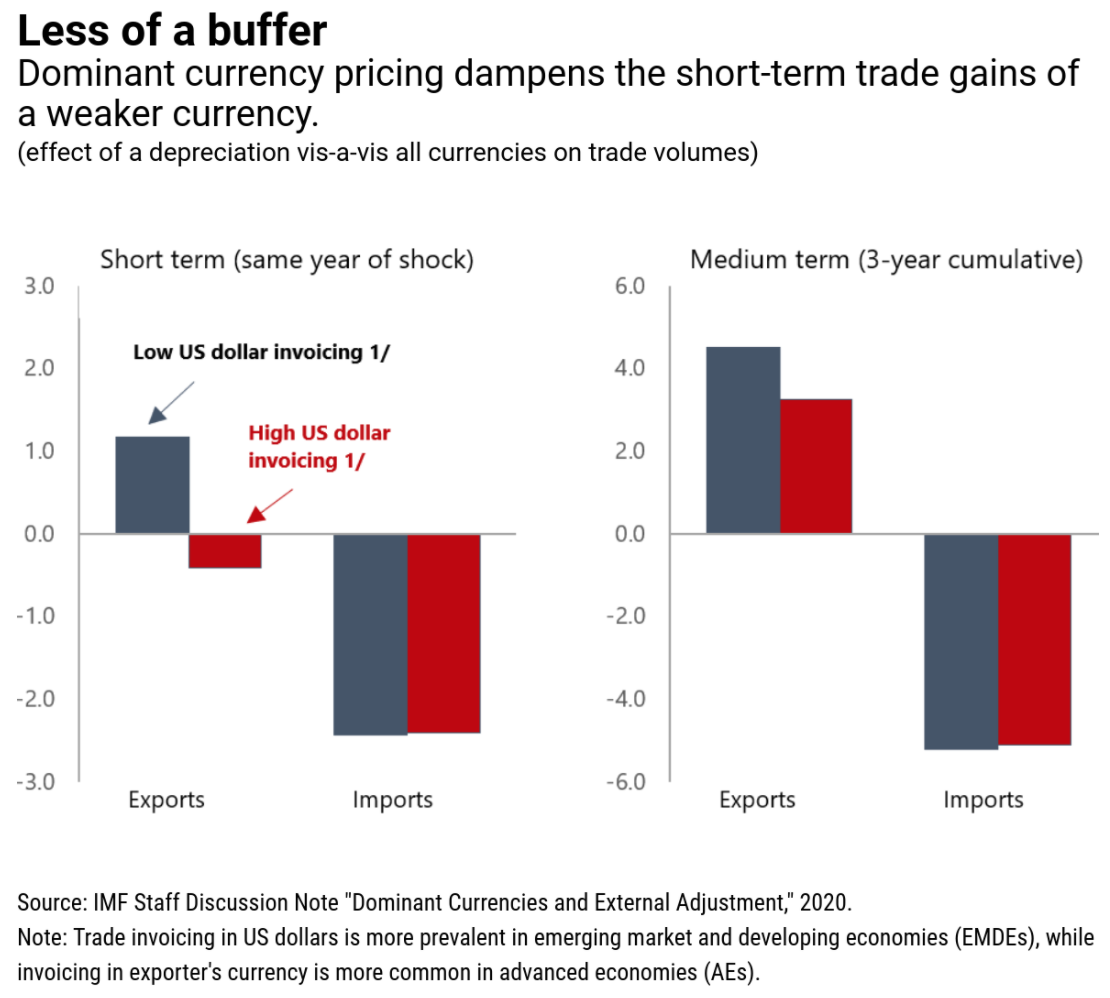

In fact, "the short-term gains from weaker currencies may be limited" for the EMDEs where firms price their international sales and finance themselves in a few foreign currencies, notably the U.S. dollar, IMF economists Gustavo Adler, Gita Gopinath and Carolina Osorio Buitron wrote in a recent blog.

This is because the practice in reality is different from traditional view on exchange rates which prices are set in the exporter's currency. Under the traditional assumption, domestically-produced goods and services become cheaper for trading partners when the domestic currency weakens, leading to more demand from them and, thus, more exports. Thus, a weaker currency can help the domestic economy recover from a negative shock.

Dollar-invoicing hinders exports

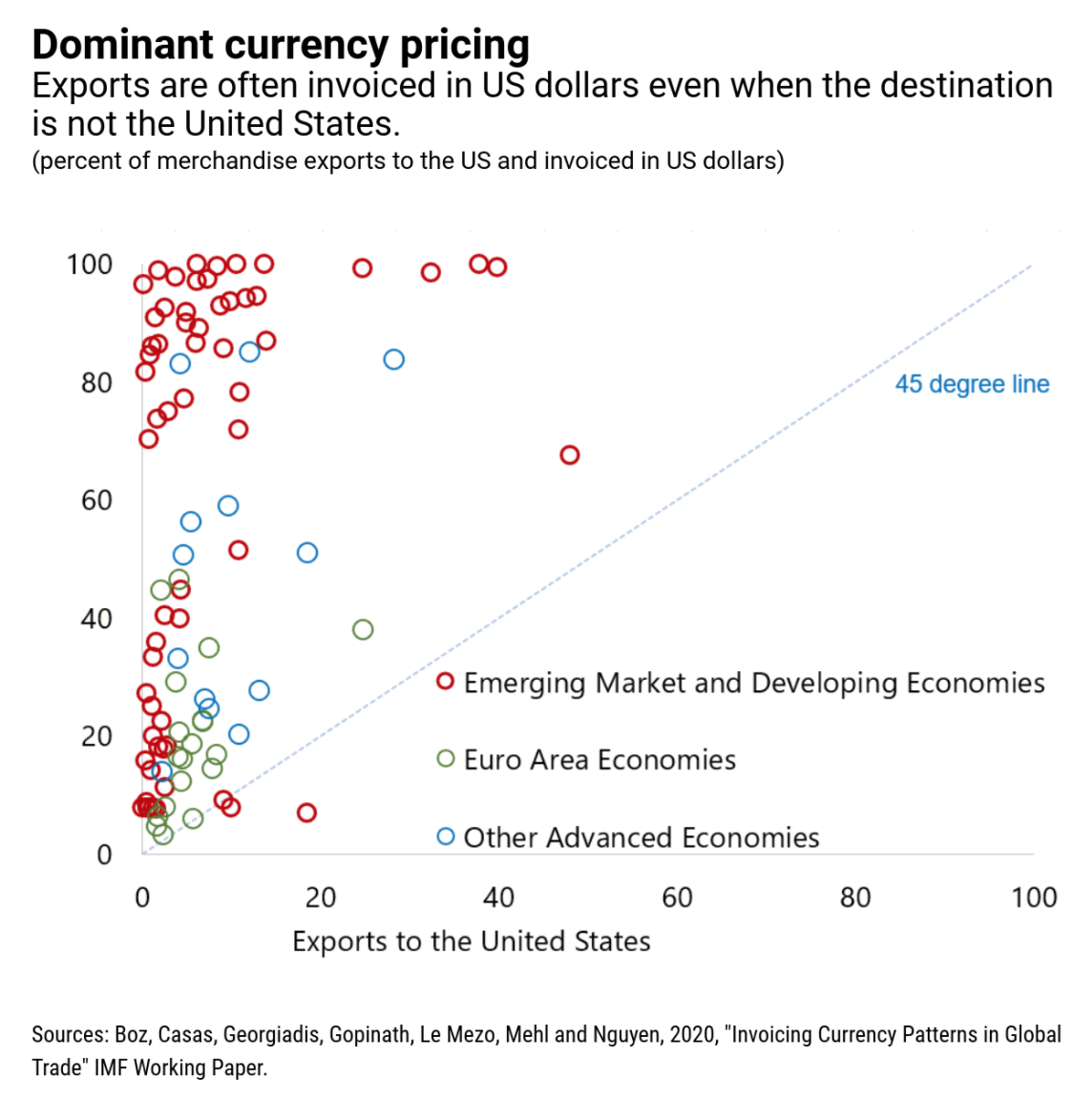

There is growing evidence that most of global trade is invoiced in a few currencies, most notably the U.S. dollar – a feature dubbed Dominant Currency Pricing, said the IMF blog.

The economists added that "the share of U.S. dollar trade invoicing across countries far exceeds their share of trade with the U.S. This is especially true in EMDEs and, given their growing role in the global economy, increasingly relevant for the international monetary system."

When pricing goods in the U.S. dollar, "a country's depreciation does not make goods and services cheaper for foreign buyers, at least in the short term, creating little incentive to increase demand," said the report. "The reaction of export quantities to the exchange rate is more muted and so is the short-term boost of a depreciation to the domestic economy."

Moreover, the IMF said a global strengthening of the U.S. dollar entails short-term contractionary effects on trade, because the weakening of other countries' currencies vis-à-vis the U.S. dollar leads to higher domestic currency prices of their imports."

Dollar-financing unfavourable for importers

The prevalence of the U.S. dollar is also a feature of corporate financing in EMDEs, which is dubbed Dominant Currency Financing. Under the paradigm, exchange rate fluctuations can also have effects through their impact on firms' balance sheets, according to the IMF.

A depreciation that increases the value of a firm's liabilities relative to its revenues weakens its balance sheet and hinders access to new financing, as firms' capacity to repay deteriorates, the economists explained, adding that "this effect depends on whether revenues are in foreign currency or in local currency."

Exporting firms that use the U.S. dollar for both pricing and financing are "naturally hedged" as liabilities and revenues move in tandem when exchange rates fluctuate, they said.

However, "revenues and liabilities of importing firms are typically not matched, and exchange rate fluctuations bring about balance sheet effects that constrain financing and import volumes," they added.

"Dominant Currency Financing tends to amplify the effect of a country's depreciation on its imports."

Moreover, the prevalent use of the U.S. dollar in corporate financing also means that a generalized strengthening of the U.S. dollar can have globally contractionary effects through importing firms balance sheets.

"The global strengthening of the U.S. dollar – which mainly reflects a flight to safe haven assets – is likely to amplify the short-term fall in global trade and economic activity, as both higher domestic prices of traded goods and services and negative balance sheet effects on importing firms, lead to lower import demand among countries other than the United States," Adler, Gopinath and Buitron said.