After Huawei was labelled and targeted as an information security "threat", TikTok, the popular short-form video app, became the new target for many at a time when U.S. elections are on the way.

Other than being owned by a Chinese company, which makes it a perfect scapegoat for China hawks to blame for whatever is needed, its unprecedented success as the world's most downloaded app also made it too outstanding to be ignored.

TikTok's useless efforts under fire from Washington

ByteDance, the Chinese owner of TikTok made its latest compromise on Sunday night. It was reported that ByteDance agreed to divest the U.S. operations of TikTok completely in a bid to save a deal with the Trump administration.

Although the company has not responded to the report so far, the deal indicates ByteDance's efforts to keep a minority stake in the U.S. business of TikTok has failed.

The company has been pushed with quickly escalated attacks from Washington. Hours after Microsoft was said to be in talks to buy TikTok, Trump announced on Friday that instead of forcing ByteDance to sell the short-form video app, he will ban TikTok from operating in the U.S., without revealing the specific time, CNN reported on Saturday.

A group of senators signed a letter to the office of the Director of National Intelligence, the FBI and the Department of Homeland Security on Tuesday, accusing TikTok, as a Chinese social media platform, could enable China to "interfere with U.S. elections.”

The U.S. Senate panel approved on July 22 a ban on using TikTok on government devices.

Faced with what some are saying is Washington's determination to make full use of China to score points with its electorate, TikTok has made all possible efforts to ease the concerns on the table, including information security and being a Chinese company.

On the same day when the No TikTok go Government Devices Act was passed, TikTok announced that it would reveal its algorithm.

Moreover, TikTok has been striving to make itself to be more international by shifting major team members from China and hiring more U.S. talent, including senior executives.

TikTok's parent company ByteDance has more than tripled its U.S. employees in the past 12 months and has more than 1,000 employees across the country from California, where TikTok is headquartered, to New York, Reuters reported in June.

In May of this year, Kevin Mayer, the former top streaming executive at Disney, chose to join TikTok as CEO and also serve as chief operating officer of ByteDance.

Before Trump rejected the potential sale of TikTok, ByteDance was exploring multiple options, including setting up an independent board of directors and selling a stake of the company to venture capital or private equity firms.

As one of the most low-profile companies, neither TikTok nor ByteDance revealed more details about the potential sale. CGTN's several inquiries about TikTok's possible response to the U.S. ban received no responses from the company by press time.

"TikTok has become the latest target, but we are not the enemy," Mayer said in the statement on Wednesday, one of a few public responses the company has made.

A new player but a major threat

Although having just launched in 2017, TikTok has been a huge success, placing pressure on other tech giants, especially those who once dominated social media.

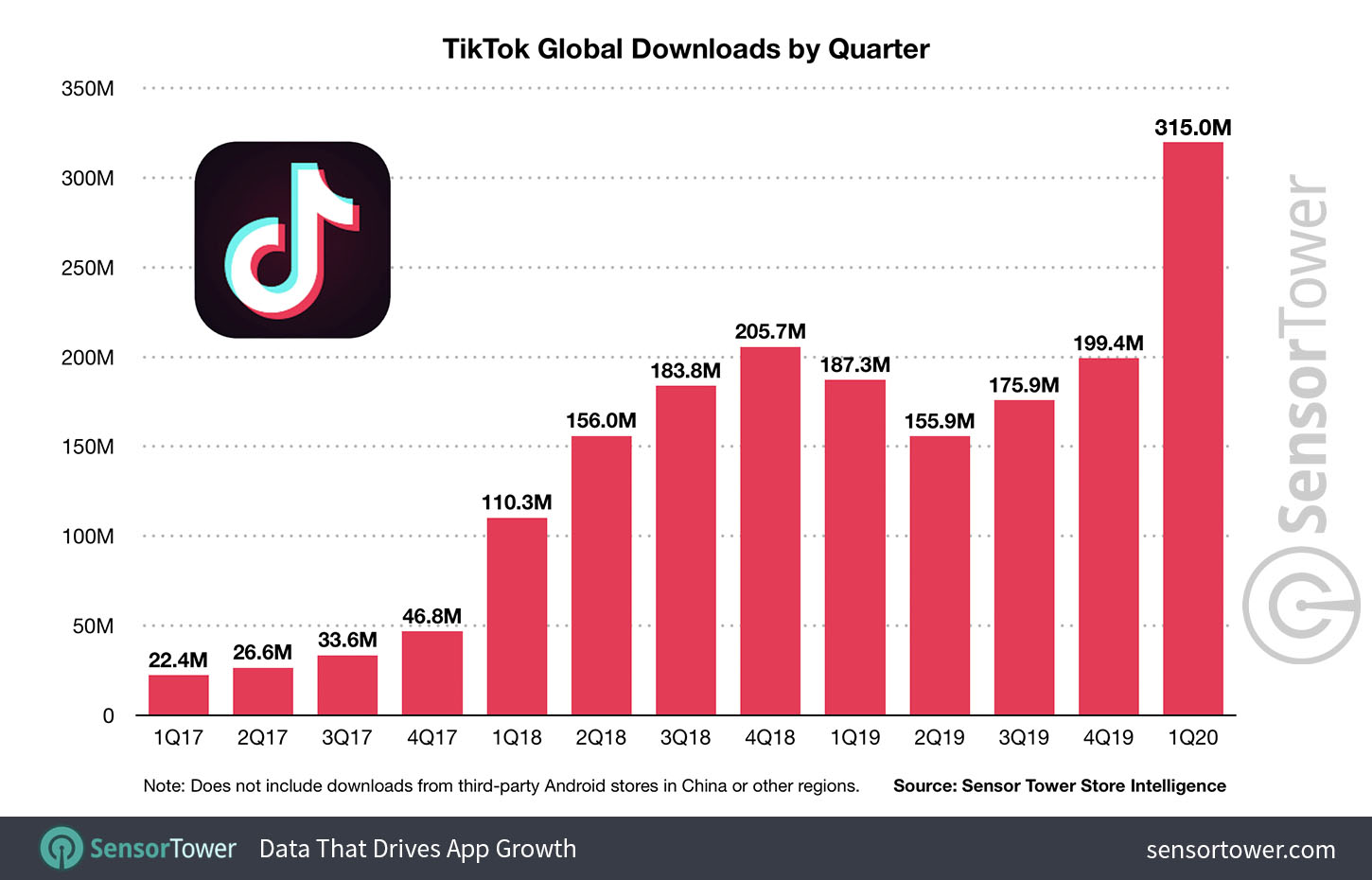

TikTok's downloads have been surging since 2018 and its popularity has skyrocketed during the pandemic with 315 million downloads in the first quarter, bringing the total number of downloads to 2.2 billion globally, according to data from research firm Sensor Tower.

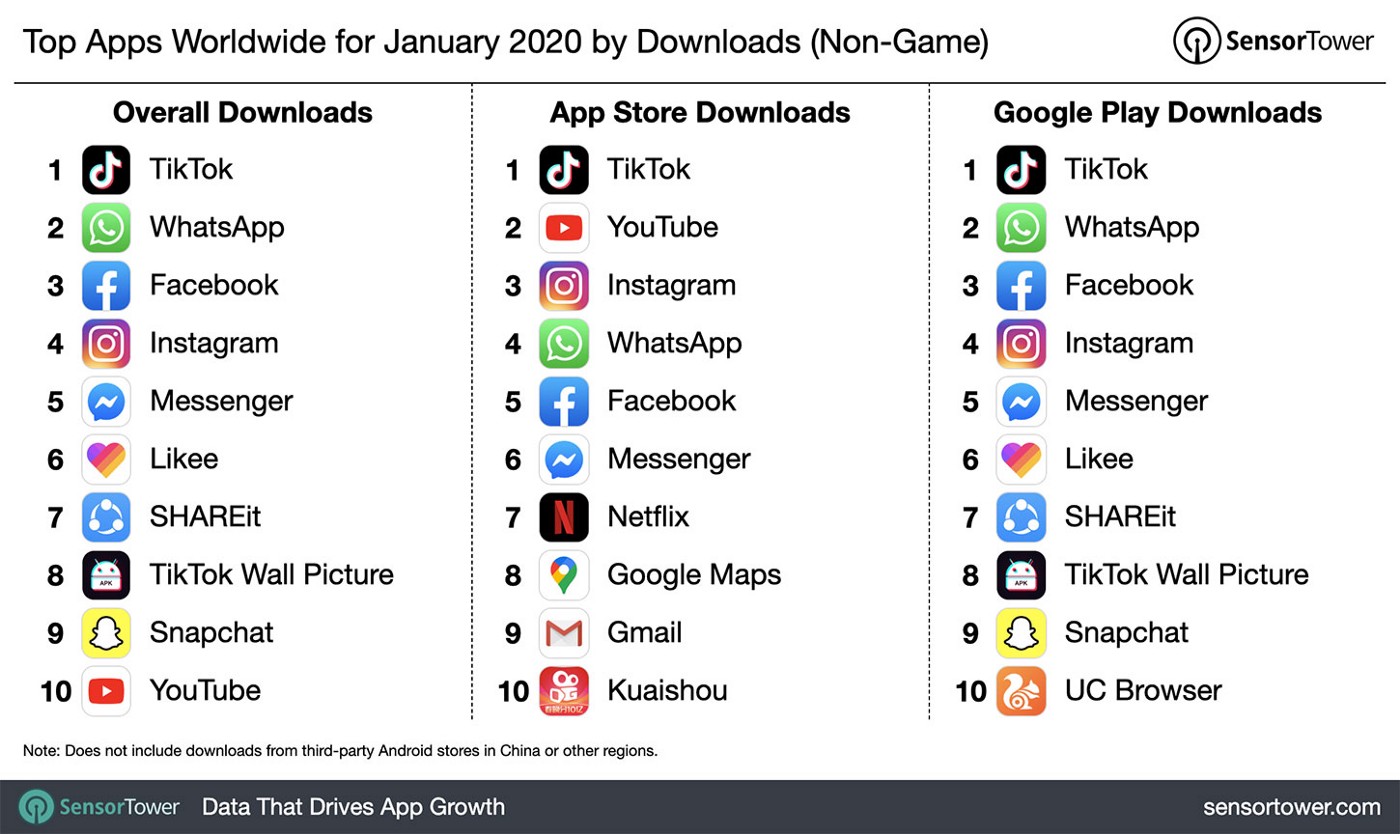

In January, the short-video app was the most downloaded app in both the Apple and Google app stores, surpassing Facebook and its Instagram. Even after India, one of its major markets, banned it last month, it still remains in the top three in the overall downloads.

In the era of globalization, the gap between young generations in different countries are narrowing and they share similar needs for online social and entertainment, Wei Fangzhou, founder and CEO of Beluga Global, a consultancy working on overseas commercial development, told CGTN, noting that is the basis for TikTok's global success.

TikTok has great growth potential for both further user growth and commercialization, an analyst who focuses on mobile marketing analytics but prefers to be anonymous told CGTN.

Other tech giants took the new player as a serious threat by beginning to develop similar products.

Instagram launched its short video app Reels late last year in several countries, expecting to bring new video features to its platform. YouTube is also reported to be working on its own similar product called Shorts.

After failing to enter Chinese market and being threatened by TikTok, global social media giant Facebook, which bought Instagram in 2012, started taking an opposite approach by attacking TikTok and Chinese tech firms.

At a Wednesday antitrust hearing, Facebook CEO Mark Zuckerberg was the only one of the heads of four tech giants who attended the hearing in person, confirmed that China "steals technology from U.S. firms" and stated his company was crucial in winning an internet competition against China.

If it is too hard to compete with a rival product, it would be easier to resort to a government approach and information security is enough to attack a Chinese company, the marketing analyst said.

In terms of value of online ads, which is the major revenue source for apps, Google and Facebook still dominates the sector but advertisers are always looking for new platforms, Wei said.

With advertisers now favoring videos more than other forms, if TikTok can achieve more success in commercialization, it may be in a better position to deal with the hostility if more people get involved, Zhang Ziteng, co-founder of New York-based WeBridge Consulting, told CGTN.